No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

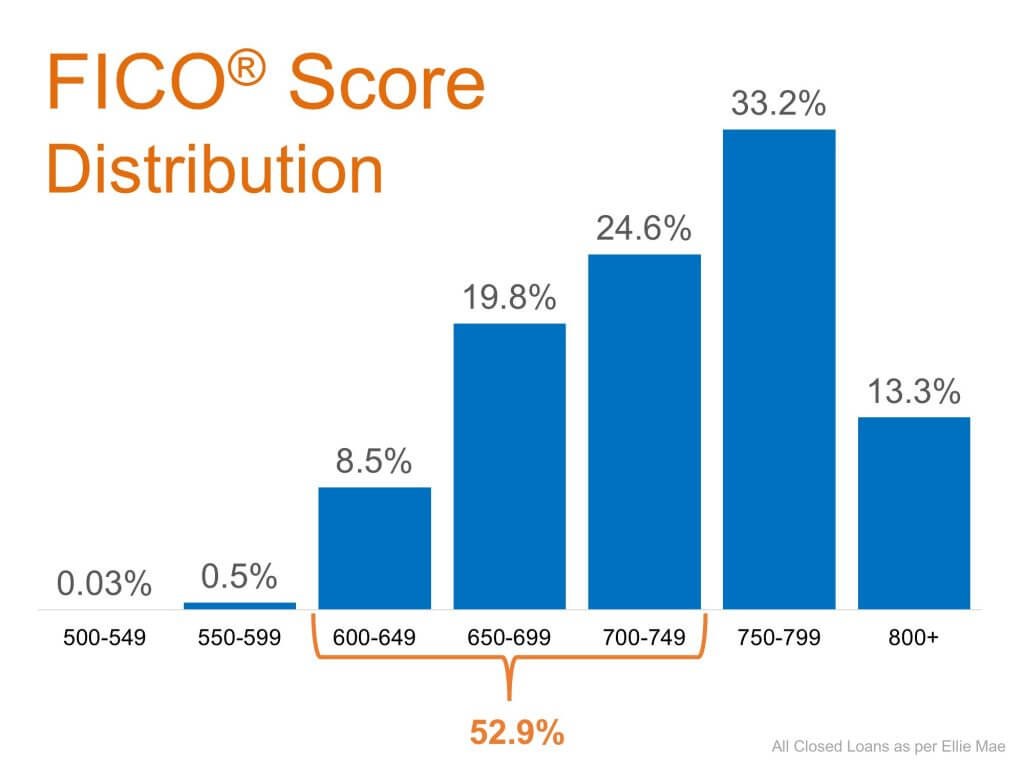

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

6 Foundational Benefits of Homeownership Today

As we think about the future and what we want to achieve beyond 2021, it’s a great time to look at the benefits of owning a home.

Do I Really Need a 20% Down Payment to Buy a Home?

Be sure to work with trusted professionals from the start to learn what you may qualify for in the homebuying process.

Why Owning a Home Is a Powerful Financial Decision

In today’s housing market, there are clear financial benefits to owning a home including the chance to build your net worth.

Want to Build Wealth? Buy a Home This Year.

A financial advantage to owning a home is the wealth built through equity when you own a home.

Turn to an Expert for the Best Advice, Not Perfect Advice

An agent can give you the best advice possible based on the information and situation at hand.

What Happens When Homeowners Leave Their Forbearance Plans?

If we do experience a higher foreclosure rate, most experts believe the current housing market will easily absorb the excess inventory.

What’s the Difference between an Appraisal and a Home Inspection?

Here’s the breakdown of each one and why they’re both important when buying a home.

Why Moving May Be Just the Boost You Need

There’s logic behind the idea that making a move could improve someone’s quality of life

Owning a Home Is Still More Affordable Than Renting One

In 2020, mortgage rates reached all-time lows 16 times, and so far, they’re continuing to hover in low territory this year.

Should I Wait for Lower Mortgage Interest Rates?

Borrowers are smart to take advantage of these low rates now and will certainly benefit as a result.