” Many people have found themselves in a similar situation and they’ve already made the choice to live in a multigenerational home.”

If your needs are changing, you may be thinking about sharing a home with additional loved ones, such as grandparents, adult children, or other extended family members. Whether it’s for financial or health-related circumstances, or simply because you’ve reached a new phase of life, you might be wondering if living with multiple generations under the same roof is a good move for you. Many people have found themselves in a similar situation and they’ve already made the choice to live in a multigenerational home.

What Is a Multigenerational Home?

The Pew Research Center defines a multigenerational household as a home with two or more adult generations. They include households with grandparents and grandchildren under the age of 25. As you weigh your options and decide if multigenerational living is right for you, here’s some helpful information highlighted by other homeowners living with additional loved ones.

The Benefits of Multigenerational Living

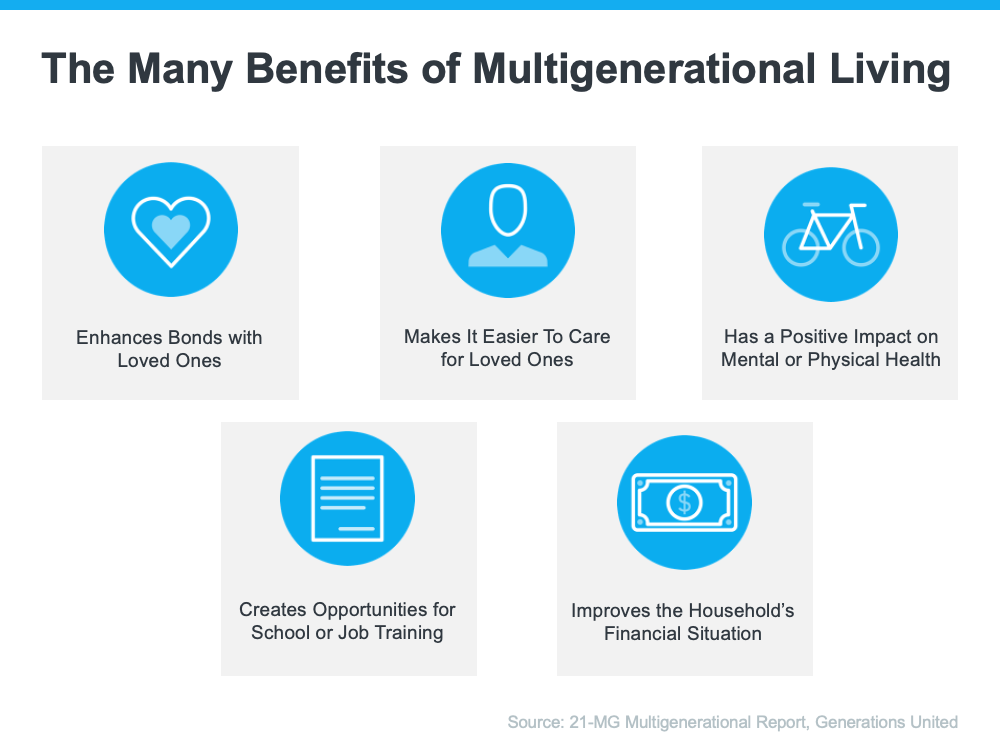

A recent report from Generations United surveyed individuals living in a multigenerational setting and asked them about the key benefits of this housing arrangement. It says:

“Nearly all Americans who live in a multigenerational household (98%) feel their household functions successfully, citing various aspects of home design, family relationships and interactions, and supports and services influencing their success.”

The study identifies some of the top benefits of this lifestyle as an improved financial situation, better mental and physical health, strengthened bonds with loved ones, and more (see chart below):

Those are just some of the reasons why most people who decide to live in this situation find it worthwhile. As Donna Butts, Executive Director at Generations United, says:

“Families may come together from need, but they are staying together by choice. Indeed, more than 7 in 10 (72 percent) of those currently living in a multigenerational household plan to continue doing so long-term.”

With More Adults Living Under One Roof, You May Need More Space

If you decide to look for a multigenerational home, it’s important to understand what everyone will need to make the arrangement work to its fullest. Something that often makes the top of the list for homeowners living with multiple generations is additional space for privacy. This could mean more bedrooms and bathrooms or features like an in-law suite or a basement.

If you’re realizing your current house doesn’t provide the room you need for multigenerational living, an expert real estate advisor can help you navigate the process to find the right home that works for you and your loved ones.

Bottom Line

Living in a multigenerational household has real and impactful benefits. If you’re interested in learning more about these options in our local area, let’s connect so you can find a home that fits your changing needs.

To view original article, visit Keeping Current Matters.

Is Wall Street Buying Up All the Homes in America?

Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

Are There Actually More Homes for Sale Right Now?

If you’re looking to buy, you may have slightly more options than you did in recent months, but you still need to brace for low inventory.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer.

People Are Still Moving, Even with Today’s Affordability Challenges

It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.

The Latest 2024 Housing Market Forecast

The housing market is expected to be more active in 2024 and that may be in part because there will always be people whose lives change and need to move.

Thinking About Using Your 401(k) To Buy a Home?

Before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert.