“A homeowner’s monthly mortgage payment pays for their shelter, but it also acts as an investment.”

Rents have increased significantly this year. The latest National Rent Report from Apartmentlist.com shows rents are rising at a rate much higher than the three years leading up to the pandemic:

“Since January of this year, the national median rent has increased by a staggering 16.4 percent. To put that in context, rent growth from January to September averaged just 3.4 percent in the pre-pandemic years from 2017-2019.”

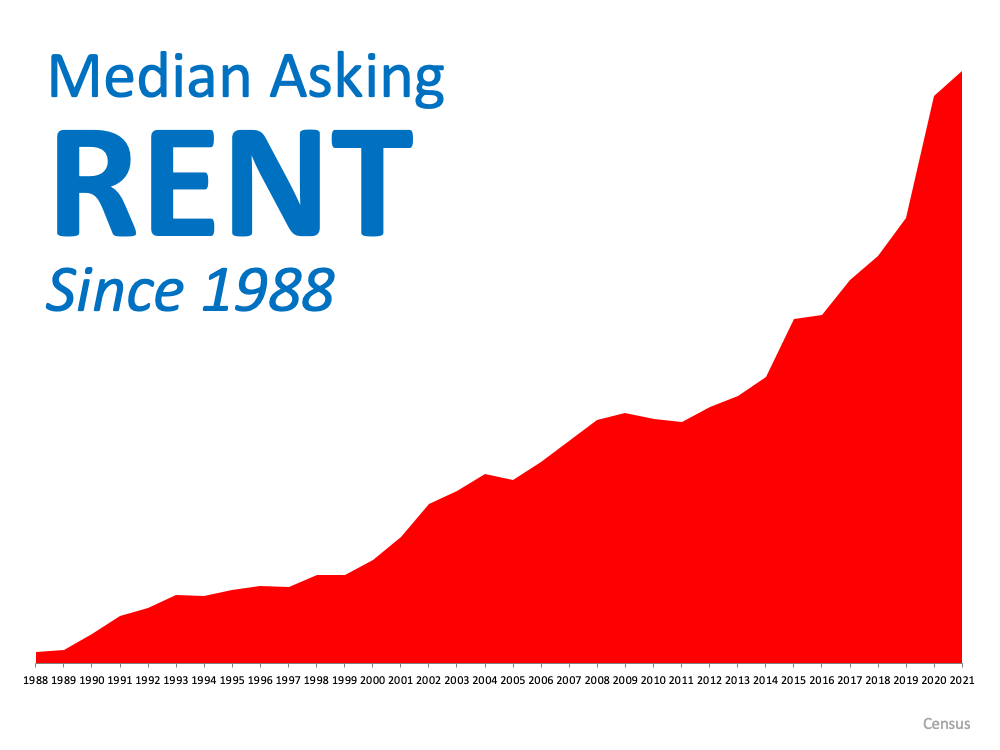

Looking back, we can see rents rising isn’t new. The median rental price has increased consistently over the past 33 years (see graph below): If you’re thinking of renting for another year, consider that rents will likely be even higher next year. But that alone doesn’t paint the picture of the true cost of renting.

If you’re thinking of renting for another year, consider that rents will likely be even higher next year. But that alone doesn’t paint the picture of the true cost of renting.

The Money Renters Stand To Lose This Year

A homeowner’s monthly mortgage payment pays for their shelter, but it also acts as an investment. That investment grows in the form of equity as a homeowner makes their mortgage payment each month to pay down what they owe on their home loan. Their equity gets an additional boost from home price appreciation, which is at near-record levels this year.

The latest Homeowner Equity Insights report from CoreLogic found homeowners gained significant wealth through their home equity this past year. The research shows:

“. . . the average homeowner gained approximately $51,500 in equity during the past year.”

As a renter, you don’t get the same benefit. Your rent payment only covers the cost of shelter and any included amenities. None of your monthly rent payments come back to you as an investment. That means, by renting this year, you likely paid more in rent than you did in the previous year, and you also missed out on the potential wealth gain of $51,500 you could have had by owning your own home.

Bottom Line

When deciding whether you should rent or buy in the future, keep in mind how much renting can cost you. Another year of renting is another year you’ll pay rising rents and miss out on building your wealth through home equity. Let’s connect today to talk more about the benefits of buying over renting.

To view original article, visit Keeping Current Matters.

The Emotional and Non-financial Benefits of Homeownership

If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you.

The Cost of Waiting for Mortgage Rates to Go Down

As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can afford.

How To Prep Your House for Sale This Fall

Taking the time upfront to prep your house appropriately and create a solid plan can help bring in the greatest return on your investment.

If You’re Thinking of Selling Your House This Fall, Hire a Pro

A trusted real estate advisor will keep you updated and help you make the best decisions based on current market trends.

The True Strength of Homeowners Today

Home equity allows homeowners to be in control. This is yet another reason we won’t see the housing market crash like we saw in 2008 when many owed more on their homes than they were worth.

Top Reasons Homeowners Are Selling Their Houses Right Now

If you find yourself wanting space, or amenities your current home just can’t provide, it may be time to consider listing your house for sale.