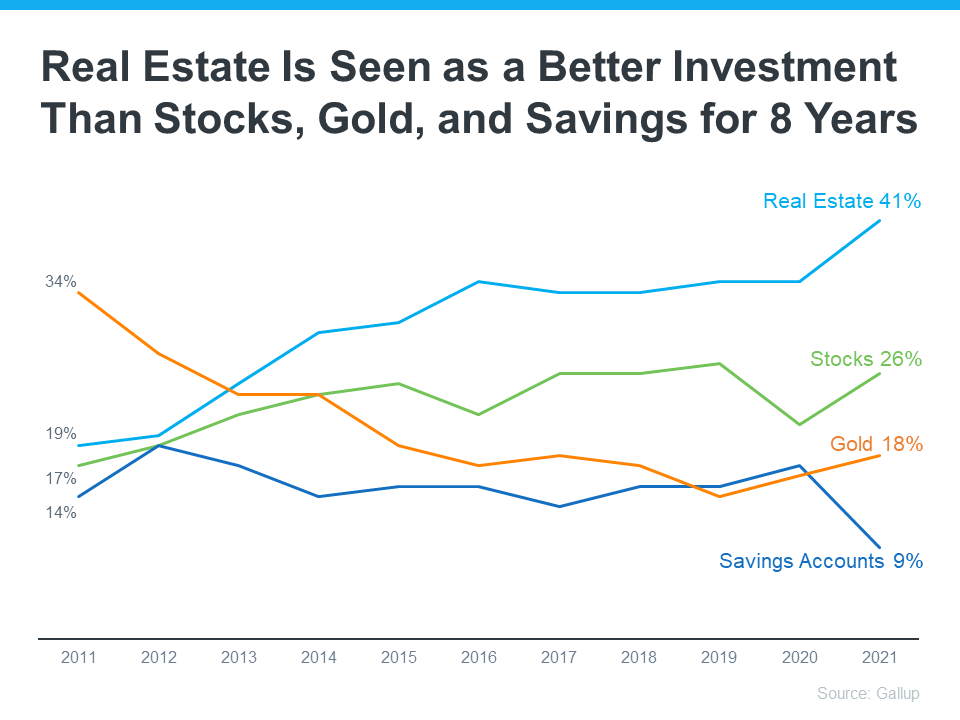

“Real Estate is seen as a better investment than stocks, gold and savings for 8 years.”

In an annual Gallup poll, Americans chose real estate as the best long-term investment. And it’s not the first time it’s topped the list, either. Real estate has been on a winning streak for the past eight years, consistently gaining traction as the best long-term investment (see graph below):

If you’re thinking about purchasing a home this year, this poll should reassure you. Even when inflation is rising like it is today, Americans agree an investment like real estate truly shines.

If you’re thinking about purchasing a home this year, this poll should reassure you. Even when inflation is rising like it is today, Americans agree an investment like real estate truly shines.

Why Is Real Estate a Great Investment During Times of High Inflation?

With inflation reaching its highest level in 40 years, it’s more important than ever to understand the financial benefits of homeownership. Rising inflation means prices are increasing across the board. That includes goods, services, housing costs, and more. But when you purchase your home, you lock in your monthly housing payments, effectively shielding yourself from increasing housing payments. James Royal, Senior Wealth Management Reporter at Bankrate, explains it like this:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

If you’re a renter, you don’t have that same benefit, and you aren’t protected from increases in your housing costs, especially rising rents.

History Shows During Inflationary Periods, Home Prices Rise as Well

As a homeowner, your house is an asset that typically increases in value over time, even during inflation. That‘s because, as prices rise, the value of your home does, too. And that makes buying a home a great hedge during periods of high inflation. Natalie Campisi, Advisor Staff for Forbes, notes:

“Tangible assets like real estate get more valuable over time, which makes buying a home a good way to spend your money during inflationary times.”

Bottom Line

Housing truly is a strong investment, especially when inflation is high. When you lock in a mortgage payment, you’re shielded from housing cost increases, and you own an asset that typically gains value with time. If you want to better understand how buying a home could be a great investment for you, let’s connect today.

To view original article, visit Keeping Current Matters.

Evaluating Your Wants and Needs as a Homebuyer Matters More Today

So, if you’re looking to buy a home, take some time to consider what’s truly essential for you in your next house.

Where Will You Go If You Sell? Newly Built Homes Might Be the Answer.

New home construction is up and is becoming an increasingly significant part of the housing inventory.

Why Homeownership Wins in the Long Run

It’s important to think about the long-term benefits of homeownership when deciding whether or not to buy a home.

The True Cost of Selling Your House on Your Own

When it comes to selling your most valuable asset, consider the invaluable support that a real estate agent can provide.

What Homebuyers Need To Know About Credit Scores

Your credit score is one of the most important factors lenders consider when you apply for a mortgage.

Why the Median Home Price Is Meaningless in Today’s Market

Using the median home price as a gauge of what’s happening with home values isn’t worthwhile right now.