No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

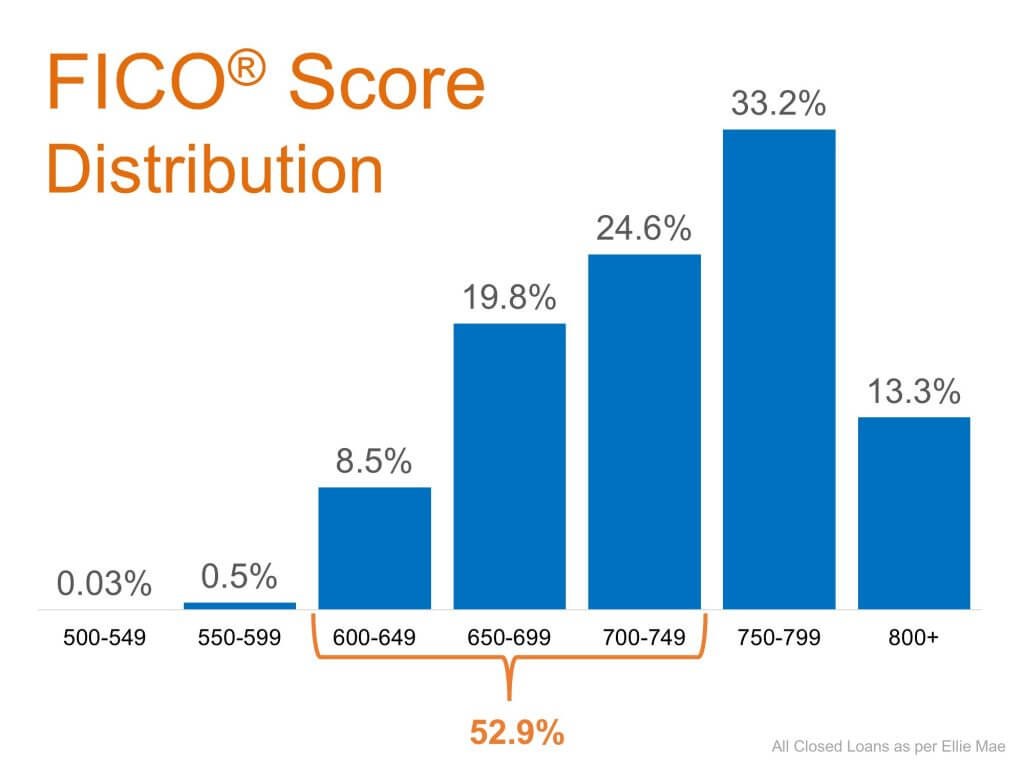

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

What You Need To Know About Selling in a Sellers’ Market

Listing your house this season means you’ll be in front of serious buyers who are ready to buy.

How Homeownership Can Help Shield You from Inflation

Buying a home allows you to stabilize what’s typically your biggest monthly expense: your housing cost.

On the Fence of Whether or Not To Move This Spring? Consider This.

When buyers have to compete with one another like this, they’ll do everything they can to make their offer stand out.

Is It Time to Buy a Smaller Home?

There are many reasons to buy a smaller home—or to downsize from your present home—but sometimes, the idea that “less is more” is what propels homeowners to buy a smaller home.

Why a Real Estate Professional is Key When Selling Your House

Real Estate professionals have the skills, experience and expertise to navigate the highly detailed and involved process of selling a home.

Using Your Tax Refund To Achieve Your Homeownership Goals This Year

If you’re getting a refund this year, here are a few tips to help with your home purchase or sale this season.

Balancing Your Wants and Needs as a Homebuyer Today

Crafting your home search checklist may seem like a small task, but it can save you time and money.

There Are Several Great Reasons to Consider Buying a Condo Today

Talking with an expert real estate advisor is the best first step to determining if condo living might work for you.

The Best Week To List Your House Is Just Around the Corner

If you’re ready to move fast, you may want to shoot for April 10th-16th as your target goal.

A Key to Building Wealth is Homeownership

Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.