No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

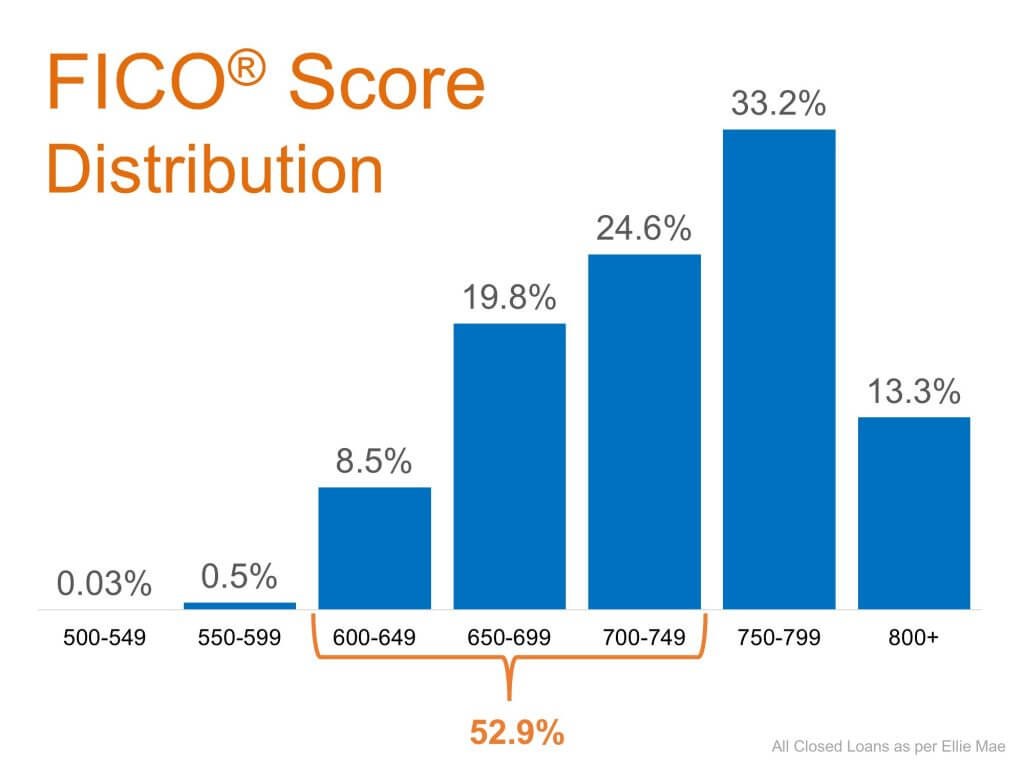

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

Real Estate Voted the Best Investment Eight Years in a Row

As a homeowner, your house is an asset that typically increases in value over time, even during inflation.

4 Simple Graphs Showing Why This Is Not a Housing Bubble

This market is very different than it was during the housing crash 15 years ago.

What Every Seller Needs to Know About Renovating This Year

Speak with a real estate professional to confirm which improvements aren’t deal-breakers for buyers.

Are You Ready To Fall in Love with Homeownership?

Buying a home is not just a financial decision. It’s also a lifestyle decision. Are you ready?

Want Top Dollar for Your House? Now’s the Time to List It.

If you’re thinking of selling your house this year, here are two reasons why now’s the time to list.

Don’t Let Student Loans Delay Your Homeownership Dreams

The key takeaway is, for many people, homeownership is achievable even with student loans.

Consumers Agree: It’s a Good Time To Sell

From record-high equity gains to record-low housing supply and high buyer demand, homeowners have more motivation than ever to sell.

Millions of Americans Have Discovered the Benefits of Multigenerational Households

Is multigenerational living right for you?

The Top Indicator if You Want to Know Where Mortgage Rates Are Heading

Mortgage rates have increased significantly since the beginning of the year.

Owning Is More Affordable than Renting in the Majority of the Country

If you’re weighing your options between renting and buying, it’s important to look at the full picture.