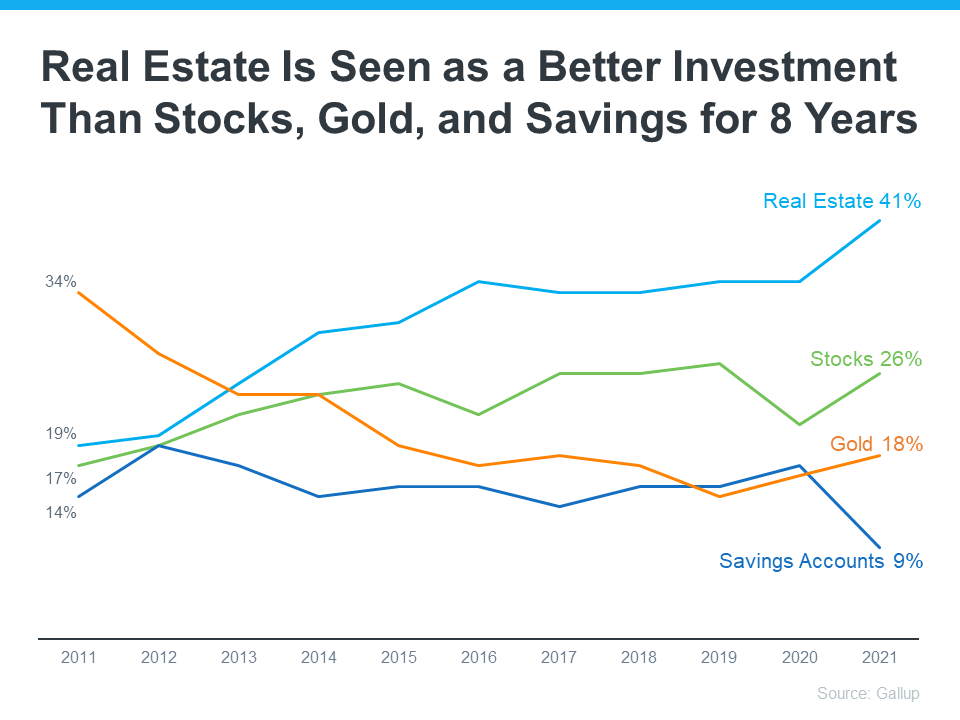

“Real Estate is seen as a better investment than stocks, gold and savings for 8 years.”

In an annual Gallup poll, Americans chose real estate as the best long-term investment. And it’s not the first time it’s topped the list, either. Real estate has been on a winning streak for the past eight years, consistently gaining traction as the best long-term investment (see graph below):

If you’re thinking about purchasing a home this year, this poll should reassure you. Even when inflation is rising like it is today, Americans agree an investment like real estate truly shines.

If you’re thinking about purchasing a home this year, this poll should reassure you. Even when inflation is rising like it is today, Americans agree an investment like real estate truly shines.

Why Is Real Estate a Great Investment During Times of High Inflation?

With inflation reaching its highest level in 40 years, it’s more important than ever to understand the financial benefits of homeownership. Rising inflation means prices are increasing across the board. That includes goods, services, housing costs, and more. But when you purchase your home, you lock in your monthly housing payments, effectively shielding yourself from increasing housing payments. James Royal, Senior Wealth Management Reporter at Bankrate, explains it like this:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

If you’re a renter, you don’t have that same benefit, and you aren’t protected from increases in your housing costs, especially rising rents.

History Shows During Inflationary Periods, Home Prices Rise as Well

As a homeowner, your house is an asset that typically increases in value over time, even during inflation. That‘s because, as prices rise, the value of your home does, too. And that makes buying a home a great hedge during periods of high inflation. Natalie Campisi, Advisor Staff for Forbes, notes:

“Tangible assets like real estate get more valuable over time, which makes buying a home a good way to spend your money during inflationary times.”

Bottom Line

Housing truly is a strong investment, especially when inflation is high. When you lock in a mortgage payment, you’re shielded from housing cost increases, and you own an asset that typically gains value with time. If you want to better understand how buying a home could be a great investment for you, let’s connect today.

To view original article, visit Keeping Current Matters.

The Truth About Down Payments

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

Expert Home Price Forecasts for 2024 Revised Up

Now that rates have come down from their peak, and with further declines expected this year, buyer demand has picked up.

Strategic Tips for Buying Your First Home

If you’re ready, willing, and able to buy your first home, here are some tips to help you turn your dream into a reality.

It’s Time To Prepare Your House for a Spring Listing

With the market gearing up for its busiest time of year, it’s important to make sure your house shines bright among the competition.

Bridging the Gaps on the Road to Homeownership

Homeownership is an important part of building household wealth that can be passed down to future generations.

Houses Are Still Selling Fast

Homes are selling faster than the norm for this time of year – and your house may sell quickly too. Are you thinking about selling your house? Give us a call!