Net Worth of Homeowners 44X Greater than Renters

Every three years, the Federal Reserve conducts their Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey data, covering 2013-2016 was released two weeks ago.

The study revealed that the 2016 median net worth of homeowners was $231,400 – a 15% increase since 2013. At the same time, the median net worth of renters decreased by 5% ($5,200 today compared to $5,500 in 2013).

These numbers reveal that the net worth of a homeowner is over 44 times greater than that of a renter.

Owning a home is a great way to build family wealth

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth by increasing the equity in your home.

That is why, for the fourth year in a row, Gallup reported that Americans picked real estate as the best long-term investment. This year’s results showed that 34% of Americans chose real estate, followed by stocks at 26% and then gold, savings accounts/CDs, or bonds.

Greater equity in your home gives you options

If you want to find out how you can use the increased equity in your home to move to a home that better fits your current lifestyle, let’s get together to discuss the process.

To see original article please visit Keeping Current Matters.

Builders & Realtors Agree: Real Estate Is Back

The housing market is well past the recovery phase and is now booming with higher home sales compared to the pre-pandemic days.

In laid-back East Moriches, concerns about future development

Steve Monzeglio describes East Moriches as a “real gem of a small South Shore town” in this recent Newsday article. Take a look!

Forbearance Numbers Are Lower than Expected

Today, the options available to homeowners will prevent a large spike in foreclosures and that’s good for the overall housing market.

Just How Strong Is the Housing Recovery?

The residential real estate market has definitely been the shining light in this country’s current economic situation.

Sellers Are Returning to the Housing Market

With sellers starting to get back into the market, if you want to sell your house for the best possible price, now is a great time to do so.

The Beginning of an Economic Recovery

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, some indicating over 20% growth along with improved consumer spending.

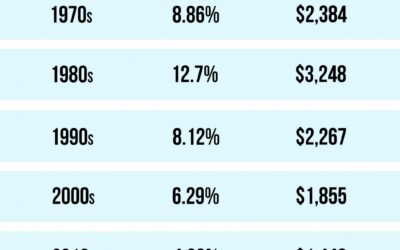

Mortgage Rates & Payments by Decade

Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your loan is significant.

#brookhamptonrealty

Homes Are More Affordable Right Now Than They Have Been in Years

If you’re thinking of making a move, now is the time to take advantage of the affordability that comes with low mortgage rates.

Why Foreclosures Won’t Crush the Housing Market Next Year

Homeowners today have many options to avoid foreclosure, and equity is surely helping to keep many afloat.

Current Buyer & Seller Perks in the Housing Market

Today’s housing market is making an impressive turnaround. It’s also setting up some outstanding opportunities for buyers and sellers.