No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

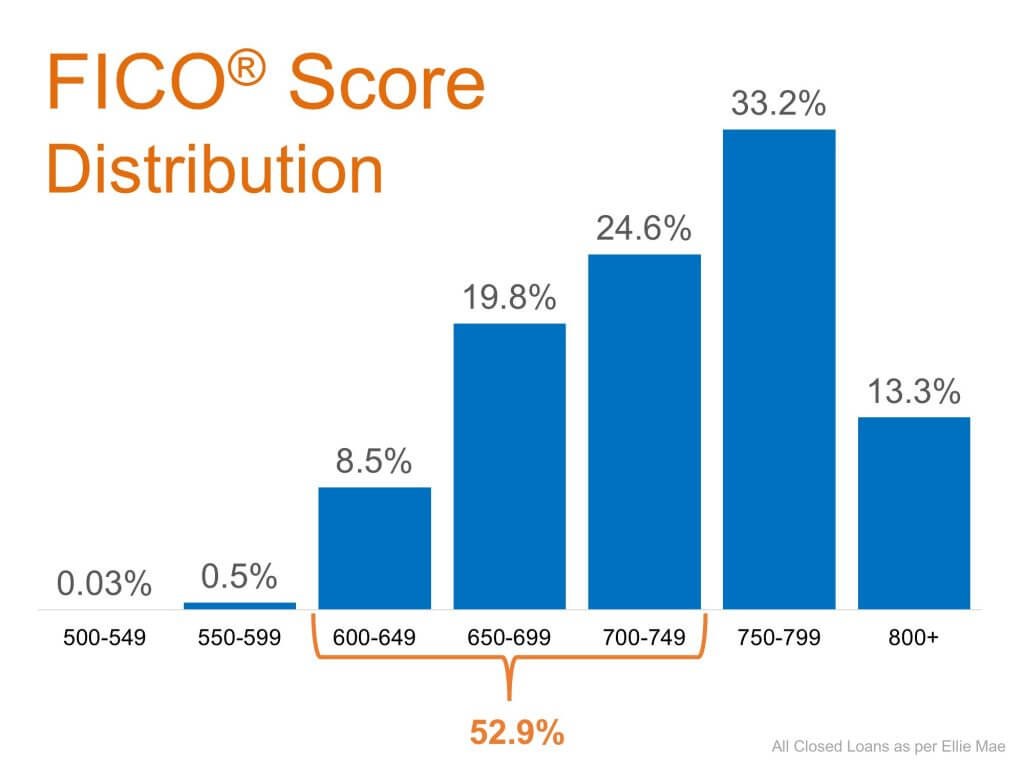

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

How Remote Work Can Power Your Vacation Home Sale

Demand is on the rise, so let’s discuss your next steps when it comes to selling your vacation home.

The Path to Homeownership

If you’re thinking of buying a home and not sure where to start, here’s a map with 10 simple steps to follow in the home buying process.

#brookhamptonrealty #realestate

A New Way to Shop for Homes in a Virtual World

In 2020, agents quickly empowered buyers and sellers with virtual tours, 3D floor plans, high-quality photos, and online open houses.

With Home Values Surging, Is it Still Affordable to Buy Right Now?

Buying a home while mortgage rates are as low as they are now may save you quite a bit of money over the life of your home loan.

Knowledge Is Power on the Path to Homeownership

Understanding what’s out there and the options available may help many buyers become homeowners faster than they thought possible.

5 Tips for Homebuyers Who Want to Make a Competitive Offer

With so many buyers competing in today’s market, it’s more important than ever to know the ins and outs of making a competitive offer.

Your House May Be High on the Buyer Wish List This Holiday Season

This year, buyers want to purchase homes for the holidays, and your house might be the perfect match.

Is Buying a Home Today a Good Financial Move?

Even though homes have appreciated by a whopping 6.7% over the last twelve months, the cost to buy a home has actually dropped.

Happy Thanksgiving

Happy Thanksgiving from all of us to all of you!

#brookhamptonrealty #grateful #realestate

#clients #buyersandsellers #friends

Don’t Let Buyer Competition Keep You from Purchasing a Home

Bidding wars may be one of the greatest challenges buyers face in today’s housing market, but they shouldn’t be a deal-breaker.