No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

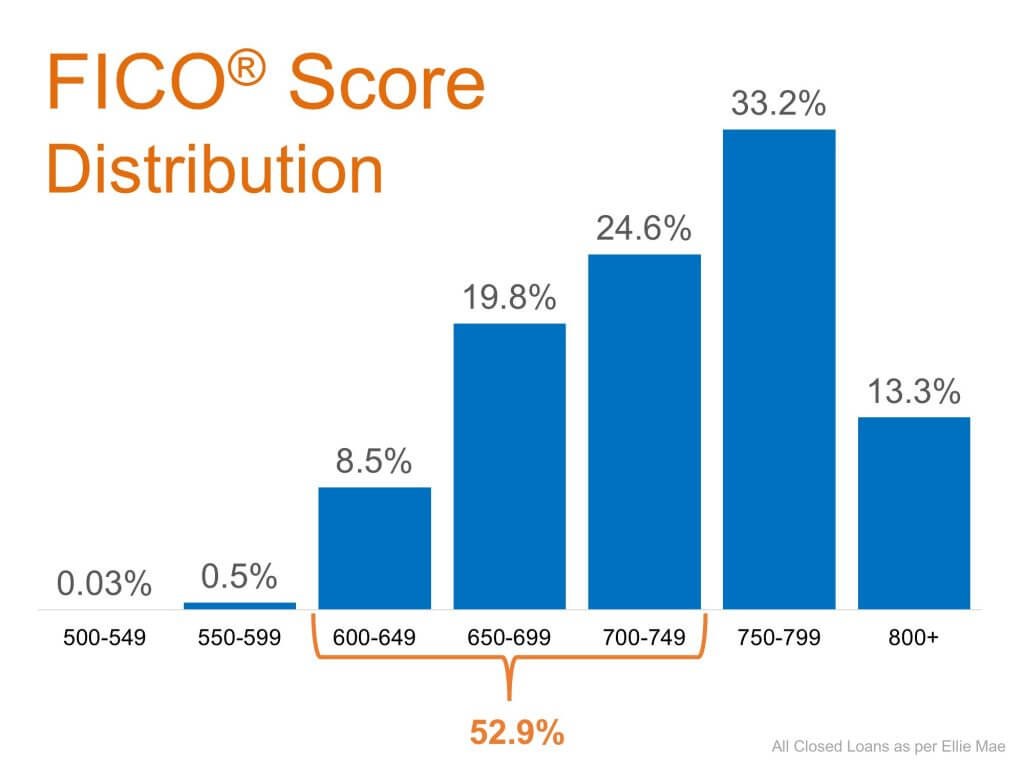

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

Confidence is the Key to Success for Young Home Buyers

For those in younger generations who aspire to buy, here are three things to consider sooner rather than later…

Equity Gain Growing in Nearly Every State

Today, the number of homeowners that currently have significant equity in their homes is growing. This year may be your year to sell!

New Homes Coming to the Housing Market This Year

New inventory means more options. More inventory means more competition. What does all this mean to you?

The Difference an Hour Makes

Don’t forget to set your clocks forward this Sunday, March 8 at 2:00 AM EST in observance of Daylight Saving Time, unless you’re a resident of Arizona or Hawaii!

Impact of the Coronavirus on the U. S. Housing Market

It is in times like these that working with an informed and educated real estate professional can make all the difference in the world.

Real Estate Is Soaring, But Not Like 2008

“Our first look at 2020 data suggests that we could see the most competitive home shopping season in years, as buyers are already competing over…homes for sale.” Jeff Tucker, Zillow Economist

How Interest Rates Can Impact Your Monthly Housing Payments

If you’re thinking about buying a home, mortgage rates are working in your favor. Waiting may mean a significant change in your payments.

How Your Tax Refund Can Move You Toward Homeownership This Year

If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment?

10 Steps to Buying a Home

Here’s a guide with 10 simple steps to follow in the home buying process. Our favorite is #3! We are here to help you make your home buying process as easy as it can be! Call us today!

How Much “Housing Wealth” Can You Build in a Decade?

“Homeownership is an important source of wealth creation, enabling current homeowners to move up the economic ladder.”