Where Are Mortgage Interest Rates Headed In 2018?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search.

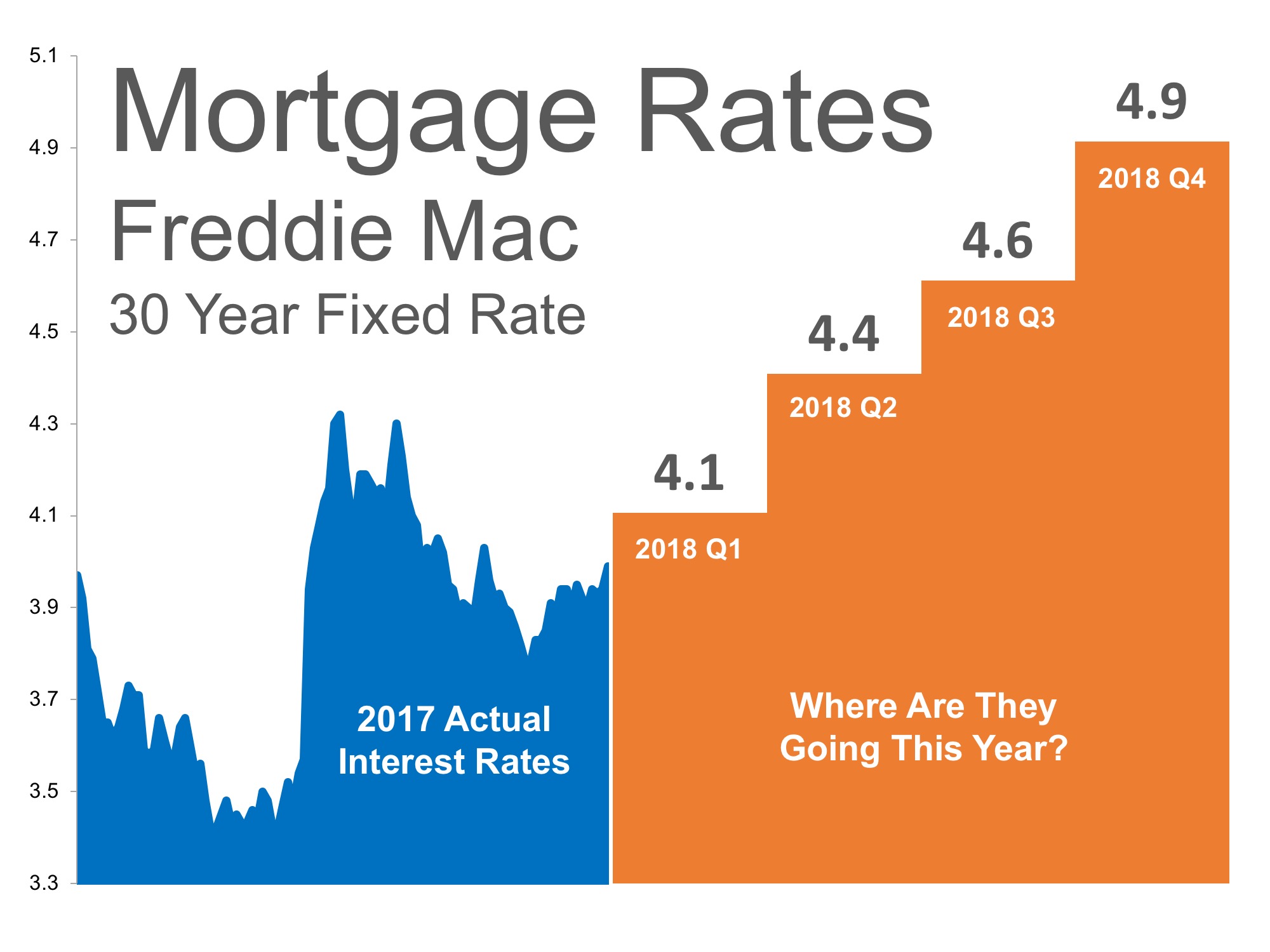

Below is a chart created using Freddie Mac’s U.S. Economic & Housing Marketing Outlook. As you can see, interest rates are projected to increase steadily over the course of the next 12 months.

How Will This Impact Your Mortgage Payment?

Depending on the amount of the loan that you secure, a half of a percent (.5%) increase in interest rate can increase your monthly mortgage payment significantly.

According to CoreLogic’s latest Home Price Index, national home prices have appreciated 7.0% from this time last year and are predicted to be 4.2% higher next year.

If both the predictions of home price and interest rate increases become reality, families would wind up paying considerably more for their next home.

Bottom Line

Even a small increase in interest rate can impact your family’s wealth. Let’s get together to evaluate your ability to purchase your dream home.

To view original article, please visit Keeping Current Matters.

Paused Your Moving Plans? Here’s Why It’s Time To Hit Play Again

Your home should sell quickly if you work with an agent to make sure it’s priced right and prepped to impress.

Don’t Miss This Prime Spring Window To Sell Your House

By targeting late spring, sellers can get their home listed when the most shoppers are looking.

4 Ways to Make an Offer That Stands Out This Spring

If you’re serious about landing a home you’ll love, you need a smart strategy that includes a working with a great agent.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Should I Buy a Home Now or Wait?

Yes, today’s housing market has challenges, but the key is making a move when it makes sense for you, rather than waiting for a perfect scenario that may never arrive.

Pre-Approval Isn’t Commitment – It’s Clarity

Pre-approval isn’t about jumping the gun or rushing your timeline. It’s about making sure you’re ready when it’s go-time.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

What You Can Do When Mortgage Rates Are a Moving Target

You can get the best rate possible in today’s market by controlling your credit score, loan type, and loan term..

Are You Saving Up to Buy a Home? Your Tax Refund Can Help

If you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home.

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.