“Today’s high buyer demand combined with low housing inventory means we’re seeing home prices appreciate at an above-average pace.”

As the economy recovers from this year’s health crisis, the housing market is playing a leading role in the turnaround. It’s safe to say that what we call “home” is taking on a new meaning, causing many of us to consider buying or selling sooner rather than later. Housing, therefore, has thrived in an otherwise down year.

Today’s high buyer demand combined with low housing inventory means we’re seeing home prices appreciate at an above-average pace. This demand is being driven by those who want to take advantage of historically low mortgage rates. According to Freddie Mac:

“The record low mortgage rate environment is providing tangible support to the economy at a critical time, as housing continues to propel growth.”

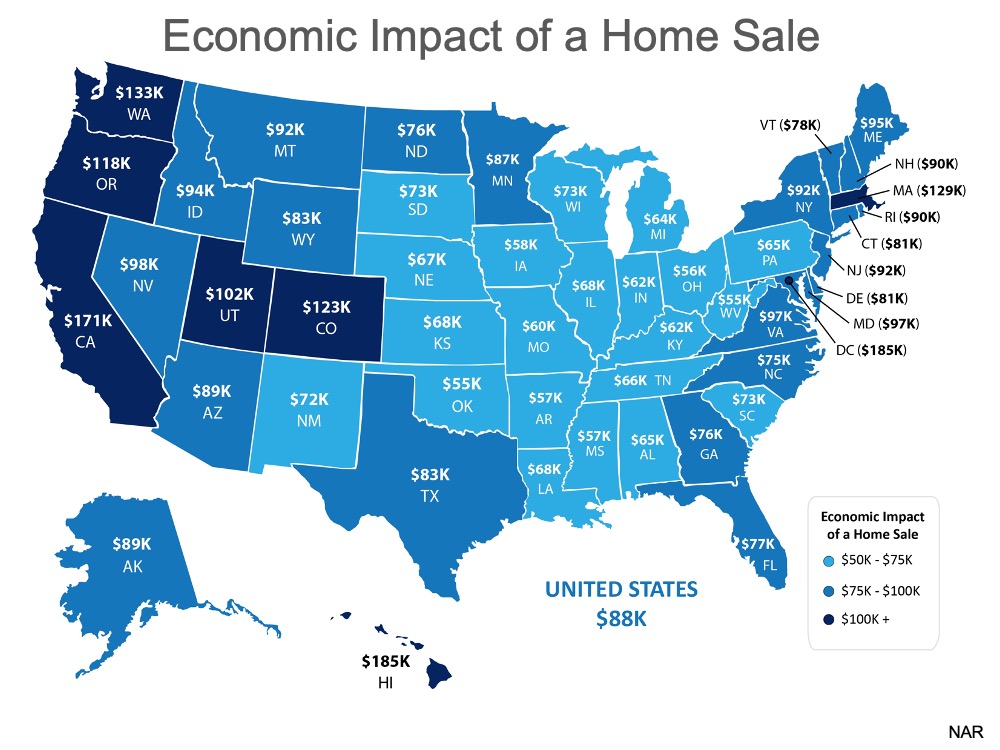

These factors are driving a positive impact on the economy as a whole. According to the National Association of Realtors (NAR), the real estate industry provided $3.7 billion dollars of economic impact to the country last year. To break it down, in 2019, the average newly constructed home contributed just over $88,000 per build to local economies. Across the country, real estate clearly makes a significant impact (See map below): In addition, last week, the Bureau of Economic Analysis announced the U.S. Gross Domestic Product increased at an annual rate of 33.1% in the 3rd quarter of this year, after decreasing by 31.4% in the second quarter. There’s no doubt the growing economy is being fueled in part by the soaring housing market. Experts forecast this housing growth to carry into 2021, continuing to make a big impact on the economy next year as well.

In addition, last week, the Bureau of Economic Analysis announced the U.S. Gross Domestic Product increased at an annual rate of 33.1% in the 3rd quarter of this year, after decreasing by 31.4% in the second quarter. There’s no doubt the growing economy is being fueled in part by the soaring housing market. Experts forecast this housing growth to carry into 2021, continuing to make a big impact on the economy next year as well.

Bottom Line

The American Dream of homeownership has continued to thrive in the midst of this year’s economic downturn, and “home” has taken on a new meaning for many of us during this time. Best of all, the housing market is making a significant impact as the economy recovers.

To view original article, visit Keeping Current Matters.

Is It Getting More Affordable To Buy a Home?

Mortgage rates are expected to come down by the end of the year, making homebuying a little more affordable.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.

Should I Move with Today’s Mortgage Rates?

While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

Keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Don’t Let Your Student Loans Delay Your Homeownership Plans

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time.