“Even when inflation is high like today, Americans recognize owning a home is a powerful financial decision.”

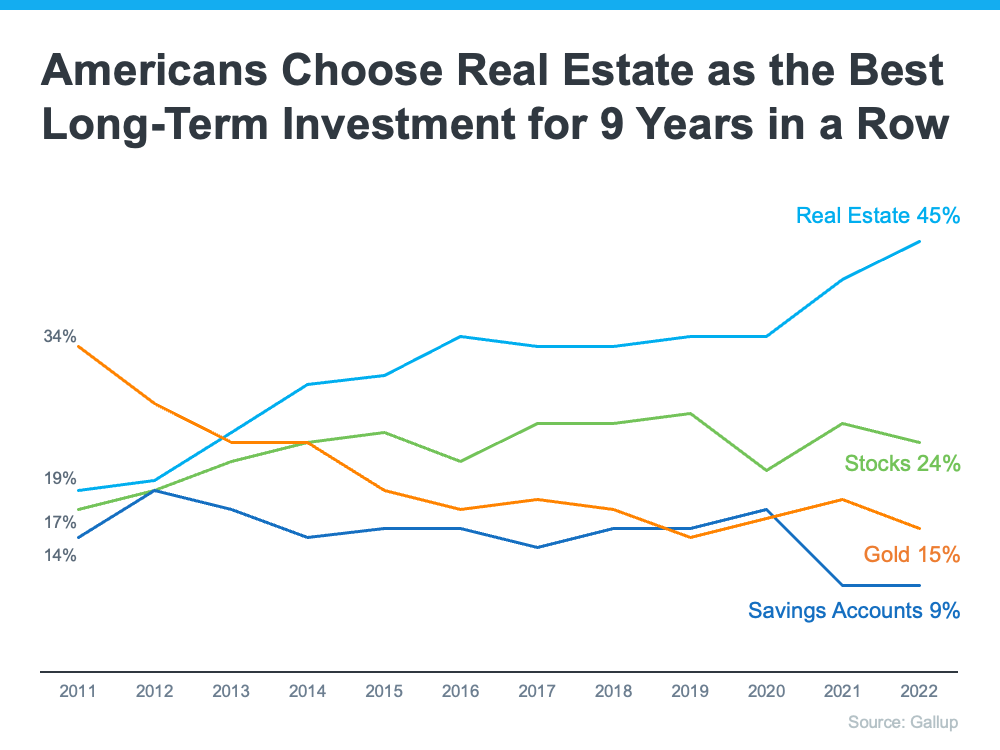

Americans’ opinion on the value of real estate as an investment is climbing. That’s according to an annual survey from Gallup. Not only is real estate viewed as the best investment for the ninth year in a row, but more Americans selected it than ever before.

The graph below shows the results of the survey since Gallup began asking the question in 2011. As the trend lines indicate, real estate has been gaining ground as the clear favorite for almost a decade now:

If you’re thinking about purchasing a home, let this poll reassure you. Even when inflation is high like today, Americans recognize owning a home is a powerful financial decision.

How an Investment in Real Estate Can Benefit You During High Inflation

Because inflation reached its highest level in 40 years recently, it’s more important than ever to understand the financial benefits of homeownership. Rising inflation means prices are increasing across the board, and that includes goods, services, housing costs, and more. When you purchase your home, you lock in your monthly housing payments, effectively shielding yourself from increases on one of your biggest budgetary items each month.

If you’re a renter, you don’t have that same benefit, and you aren’t protected from these increases, especially as rents rise. As Danielle Hale, Chief Economist at realtor.com, notes:

“Rising rents, which continue to climb at double-digit pace . . . and the prospect of locking in a monthly housing cost in a market with widespread inflation are motivating today’s first-time homebuyers.”

When Inflation Has Risen in the Past, Home Prices Have Too

Your house is also an asset that typically increases in value over time, even during inflation. That‘s because as prices rise, the value of your home does too. Mark Cussen, Financial Writer for Investopedia, puts it like this:

“There are many advantages to investing in real estate. . . . It often acts as a good inflation hedge since there will always be a demand for homes, regardless of the economic climate, and because as inflation rises, so do property values. . . .”

And since rising home values help increase your equity, and by extension your net worth, homeownership is historically a good hedge against inflation.

Bottom Line

Buying a home is a powerful decision. It’s no wonder why so many people view it as the best long-term investment, even when inflation is high. When you buy, you help shield yourself from increases in your housing costs and you own an asset that typically gains value with time. If you want to better understand how buying a home could be a great investment for you, let’s connect today.

To view original article, visit Keeping Current Matters.

Why It’s Still a Sellers’ Market

While buyer demand is softening due to higher mortgage rates, homes that are priced right are still selling fast. That means your window of opportunity to list your house hasn’t closed.

3 Graphs To Show This Isn’t a Housing Bubble

It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. Today’s market is nothing like that.

Why Are People Moving Today?

While mortgage rates are higher than they were at the start of the year and home prices are rising, you shouldn’t put your plans on hold based solely on market factors.

A Window of Opportunity for Homebuyers

The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic.

What’s Causing Ongoing Home Price Appreciation?

Experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand.

Think Home Prices Are Going To Fall? Think Again

If you’re planning to buy a home, you shouldn’t wait for home prices to drop to make your purchase.