“Earlier this month, realtor.com announced the release of their initial Housing Recovery Index, a weekly guide showing how the pandemic has impacted the residential real estate market.”

- Housing Demand – Growth in online search activity

- Home Price – Growth in asking prices

- Housing Supply – Growth of new listings

- Pace of Sales – Difference in time-on-market

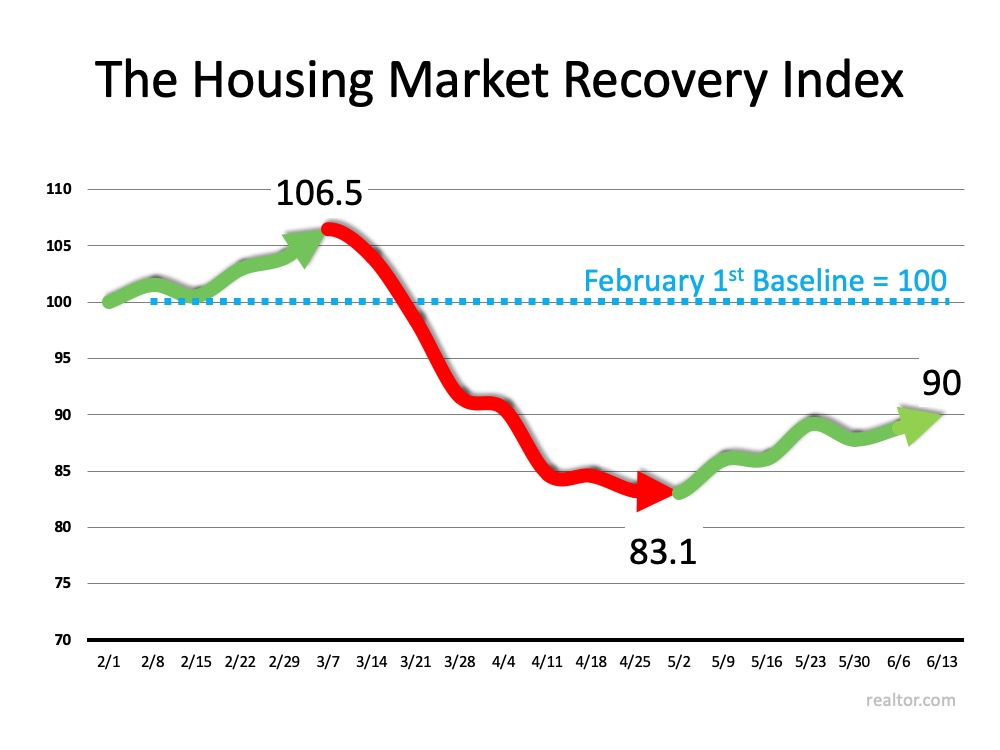

The index then compares the current status “to the last week of January 2020 market trend, as a baseline for pre-COVID market growth. The overall index is set to 100 in this baseline period. The higher a market’s index value, the higher its recovery and vice versa.”

The graph below charts the index by showing how the real estate market started out strong in early 2020, and then dropped dramatically at the beginning of March when the pandemic paused the economy. It also shows the strength of the recovery since the beginning of May. It’s clear to see that the housing market is showing promising signs of recovery from the deep economic cuts we experienced earlier this spring. As noted by Dean Mon, Chairman of the National Association of Home Builders (NAHB):

It’s clear to see that the housing market is showing promising signs of recovery from the deep economic cuts we experienced earlier this spring. As noted by Dean Mon, Chairman of the National Association of Home Builders (NAHB):

“As the nation reopens, housing is well-positioned to lead the economy forward.”

The data today indicates the housing market is already on the way up.

Bottom Line

Staying connected to the housing market’s performance over the coming months will be essential, as we continue to evaluate exactly how the housing market is doing in this uncharted time ahead.

To view original article, visit Keeping Current Matters.

Is Your House Priced Too High?

Pricing your house correctly is one of the most crucial steps in the selling process and if you’re asking too much you may be turning potential buyers away.

Falling Mortgage Rates Are Bringing Buyers Back

If you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with an agent.

Mortgage Rates Drop to Lowest Level in over a Year and a Half

Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.

The Best Time to Buy a Home This Year

Mortgage rates just hit their lowest point in 19 months, and that goes a long way to help with your purchasing power and affordability. Are you ready to buy?

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

While home affordability is finally starting to show signs of improving, it’s still tight. Your lender can help you.

2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it’s important to know what experts are projecting for the housing market.