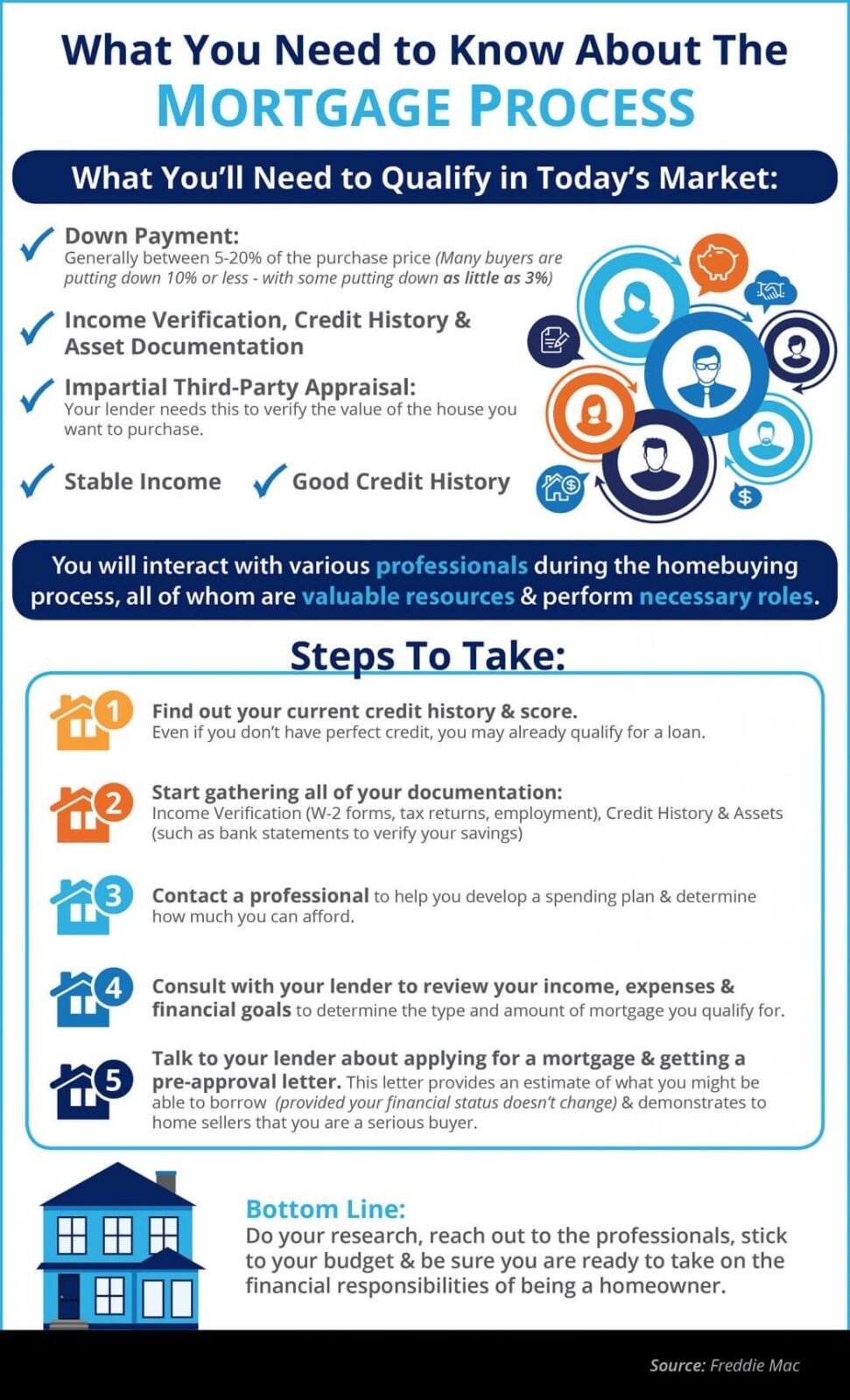

The Mortgage Process: What You Need to Know

Some Highlights:

-

Many buyers are purchasing a home with a down payment as little as 3%.

-

You may already qualify for a loan, even if you don’t have perfect credit.

-

Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

To see original article please visit Keeping Current Matters.

6 Foundational Benefits of Homeownership Today

As we think about the future and what we want to achieve beyond 2021, it’s a great time to look at the benefits of owning a home.

Do I Really Need a 20% Down Payment to Buy a Home?

Be sure to work with trusted professionals from the start to learn what you may qualify for in the homebuying process.

Why Owning a Home Is a Powerful Financial Decision

In today’s housing market, there are clear financial benefits to owning a home including the chance to build your net worth.

Want to Build Wealth? Buy a Home This Year.

A financial advantage to owning a home is the wealth built through equity when you own a home.

Turn to an Expert for the Best Advice, Not Perfect Advice

An agent can give you the best advice possible based on the information and situation at hand.

What Happens When Homeowners Leave Their Forbearance Plans?

If we do experience a higher foreclosure rate, most experts believe the current housing market will easily absorb the excess inventory.

What’s the Difference between an Appraisal and a Home Inspection?

Here’s the breakdown of each one and why they’re both important when buying a home.

Why Moving May Be Just the Boost You Need

There’s logic behind the idea that making a move could improve someone’s quality of life

Owning a Home Is Still More Affordable Than Renting One

In 2020, mortgage rates reached all-time lows 16 times, and so far, they’re continuing to hover in low territory this year.

Should I Wait for Lower Mortgage Interest Rates?

Borrowers are smart to take advantage of these low rates now and will certainly benefit as a result.