Millionaire to Millennials: Buy a Home Now!

In a CNBC article, self-made millionaire David Bach explained that “the single biggest mistake millennials are making” is not purchasing a home because buying real estate is “an escalator to wealth.”

Bach went on to explain:

“If millennials don’t buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter.”

In his bestselling book, “The Automatic Millionaire,” Bach does the math:

“As a renter, you can easily spend half a million dollars or more on rent over the years ($1,500 a month for 30 years comes to $540,000), and in the end wind up just where you started — owning nothing. Or you can buy a house and spend the same amount paying down a mortgage, and in the end wind up owning your own home free and clear!”

Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists. He has been a contributor to NBC’s Today Show, appearing more than 100 times, as well as a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS. He has also been profiled in many major publications, including the New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, Washington Post, the Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

To see original article please visit Keeping Current Matters.

Where Are Home Values Headed Over the Next 12 Months?

The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.

Housing Market on Track to Beat Last Year’s Success

Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels.

Why Pricing Your Home Right Matters This Fall

To sell your home quickly and for the best possible price, you should price your home competitively right from the start.

Home Equity Gives Sellers Options in Today’s Market

Across the country, home equity was increasing before the health crisis swept our nation, and it continues to grow throughout the year.

Home Builder Confidence Hits All-Time Record

The housing market continued to exceed expectations in August, as housing demand for new homes stayed strong.

The Cost of a Home Is Far More Important than the Price

Thanks to today’s lower interest rates, even with the price increase, you would still save $61 in your monthly mortgage payments.

Is the Economic Recovery Beating All Projections?

Is the U.S. economy and labor market are recovering from the coronavirus-related downturn more quickly than previously expected?

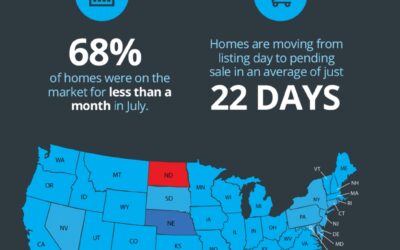

Homes Across the Country Are Selling Fast

Buyers are actively searching for and purchasing homes at a record-breaking pace.

How Low Inventory May Impact the Housing Market This Fall

Considering selling your house? Let’s talk about how you can benefit from the market trends in our area.

The Surging Real Estate Market Continues to Climb

Though there is some evidence that the overall economic recovery may be slowing, the housing market is still gaining momentum.