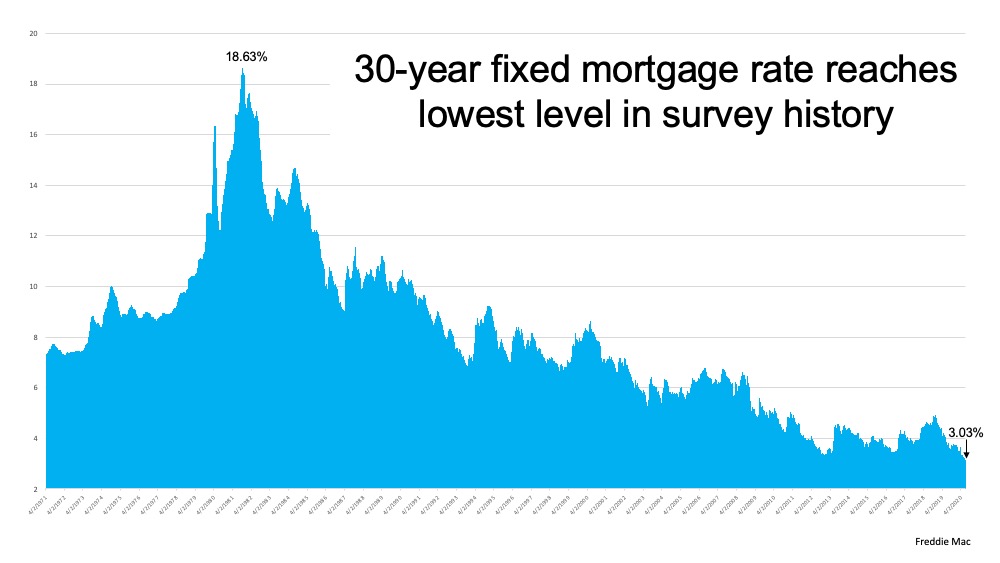

” Last week’s reported mortgage rate reached the lowest point in the history of the survey, which dates back to 1971.”

Over the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the history of the survey, which dates back to 1971 (See graph below):

What does this mean for buyers?

This is huge for homebuyers. Those currently taking advantage of the increasing affordability that comes with historically low interest rates are winning big. According to Sam Khater, Chief Economist at Freddie Mac:

“The summer is heating up as record low mortgage rates continue to spur homebuyer demand.”

In addition, move.com notes:

“Summer home buying season is off to a roaring start. As buyers flooded into the market, realtor.com® monthly traffic hit an all-time high of 86 million unique users in June 2020, breaking May’s record of 85 million unique users. Realtor.com® daily traffic also hit its highest level ever of 7 million unique users on June 25, signaling that despite the global pandemic buyers are ready to make a purchase.”

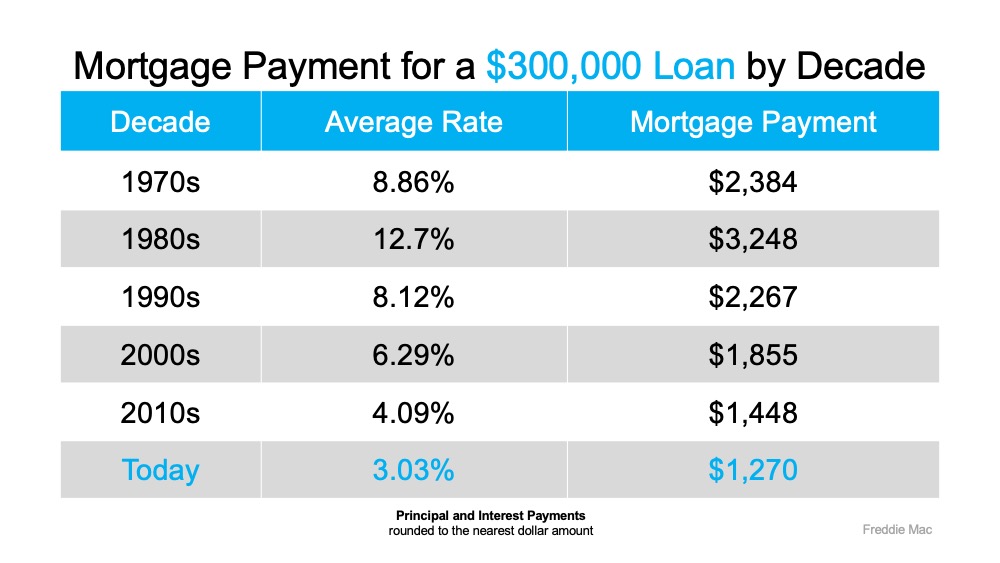

Clearly, buyers are capitalizing on today’s low rates. As shown in the chart below, the average monthly mortgage payment decreases significantly when rates are as low as they are today. A lower monthly payment means savings that can add up significantly over the life of a home loan. It also means that qualified buyers may be able to purchase more home for their money. Maybe that’s a bigger home than what they’d be able to afford at a higher rate, an increasingly desirable option considering the amount of time families are now spending at home given today’s health crisis.

A lower monthly payment means savings that can add up significantly over the life of a home loan. It also means that qualified buyers may be able to purchase more home for their money. Maybe that’s a bigger home than what they’d be able to afford at a higher rate, an increasingly desirable option considering the amount of time families are now spending at home given today’s health crisis.

Bottom Line

If you’re in a position to buy a home this year, let’s connect to initiate the process while mortgage rates are historically low.

To view original article, visit Keeping Current Matters.

Trying To Buy a Home? Hang in There.

As we move into the spring buying season, even though we are still in a sellers’ market, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.

Two Reasons You Should Sell Your House

Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving and let’s connect today!

How Changing Mortgage Rates Can Affect You

It’s critical to lean on your expert real estate advisors to explore your mortgage options and understand what impacts mortgage rates.

We’re in a Sellers’ Market. What Does That Mean?

Right now, there are still buyers who are ready, willing, and able to purchase a home. List your home at the right price 🙂

How Homeownership is Life Changing for Many Women

The financial security and independence homeownership provides can be life changing.

Get Ready: The Best Time To List Your House Is Almost Here

If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching.