“National Association of Realtors’ 2019 Home Buyer and Seller Generational Report revealed interesting tidbits about baby boomers!”

As loved ones start to get older, we start to wonder: how long will they be able to live alone? Will they need someone there to help them with daily life? There’s a reason to ask those questions now more than ever, as the average life expectancy in the U.S. is 78 years old! As a result, 41% of Americans in the market are searching for a home that can accommodate a multigenerational family.

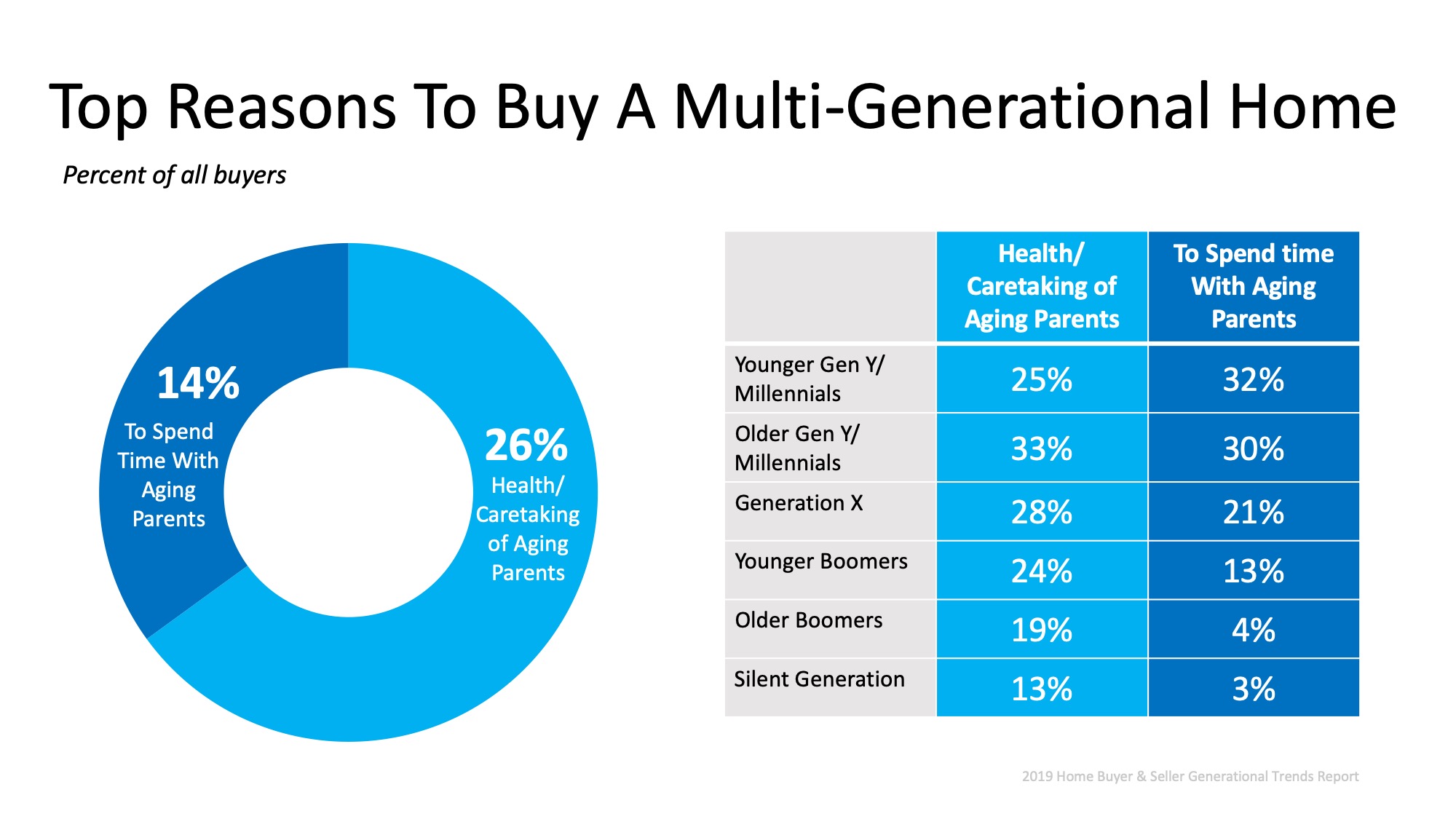

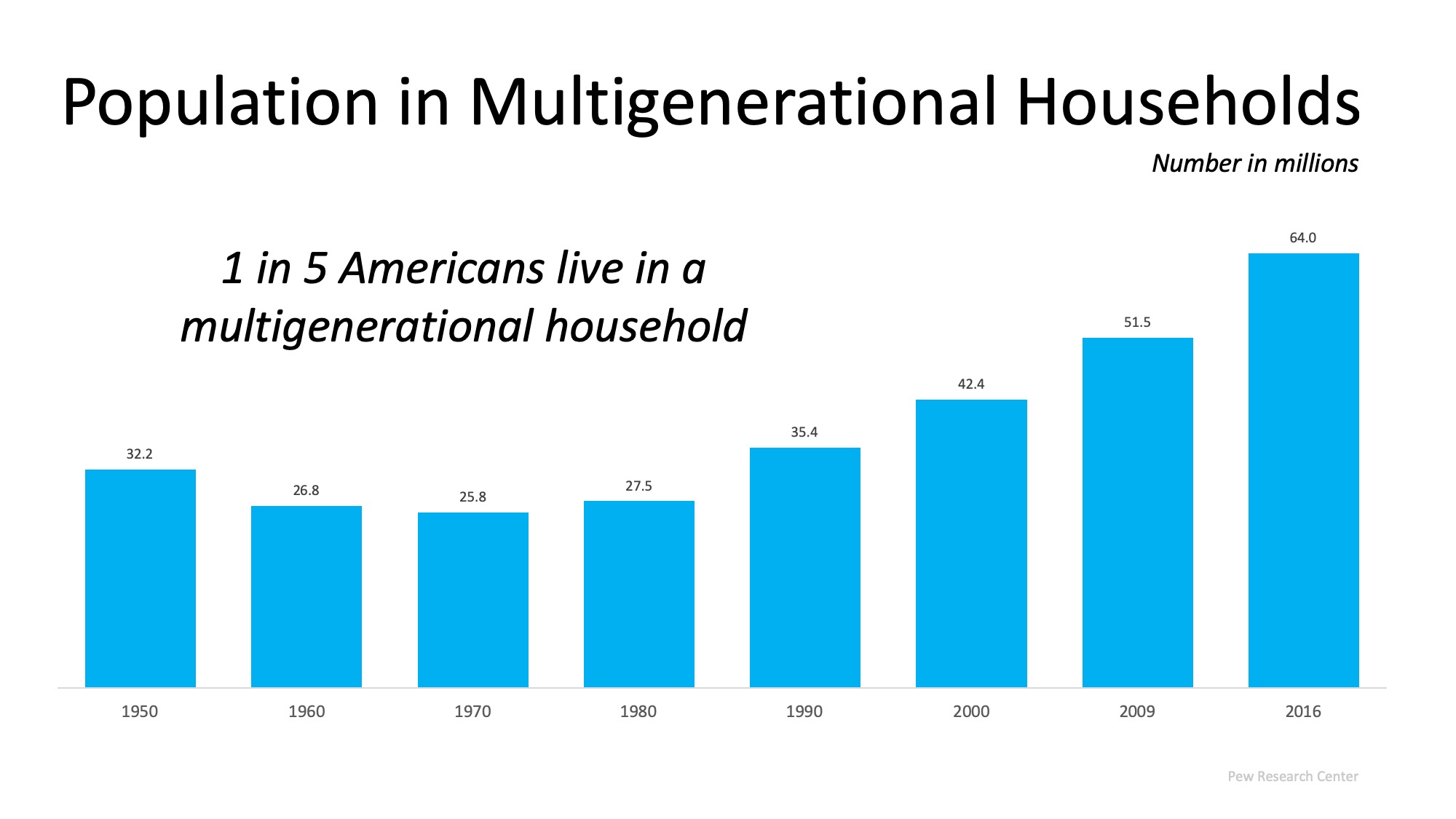

The graph below shows the number of people by generation that purchased a multigenerational home because they will either be taking care of an aging parent or they just want to spend time together. Of those buyers, 26% indicated they will be taking care of an aging parent, and 14% said they want to spend time with an aging parent. These numbers do not come as a surprise. According to Pew Research Center, 64 million Americans (20% of the population) lived in a multigenerational household in 2016 (Last numbers available).

Of those buyers, 26% indicated they will be taking care of an aging parent, and 14% said they want to spend time with an aging parent. These numbers do not come as a surprise. According to Pew Research Center, 64 million Americans (20% of the population) lived in a multigenerational household in 2016 (Last numbers available). An increasing number of studies affirm the benefits of being part of a multigenerational household. These benefits aren’t just for the grandchildren, but for the grandparents as well. According to these two resources:

An increasing number of studies affirm the benefits of being part of a multigenerational household. These benefits aren’t just for the grandchildren, but for the grandparents as well. According to these two resources:

The University of Oxford

“Children who are close to their grandparents have fewer emotional and behavioral problems and are better able to cope with traumatic life events, like a divorce or bullying at school”.

Boston College

“Researchers found that emotionally close ties between grandparents and adult grandchildren reduced depressive symptoms in both groups”.

This research gives helpful insight into why 41% of Americans are in the market to buy a multigenerational home.

Bottom Line

If you have a home that could accommodate a multigenerational family and are thinking about selling, now is the perfect time to put it on the market! The number of buyers looking for this type of home will only continue to increase.

To view original article, visit Keeping Current Matters.

Why Did More People Decide To Sell Their Homes Recently?

As rates came down at the end of the summer, more people jumped into the market and decided to make their move.

Now’s the Time to Upgrade to Your Dream Home

A recent survey reveals the top motivator for today’s homebuyers is the desire for more space or an upgraded home.

Why an Agent Is Essential When Buying a Newly Built Home

By working with a knowledgeable real estate agent, you can feel confident when buying a newly built home today.

This Is the Sweet Spot Homebuyers Have Been Waiting For

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible.

Why Now’s Not the Time To Take Your House Off the Market

By keeping your home on the market, you increase the chances of attracting people who are truly ready to make a purchase.

Buying Beats Renting in 22 Major U.S. Cities

Whether you live in one of these budget-friendly cities or any town in-between, it’s time to to talk a local real estate agent to get started.