No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

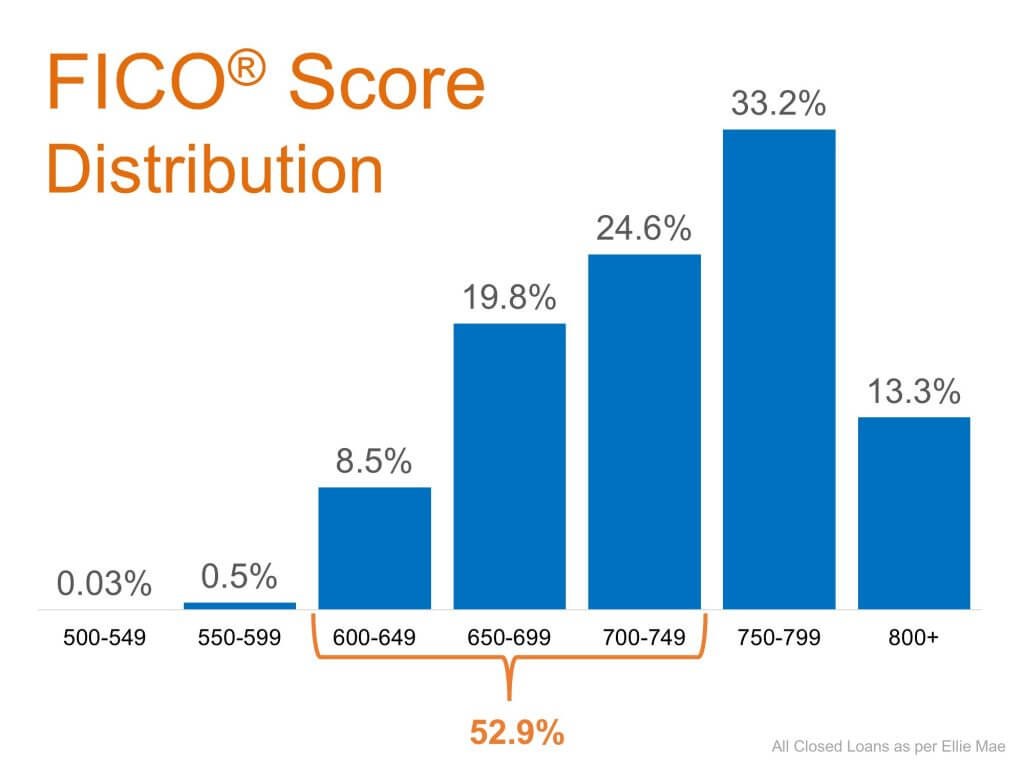

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

Thinking of Selling? Now May Be the Time.

The market is entering the year like a lion. There’s no indication it will lose that roar, assuming inventory continues to come to market.

Entry-Level Homeowners Are in the Driver’s Seat

Whatever you choose, if you’re moving out of an entry-level house, you’re likely going to be in the driver’s seat as a seller.

Opportunity in the Luxury Market This Year

With a strong economy and a backdrop set for moving up this year, it’s a great time to explore the luxury market.

Interest Rates Over Time

With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time.

The #1 Misconception in the Homebuying Process

If you’re thinking about purchasing a home, realize that homes are still affordable even though prices are increasing.

The Many Benefits of Aging in a Community

“Aging-in-place” definitely has its advantages, but it could mean getting “stuck-in-place” too. We can help you figure it all out!

How Trusted Professionals Make Homebuying Easier to Understand

There are many possible steps in a real estate transaction, but they don’t have to be confusing.

The Overlooked Financial Advantages of Homeownership

With a mortgage, you can keep your monthly housing costs steady and predictable.

How the Housing Market Benefits with Uncertainty in the World

“Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.”

The #1 Reason to List Your House Right Now

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand.