“Today’s high buyer demand combined with low housing inventory means we’re seeing home prices appreciate at an above-average pace.”

As the economy recovers from this year’s health crisis, the housing market is playing a leading role in the turnaround. It’s safe to say that what we call “home” is taking on a new meaning, causing many of us to consider buying or selling sooner rather than later. Housing, therefore, has thrived in an otherwise down year.

Today’s high buyer demand combined with low housing inventory means we’re seeing home prices appreciate at an above-average pace. This demand is being driven by those who want to take advantage of historically low mortgage rates. According to Freddie Mac:

“The record low mortgage rate environment is providing tangible support to the economy at a critical time, as housing continues to propel growth.”

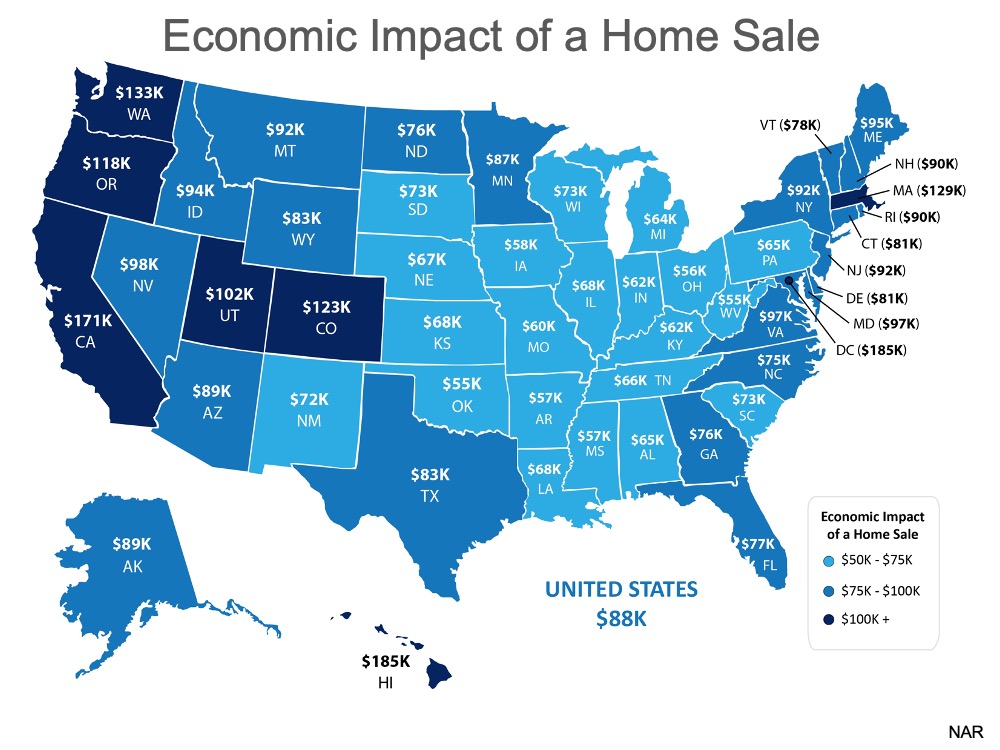

These factors are driving a positive impact on the economy as a whole. According to the National Association of Realtors (NAR), the real estate industry provided $3.7 billion dollars of economic impact to the country last year. To break it down, in 2019, the average newly constructed home contributed just over $88,000 per build to local economies. Across the country, real estate clearly makes a significant impact (See map below): In addition, last week, the Bureau of Economic Analysis announced the U.S. Gross Domestic Product increased at an annual rate of 33.1% in the 3rd quarter of this year, after decreasing by 31.4% in the second quarter. There’s no doubt the growing economy is being fueled in part by the soaring housing market. Experts forecast this housing growth to carry into 2021, continuing to make a big impact on the economy next year as well.

In addition, last week, the Bureau of Economic Analysis announced the U.S. Gross Domestic Product increased at an annual rate of 33.1% in the 3rd quarter of this year, after decreasing by 31.4% in the second quarter. There’s no doubt the growing economy is being fueled in part by the soaring housing market. Experts forecast this housing growth to carry into 2021, continuing to make a big impact on the economy next year as well.

Bottom Line

The American Dream of homeownership has continued to thrive in the midst of this year’s economic downturn, and “home” has taken on a new meaning for many of us during this time. Best of all, the housing market is making a significant impact as the economy recovers.

To view original article, visit Keeping Current Matters.

Why Today’s Seller’s Market Is Good for Your Bottom Line

The market is still working in favor of sellers. If you house is ready and priced competitively, it should get a lot of attention.

What Mortgage Rate Do You Need To Move?

While mortgage rates are nearly impossible to forecast, the optimism from the experts should give you insight into what’s ahead.

Finding Your Perfect Home in a Fixer Upper

Your agent can also offer advice on which upgrades and renovations will set you up to get the greatest return on your investment.

The Benefits of Downsizing When You Retire

When you downsize your house, you often end up downsizing the bills that come with it, like energy costs, and maintenance requirements.

Why There Won’t Be a Recession That Tanks the Housing Market

The fundamentals of the economy, despite some hiccups, are doing pretty good.

What To Know About Credit Scores Before Buying a Home

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan.