“A homeowner’s monthly mortgage payment pays for their shelter, but it also acts as an investment.”

Rents have increased significantly this year. The latest National Rent Report from Apartmentlist.com shows rents are rising at a rate much higher than the three years leading up to the pandemic:

“Since January of this year, the national median rent has increased by a staggering 16.4 percent. To put that in context, rent growth from January to September averaged just 3.4 percent in the pre-pandemic years from 2017-2019.”

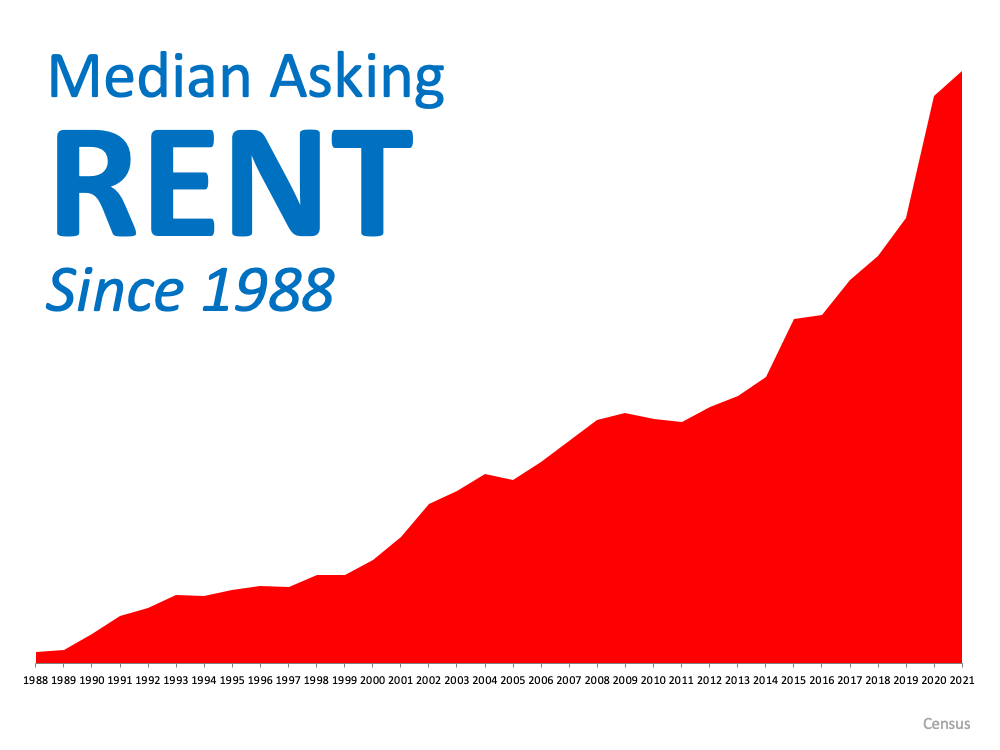

Looking back, we can see rents rising isn’t new. The median rental price has increased consistently over the past 33 years (see graph below): If you’re thinking of renting for another year, consider that rents will likely be even higher next year. But that alone doesn’t paint the picture of the true cost of renting.

If you’re thinking of renting for another year, consider that rents will likely be even higher next year. But that alone doesn’t paint the picture of the true cost of renting.

The Money Renters Stand To Lose This Year

A homeowner’s monthly mortgage payment pays for their shelter, but it also acts as an investment. That investment grows in the form of equity as a homeowner makes their mortgage payment each month to pay down what they owe on their home loan. Their equity gets an additional boost from home price appreciation, which is at near-record levels this year.

The latest Homeowner Equity Insights report from CoreLogic found homeowners gained significant wealth through their home equity this past year. The research shows:

“. . . the average homeowner gained approximately $51,500 in equity during the past year.”

As a renter, you don’t get the same benefit. Your rent payment only covers the cost of shelter and any included amenities. None of your monthly rent payments come back to you as an investment. That means, by renting this year, you likely paid more in rent than you did in the previous year, and you also missed out on the potential wealth gain of $51,500 you could have had by owning your own home.

Bottom Line

When deciding whether you should rent or buy in the future, keep in mind how much renting can cost you. Another year of renting is another year you’ll pay rising rents and miss out on building your wealth through home equity. Let’s connect today to talk more about the benefits of buying over renting.

To view original article, visit Keeping Current Matters.

Planning to Retire? Your Equity Can Help You Make a Move

Whether you’re looking to downsize, relocate to a dream destination, or move closer to friends or loved ones, equity in your home may help.

Expert Home Price Forecasts Revised Up for 2023

As activity slows again at the end of the year, home price growth will slow too. This doesn’t mean prices are falling.

Buyer Traffic Is Still Stronger than the Norm

Buyers will always need to buy, and those who can afford to move at today’s rates are going to do so.

Why You May Still Want To Sell Your House After All

If you need to sell now because something in your own life has changed, don’t let mortgage rates hold you back from what you want.

Gen Z: The Next Generation Is Making Moves in the Housing Market

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.