“Living with loved ones could help you achieve your homeownership goals.”

If you’re thinking of buying a home and living with siblings, parents, or grandparents, then multigenerational living may be for you. The Pew Research Center defines a multigenerational household as a home with two or more adult generations. And the number of individuals choosing multigenerational living has increased over the past 50 years.

As you consider this option for your own home search, know it could help you on your homeownership journey and provide you with other incredible benefits along the way.

Living with Loved Ones Could Help You Achieve Your Homeownership Goals

There are several reasons people choose to live in a multigenerational household, and for many, the arrangement is a personal one. But according to the Pew Research Center, the top reason people choose to live together today is financial.

A recent study from Freddie Mac also finds more people are choosing to buy a home together so they can save money in the homebuying process. As the study says:

“. . . an increasing percentage of young adult first-time homebuyers are relying on support from older generations, including their parents, to buy a home together.”

For these individuals, combining their resources can help them achieve their dream of buying and owning a home. By pooling their incomes together to make that purchase, they may be able to afford a home they couldn’t on their own.

Other Key Benefits of Multigenerational Living

Not to mention, living in a home with loved ones can have other benefits too, like giving you more quality time to spend together. Darla Mercado, Certified Financial Planner and Markets Editor for CNBC.com, explains how this living arrangement can help on a personal and financial level:

“Residing with relatives can offer advantages . . . you can pool multiple streams of income, for instance. And in households with young children, grandparents can pitch in with child care.”

If this sounds like a great option for you, it’s important to work with a trusted real estate professional to discuss your needs. They can help you navigate the process to find the right home for you and your loved ones.

Bottom Line

More people are discovering the benefits of multigenerational living. For the best information and help deciding what’s right for your personal situation, let’s connect and start the conversation today.

To view original article, visit Keeping Current Matters.

Forbearance Numbers Are Lower than Expected

Today, the options available to homeowners will prevent a large spike in foreclosures and that’s good for the overall housing market.

Just How Strong Is the Housing Recovery?

The residential real estate market has definitely been the shining light in this country’s current economic situation.

Sellers Are Returning to the Housing Market

With sellers starting to get back into the market, if you want to sell your house for the best possible price, now is a great time to do so.

The Beginning of an Economic Recovery

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, some indicating over 20% growth along with improved consumer spending.

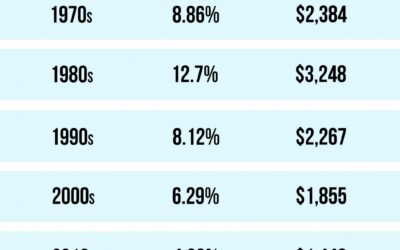

Mortgage Rates & Payments by Decade

Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your loan is significant.

#brookhamptonrealty

Homes Are More Affordable Right Now Than They Have Been in Years

If you’re thinking of making a move, now is the time to take advantage of the affordability that comes with low mortgage rates.