No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

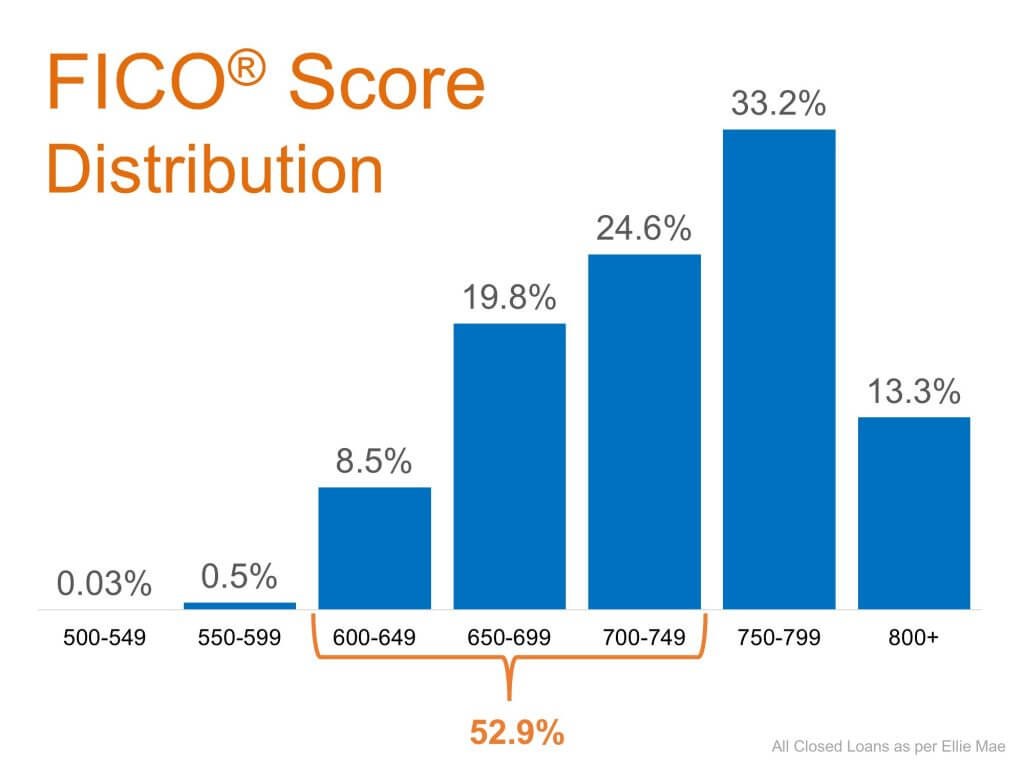

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

The Difference a Year Makes for Homeownership

Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The Do’s and Dont’s after Applying for a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close.

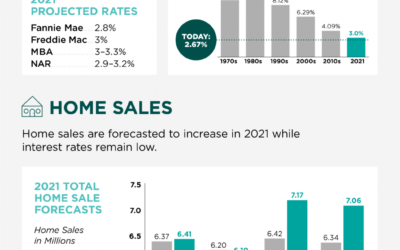

2021 Housing Forecast – Infographic

With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.

Homeowner Equity Increases an Astonishing $1 Trillion

Over the past year, strong home price growth has created a record level of home equity for homeowners.

The Holidays Aren’t Stopping Homebuyers This Year

There are first-time, move-up, and move-down buyers actively looking for the home of their dreams this winter.

5 Steps to Follow When Applying for Forbearance

Help is out there for homeowners in need, but it’s important to apply now while this benefit is still available.

Winning as a Buyer in a Sellers’ Market

Buying a home in today’s sellers’ market doesn’t have to feel like an uphill battle. Make your life easier by working with one of our trusted agents!

Why It Makes Sense to Sell Your House This Holiday Season

The supply of homes for sale is not keeping up with this high demand, making now the optimal time to sell your house.

Are Home Prices Headed Toward Bubble Territory?

High demand coupled with restricted supply has caused home prices to appreciate above historic levels.

An Honest Look at Unemployment Numbers

Though millions of Americans are still out of work, the situation was forecasted to be even direr than it is today.