“Last year’s forecasts put doubt in the minds of many consumers about the strength of the residential real estate market.”

During the fourth quarter of last year, many housing experts predicted home prices were going to crash this year. Here are a few of those forecasts:

Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at the Wharton School of Business:

“I expect housing prices fall 10% to 15%, and the housing prices are accelerating on the downside.”

Mark Zandi, Chief Economist at Moody’s Analytics:

“Buckle in. Assuming rates remain near their current 6.5% and the economy skirts recession, then national house prices will fall almost 10% peak-to-trough. Most of those declines will happen sooner rather than later. And house prices will fall 20% if there is a typical recession.”

“Housing is already cooling in the U.S., according to July data that was reported last week. As interest rates climb steadily higher, Goldman Sachs Research’s G-10 home price model suggests home prices will decline by around 5% to 10% from the peak in the U.S. . . . Economists at Goldman Sachs Research say there are risks that housing markets could decline more than their model suggests.”

The Bad News: It Rattled Consumer Confidence

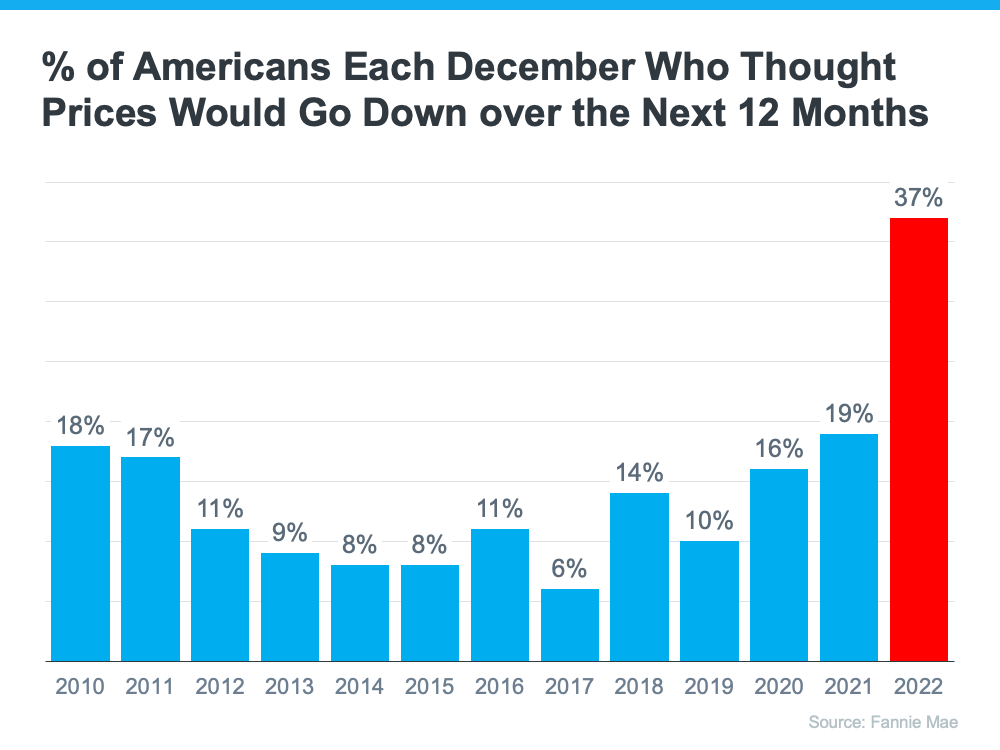

These forecasts put doubt in the minds of many consumers about the strength of the residential real estate market. Evidence of this can be seen in the December Consumer Confidence Survey from Fannie Mae. It showed a larger percentage of Americans believed home prices would fall over the next 12 months than in any other December in the history of the survey (see graph below). That caused people to hesitate about their homebuying or selling plans as we entered the new year.

The Good News: Home Prices Never Crashed

However, home prices didn’t come crashing down and seem to be already rebounding from the minimal depreciation experienced over the last several months.

In a report just released, Goldman Sachs explained:

“The global housing market seems to be stabilizing faster than expected despite months of rising mortgage rates, according to Goldman Sachs Research. House prices are defying expectations and are rising in major economies such as the U.S.,. . . ”

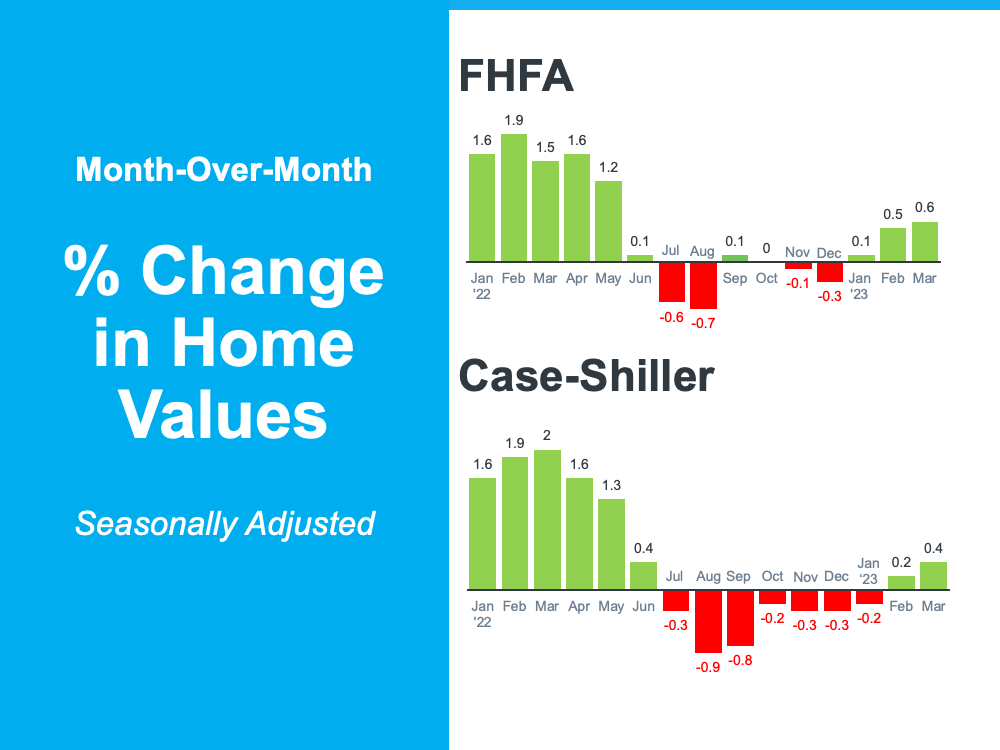

Those claims from Goldman Sachs were verified by the release last week of two indexes on home prices: Case-Shiller and the FHFA. Here are the numbers each reported:

Home values seem to have turned the corner and are headed back up.

Bottom Line

When the forecasts of significant home price appreciation were made last fall, they were made with megaphones. Mass media outlets, industry newspapers, and podcasts all broadcasted the news of an eminent crash in prices.

Now, forecasters are saying the worst is over and it wasn’t anywhere near as bad as they originally projected. However, they are whispering the news instead of using megaphones. As real estate professionals, it is our responsibility – some may say duty – to correct this narrative in the minds of the American consumer.

To view the original article, visit Keeping Current Matters.

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Best Week To List Your House Is Almost Here – Are You Ready?

A seller listing a well-priced, move-in ready home is likely to find success.