No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

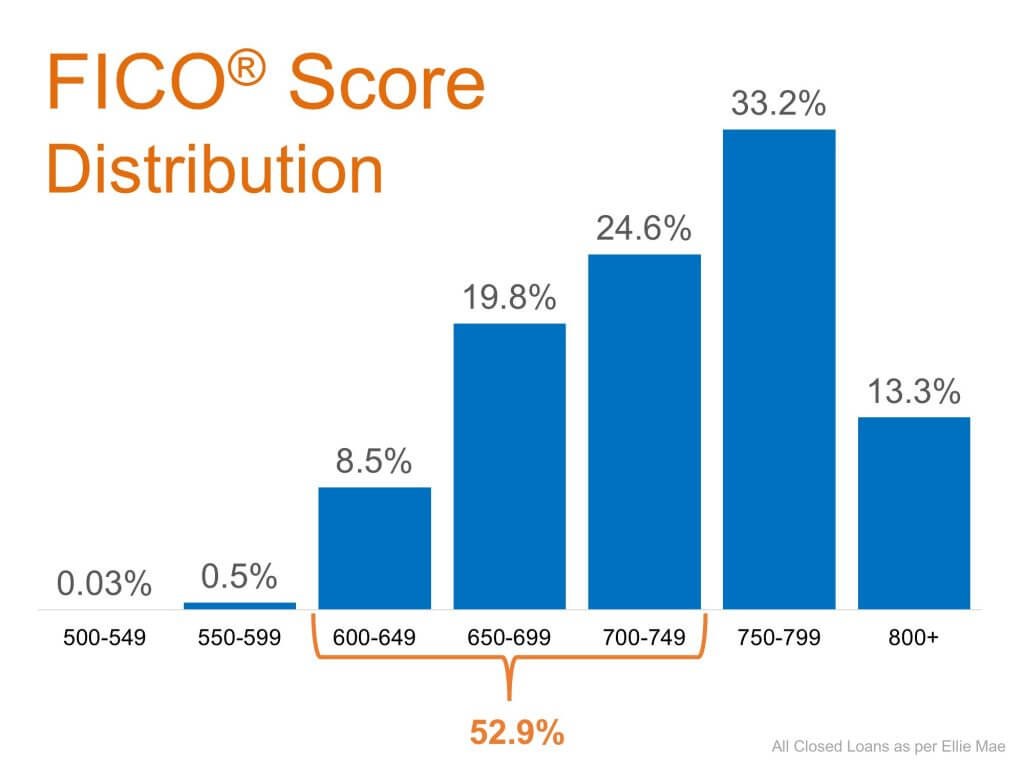

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

Real Estate Is a Driving Force in the Economy

The American Dream of homeownership has continued to thrive in the midst of this year’s economic downturn.

Rent vs. Buy: How to Decide What’s Best for You

With today’s low mortgage rates, there’s great opportunity for current renters to make a move into homeownership.

4 Reasons Why the Election Won’t Dampen the Housing Market

Recent trends suggest that the housing market will continue its strong momentum in the months to come.

Buyer Interest Is Growing among Younger Generations

he demand for homes this year is extraordinary as record-breaking numbers of hopeful buyers continue to shop for homes.

Two Important Impacts of Home Equity

According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year which can make moving up a real possibility.

Home Values Projected to Keep Rising

Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come. Buyer demand is high, inventory is low driving home prices higher.

Why Today’s Options Will Save Homeowners from Foreclosure

Homeowners now have a large amount of equity in their homes and may decide to sell rather than wait for the bank to foreclose.

Real Estate Continues to Show Unprecedented Strength This Year

Home sales continue to amaze industry experts, and there are plenty of buyers in the pipeline ready to enter the market.

How to Prepare for a Bidding War

From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

Do You Need to Know More about Forbearance and Mortgage Relief Options?

Know your options! Call your mortgage provider.