“Even when inflation is high like today, Americans recognize owning a home is a powerful financial decision.”

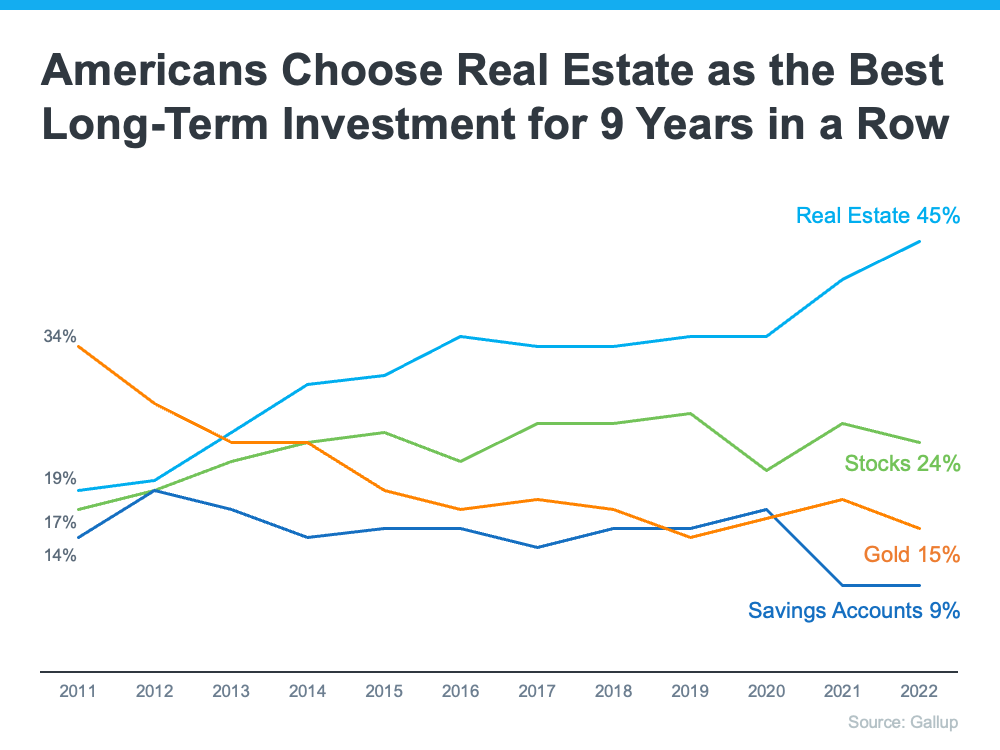

Americans’ opinion on the value of real estate as an investment is climbing. That’s according to an annual survey from Gallup. Not only is real estate viewed as the best investment for the ninth year in a row, but more Americans selected it than ever before.

The graph below shows the results of the survey since Gallup began asking the question in 2011. As the trend lines indicate, real estate has been gaining ground as the clear favorite for almost a decade now:

If you’re thinking about purchasing a home, let this poll reassure you. Even when inflation is high like today, Americans recognize owning a home is a powerful financial decision.

How an Investment in Real Estate Can Benefit You During High Inflation

Because inflation reached its highest level in 40 years recently, it’s more important than ever to understand the financial benefits of homeownership. Rising inflation means prices are increasing across the board, and that includes goods, services, housing costs, and more. When you purchase your home, you lock in your monthly housing payments, effectively shielding yourself from increases on one of your biggest budgetary items each month.

If you’re a renter, you don’t have that same benefit, and you aren’t protected from these increases, especially as rents rise. As Danielle Hale, Chief Economist at realtor.com, notes:

“Rising rents, which continue to climb at double-digit pace . . . and the prospect of locking in a monthly housing cost in a market with widespread inflation are motivating today’s first-time homebuyers.”

When Inflation Has Risen in the Past, Home Prices Have Too

Your house is also an asset that typically increases in value over time, even during inflation. That‘s because as prices rise, the value of your home does too. Mark Cussen, Financial Writer for Investopedia, puts it like this:

“There are many advantages to investing in real estate. . . . It often acts as a good inflation hedge since there will always be a demand for homes, regardless of the economic climate, and because as inflation rises, so do property values. . . .”

And since rising home values help increase your equity, and by extension your net worth, homeownership is historically a good hedge against inflation.

Bottom Line

Buying a home is a powerful decision. It’s no wonder why so many people view it as the best long-term investment, even when inflation is high. When you buy, you help shield yourself from increases in your housing costs and you own an asset that typically gains value with time. If you want to better understand how buying a home could be a great investment for you, let’s connect today.

To view original article, visit Keeping Current Matters.

Are The Top 3 Housing Market Questions on Your Mind?

When it comes to what’s happening in the housing market, there’s a lot of confusion going around right now.

Is Wall Street Buying Up All the Homes in America?

Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

Are There Actually More Homes for Sale Right Now?

If you’re looking to buy, you may have slightly more options than you did in recent months, but you still need to brace for low inventory.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer.

People Are Still Moving, Even with Today’s Affordability Challenges

It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.

The Latest 2024 Housing Market Forecast

The housing market is expected to be more active in 2024 and that may be in part because there will always be people whose lives change and need to move.