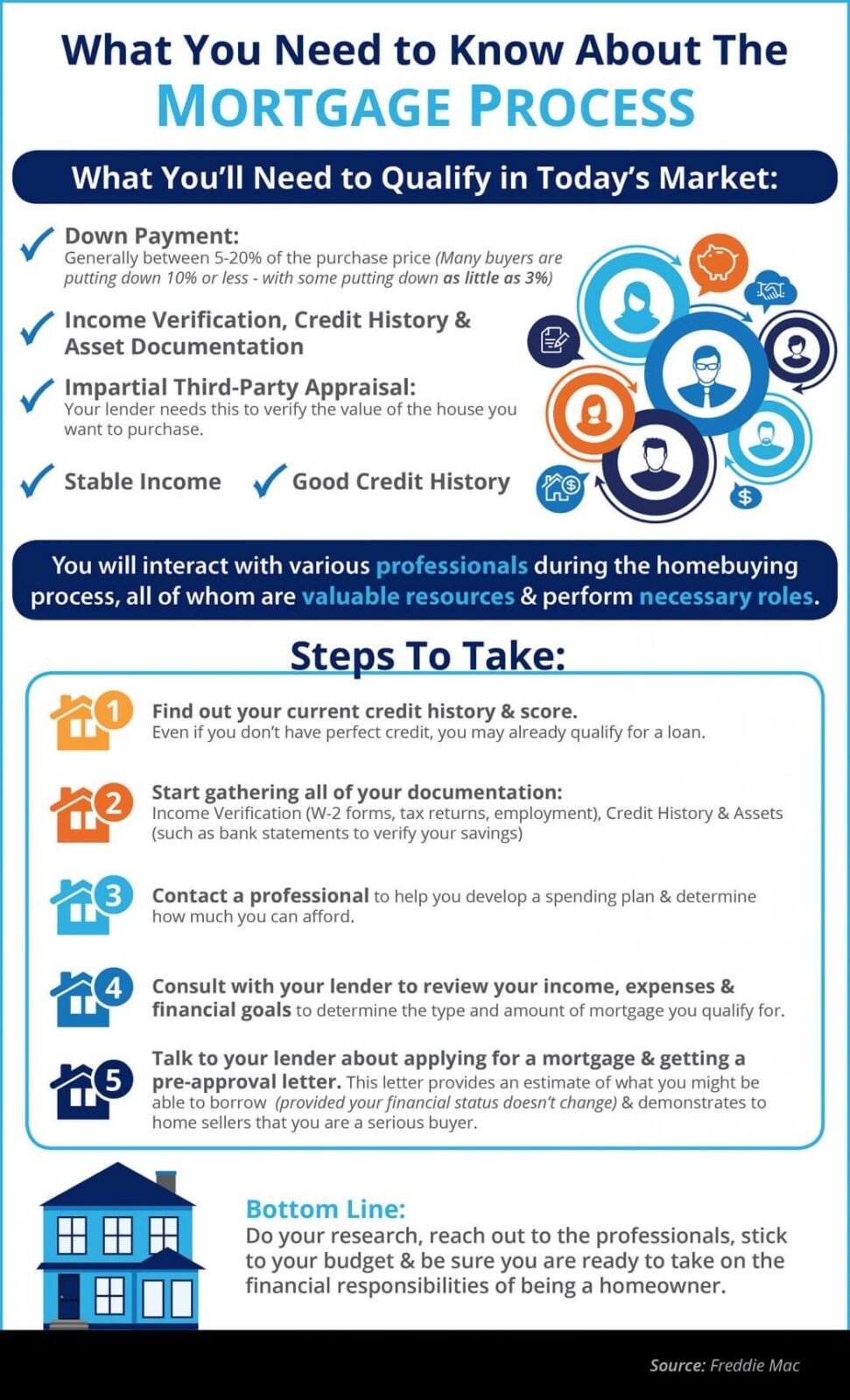

The Mortgage Process: What You Need to Know

Some Highlights:

-

Many buyers are purchasing a home with a down payment as little as 3%.

-

You may already qualify for a loan, even if you don’t have perfect credit.

-

Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

To see original article please visit Keeping Current Matters.

Thinking of Selling? Now May Be the Time.

The market is entering the year like a lion. There’s no indication it will lose that roar, assuming inventory continues to come to market.

Entry-Level Homeowners Are in the Driver’s Seat

Whatever you choose, if you’re moving out of an entry-level house, you’re likely going to be in the driver’s seat as a seller.

Opportunity in the Luxury Market This Year

With a strong economy and a backdrop set for moving up this year, it’s a great time to explore the luxury market.

Interest Rates Over Time

With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time.

The #1 Misconception in the Homebuying Process

If you’re thinking about purchasing a home, realize that homes are still affordable even though prices are increasing.

The Many Benefits of Aging in a Community

“Aging-in-place” definitely has its advantages, but it could mean getting “stuck-in-place” too. We can help you figure it all out!

How Trusted Professionals Make Homebuying Easier to Understand

There are many possible steps in a real estate transaction, but they don’t have to be confusing.

The Overlooked Financial Advantages of Homeownership

With a mortgage, you can keep your monthly housing costs steady and predictable.

How the Housing Market Benefits with Uncertainty in the World

“Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.”

The #1 Reason to List Your House Right Now

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand.