Net Worth of Homeowners 44X Greater than Renters

Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey data, covering 2013-2016 was released two weeks ago.

The study revealed that the 2016 median net worth of homeowners was $231,400 – a 15% increase since 2013. At the same time, the median net worth of renters decreased by 5% ($5,200 today compared to $5,500 in 2013).

These numbers reveal that the net worth of a homeowner is over 44 times greater than that of a renter.

Owning a home is a great way to build family wealth

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth by increasing the equity in your home.

That is why, for the fourth year in a row, Gallup reported that Americans picked real estate as the best long-term investment. This year’s results showed that 34% of Americans chose real estate, followed by stocks at 26% and then gold, savings accounts/CDs, or bonds.

Greater equity in your home gives you options

If you want to find out how you can use the increased equity in your home to move to a home that better fits your current lifestyle, let’s get together to discuss the process.

To see original article please visit Keeping Current Matters.

Where Are Home Values Headed Over the Next 12 Months?

The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.

Housing Market on Track to Beat Last Year’s Success

Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels.

Why Pricing Your Home Right Matters This Fall

To sell your home quickly and for the best possible price, you should price your home competitively right from the start.

Home Equity Gives Sellers Options in Today’s Market

Across the country, home equity was increasing before the health crisis swept our nation, and it continues to grow throughout the year.

Home Builder Confidence Hits All-Time Record

The housing market continued to exceed expectations in August, as housing demand for new homes stayed strong.

The Cost of a Home Is Far More Important than the Price

Thanks to today’s lower interest rates, even with the price increase, you would still save $61 in your monthly mortgage payments.

Is the Economic Recovery Beating All Projections?

Is the U.S. economy and labor market are recovering from the coronavirus-related downturn more quickly than previously expected?

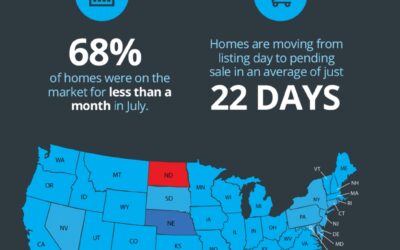

Homes Across the Country Are Selling Fast

Buyers are actively searching for and purchasing homes at a record-breaking pace.

How Low Inventory May Impact the Housing Market This Fall

Considering selling your house? Let’s talk about how you can benefit from the market trends in our area.

The Surging Real Estate Market Continues to Climb

Though there is some evidence that the overall economic recovery may be slowing, the housing market is still gaining momentum.