“To take advantage of today’s real estate market, experts are encouraging homeowners to act now before interest rates climb.”

This year, mortgage rates have started to slowly climb above recent record-breaking lows. Many homeowners planning to move may feel like they’ve missed the chance to score a great rate on their next mortgage. In reality, there’s still time to secure a rate far below the historic norm. Here’s why.

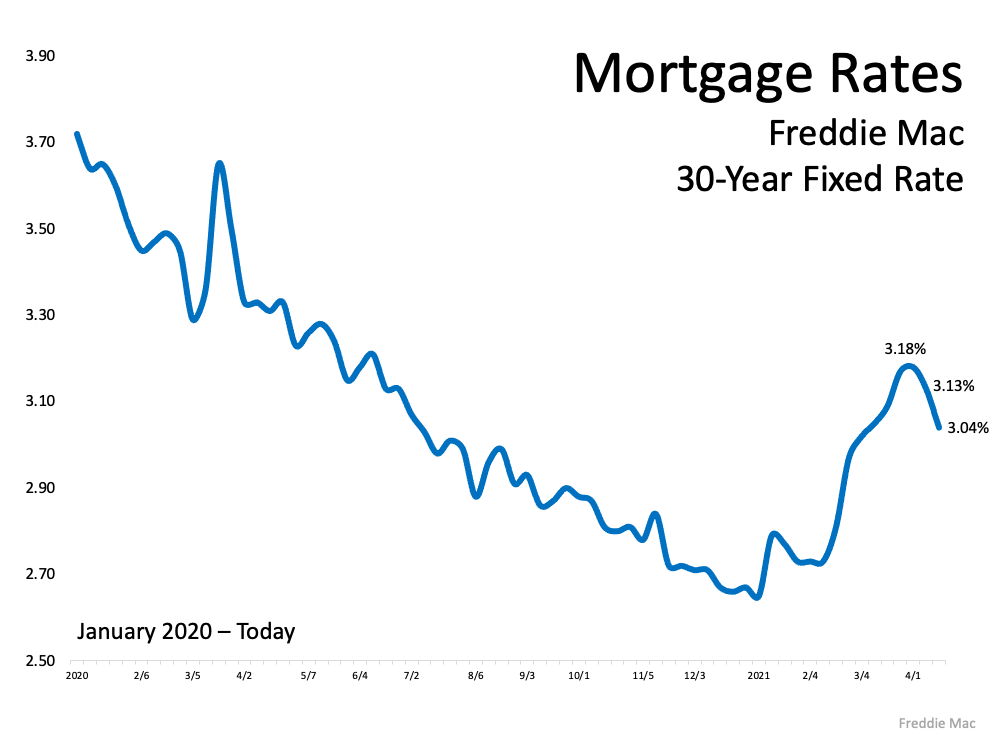

After creeping up for seven consecutive weeks, average mortgage rates have dropped more recently (See graph below). With rates taking a slight dip over the past two weeks at the same time the inventory of houses for sale is so low, homeowners today are sitting in the optimal seat to sell. What’s the advantage of selling your house now? Securing a low mortgage rate on your next home. To take advantage of today’s real estate market, experts are encouraging homeowners to act now before interest rates climb. Danielle Hale, Chief Economist at realtor.com, explains:

To take advantage of today’s real estate market, experts are encouraging homeowners to act now before interest rates climb. Danielle Hale, Chief Economist at realtor.com, explains:

“…mortgage rates slid for a second week … but we don’t expect rates to stay at this level for too long.”

Hale continues to say:

“For sellers, getting in early optimizes odds of a quick sale at a good price before there’s too much competition, but that means acting now … In this environment, sellers probably really can’t go wrong, and that’s especially true in the nation’s hottest housing markets where homes are selling quickly and getting the greatest number of viewers online.”

Most experts agree that rates will continue to trend upward. Sam Khater, Chief Economist at Freddie Mac, states:

“Despite the pause in mortgage rates recently, we expect them to increase modestly for the remainder of this year.”

In addition, Freddie Mac recently released their Quarterly Forecast, which notes:

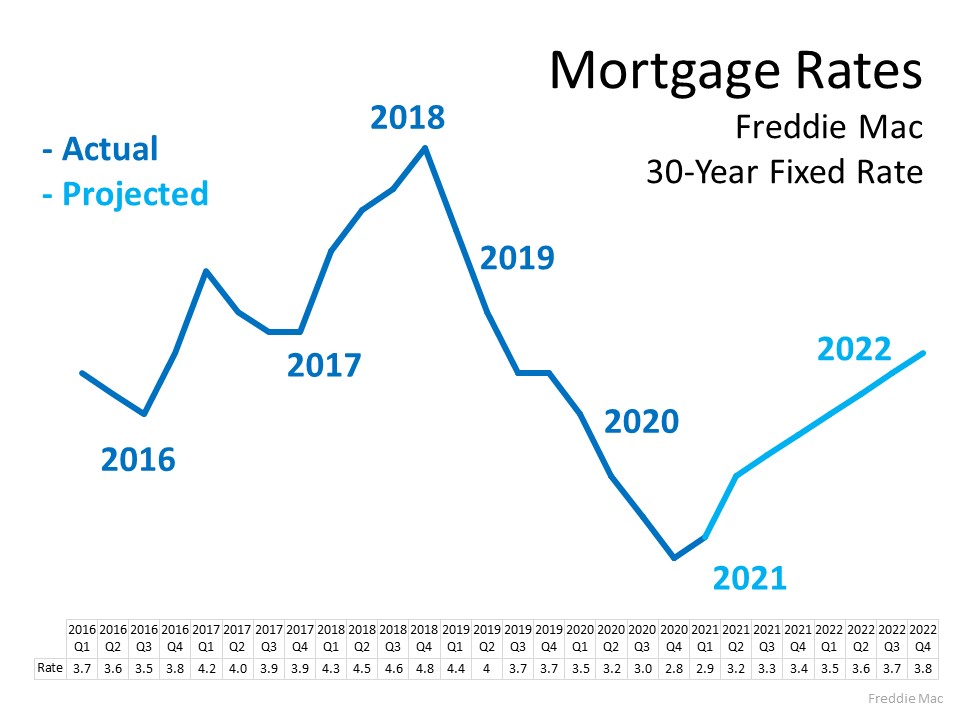

“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.” (See graph below):

While buyers everywhere want to secure the lowest rate possible, it’s important to remember that today’s rates are still much lower than the historic norm. Odeta Kushi, Deputy Chief Economist at First American, emphasizes:

While buyers everywhere want to secure the lowest rate possible, it’s important to remember that today’s rates are still much lower than the historic norm. Odeta Kushi, Deputy Chief Economist at First American, emphasizes:

“While mortgage rates have trended up in recent months, they are still historically low, so relative to one year ago, housing actually is still more affordable and that’s really thanks to this low mortgage rate environment we find ourselves in.”

Bottom Line

If you’re thinking of moving, don’t miss the opportunity to score a great rate on your next home mortgage. Let’s connect today so you can get your house ready to sell and find your dream home while mortgage rates are still low.

To view original article, visit Keeping Current Matters.

Buyer Bright Spot: There Are More Homes on the Market

The number of homes for sale has grown a whole lot lately and that’s true for both existing and newly built homes.

How Home Equity Can Help Fuel Your Retirement

Your agent will help you understand how much equity to have and how you can use it and help you navigate the entire process.

The Real Benefits of Buying a Home This Year

Let’s break down why homeownership is worth considering in 2025 and beyond, and how it can help set you up for the future.

3 Reasons To Buy a Home Before Spring

What if buying now — before the spring rush — might actually give you the upper hand? You’ll have less competition, more negotiating power and be able to lock in today’s prices before they rise.

The Secret To Selling? Using an Agent To Get Your House Noticed

The way your agent markets your house can be the difference between whether or not it stands out and gets attention from buyers.

If Your House’s Price Is Not Compelling, It’s Not Selling

Work with a local real estate agent who’s going to be honest with you about how you should price your house.