“Housing supply is still historically low.”

At first glance, the increase in housing supply compared to last year may not sound like good news for prospective sellers, but it actually gives you two key opportunities in today’s housing market.

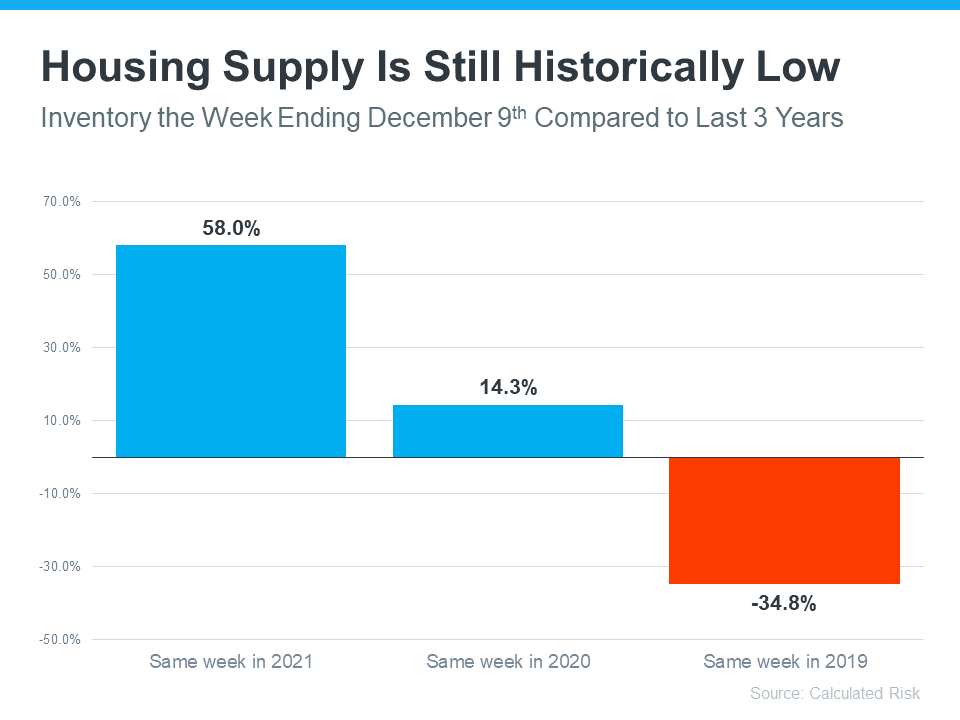

An article from Calculated Risk helps put the inventory gains the market has seen in 2022 into perspective by comparing it to recent years (see graph below). It shows supply has surpassed 2021 levels by 58%. But the further back you look, the more you’ll understand the bigger picture. And if you go all the way back to 2019, the last normal year in real estate, we’re roughly 35% below the housing supply we had at that time.

Opportunity #1: Take Advantage of More Options for Your Move

If your current house no longer meets your needs or lacks the space and features you want, this inventory growth gives you even more opportunity to sell and move into the home of your dreams. With more houses on the market, you’ll have more to choose from when you search for your next home.

Partnering with a local real estate professional can help you make sure you’re up to date on the homes available in your area. And when you do find the one, a professional can advise you on how to write a winning offer.

Opportunity #2: Sell While Inventory Is Still Low Overall

But again, despite the growth, inventory is still low compared to more normal years, and that isn’t going to change overnight. For you, that means your house should still be in demand among potential buyers if you price it right.

As an article from realtor.com says:

“Today’s shoppers generally have more homes to consider than last year’s shoppers did, but the market is still not back to pre-pandemic inventory levels.”

Bottom Line

If you’re a homeowner looking to sell, you have more homes to choose from and can still sell your house while inventory is low overall. Let’s connect to get started, so you can have the best of both worlds.

To view original article, visit Keeping Current Matters.

Sellers: Don’t Let These Two Things Hold You Back

If fear you won’t be able to find your next home is the primary thing holding you back, remember to consider all your options.

Pricing Your House Right Still Matters Today

Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it.

Homebuyers Are Still More Active Than Usual

Buyer demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on the market.

Don’t Fall for the Next Shocking Headlines About Home Prices

In the coming months, you’re going to see even more headlines that either get what’s happening with home prices wrong or are misleading.

Foreclosure Numbers Today Aren’t Like 2008

Today, foreclosures are far below the record-high number that was reported when the housing market crashed.

Explaining Today’s Mortgage Rates

Factors such as inflation, other economic drivers, and the policy and decisions from the Federal Reserve are all influencing mortgage rates today.