” Many people have found themselves in a similar situation and they’ve already made the choice to live in a multigenerational home.”

If your needs are changing, you may be thinking about sharing a home with additional loved ones, such as grandparents, adult children, or other extended family members. Whether it’s for financial or health-related circumstances, or simply because you’ve reached a new phase of life, you might be wondering if living with multiple generations under the same roof is a good move for you. Many people have found themselves in a similar situation and they’ve already made the choice to live in a multigenerational home.

What Is a Multigenerational Home?

The Pew Research Center defines a multigenerational household as a home with two or more adult generations. They include households with grandparents and grandchildren under the age of 25. As you weigh your options and decide if multigenerational living is right for you, here’s some helpful information highlighted by other homeowners living with additional loved ones.

The Benefits of Multigenerational Living

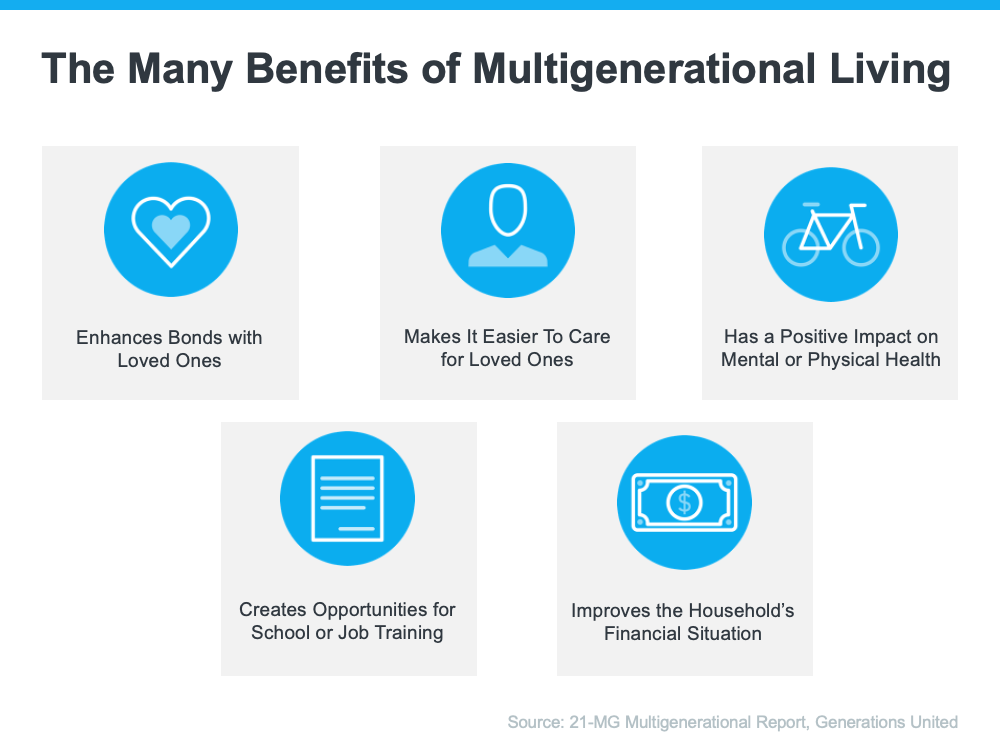

A recent report from Generations United surveyed individuals living in a multigenerational setting and asked them about the key benefits of this housing arrangement. It says:

“Nearly all Americans who live in a multigenerational household (98%) feel their household functions successfully, citing various aspects of home design, family relationships and interactions, and supports and services influencing their success.”

The study identifies some of the top benefits of this lifestyle as an improved financial situation, better mental and physical health, strengthened bonds with loved ones, and more (see chart below):

Those are just some of the reasons why most people who decide to live in this situation find it worthwhile. As Donna Butts, Executive Director at Generations United, says:

“Families may come together from need, but they are staying together by choice. Indeed, more than 7 in 10 (72 percent) of those currently living in a multigenerational household plan to continue doing so long-term.”

With More Adults Living Under One Roof, You May Need More Space

If you decide to look for a multigenerational home, it’s important to understand what everyone will need to make the arrangement work to its fullest. Something that often makes the top of the list for homeowners living with multiple generations is additional space for privacy. This could mean more bedrooms and bathrooms or features like an in-law suite or a basement.

If you’re realizing your current house doesn’t provide the room you need for multigenerational living, an expert real estate advisor can help you navigate the process to find the right home that works for you and your loved ones.

Bottom Line

Living in a multigenerational household has real and impactful benefits. If you’re interested in learning more about these options in our local area, let’s connect so you can find a home that fits your changing needs.

To view original article, visit Keeping Current Matters.

The Average Homeowner Gained $56,700 in Equity over the Past Year

Understanding the importance of equity can help you realize why homeownership is a worthwhile goal.

Homebuyers: Be Ready To Act This Winter

Competition among buyers will remain fierce as there still won’t be enough homes for sale to meet the demand. so be ready to act!

What Everyone Wants To Know: Will Home Prices Decline in 2022?

it’s important to note that price increases won’t be as monumental as they were in 2021 – but they certainly won’t decline anytime soon.

Advice for First-Generation Homebuyers

Your dream of homeownership has far-reaching impacts and if you’re about to be the first person in your family to buy a home, let that motivate you throughout the process.

If You Think the Housing Market Will Slow This Winter, Think Again.

All signs point to the winter housing market picking up steam, making it much busier than in a more typical year.

Struggling to Find a Home to Buy? New Construction May be an Option

Working with the guidance of your trusted real estate advisor will help you make the most informed and educated decision.