Some Highlights

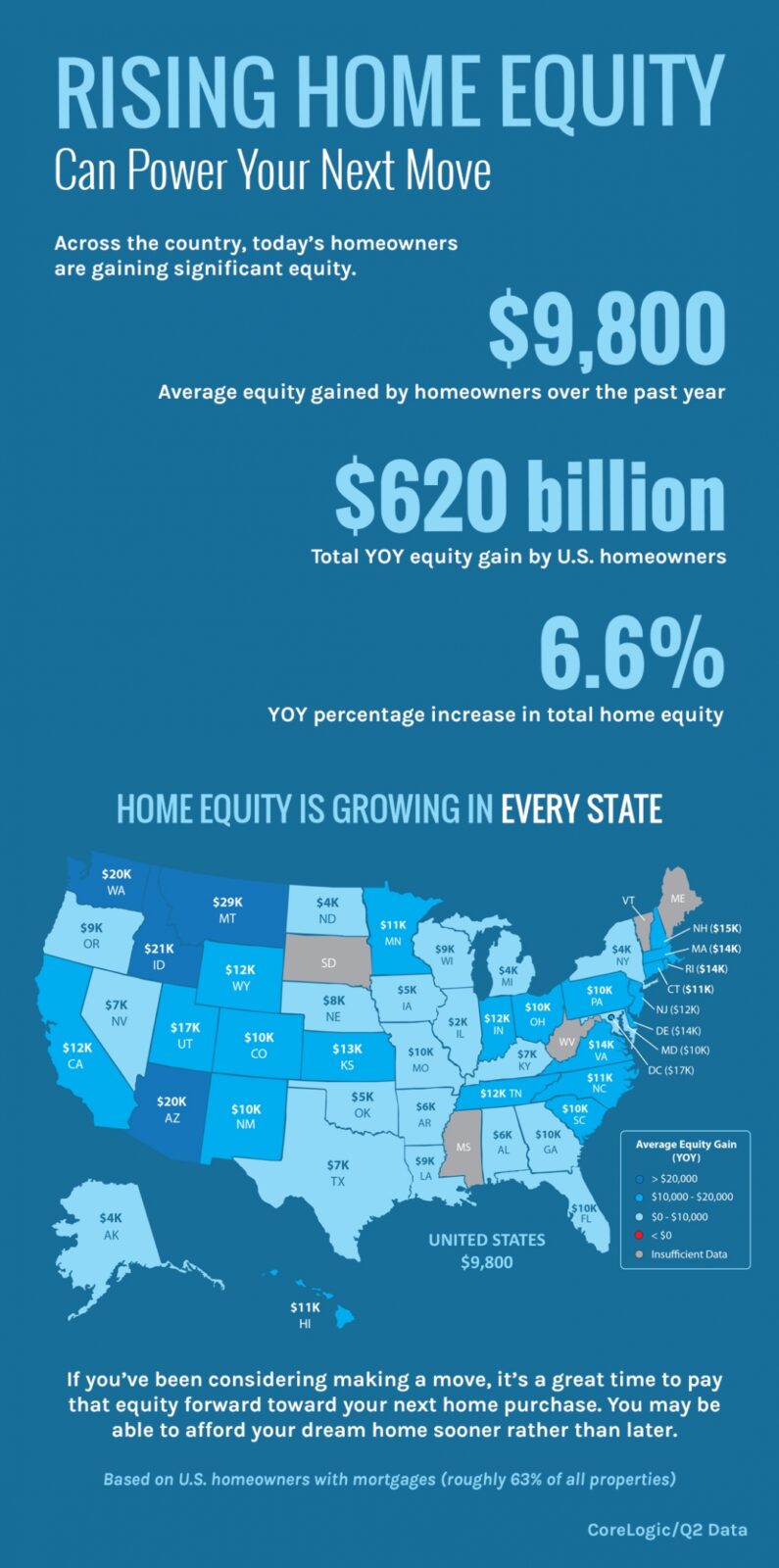

- According to CoreLogic, homeowners across the country are gaining significant equity.

- Over the past year, the average homeowner gained $9,800 in equity, growing their overall net worth.

- If you’re ready to sell your house and begin looking for your dream home, let’s connect to plan how your equity can make that possible.

To view original article, visit Keeping Current Matters.

Planning to Move? You Can Still Secure a Low Mortgage Rate on Your Next Home

To take advantage of today’s real estate market, experts are encouraging homeowners to act now before interest rates climb.

How Much Time Do You Need To Save for a Down Payment?

The national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53).

93% of Americans Believe a Home Is a Better Investment Than Stocks

Housing represents the largest asset owned by most households and is a major means of wealth accumulation.

Some Buyers Prefer Smaller Homes

If your house is no longer the best fit for your evolving needs, it may be time to put your equity to work for you and downsize to the home you really want.

Homeownership Is Full of Financial Benefits

Does homeownership actually give you a better chance to build wealth?

Latest Jobs Report: What Does It Mean for You & the Housing Market?

With listing inventory down 52% from a year ago, bidding wars are skyrocketing. As a result, home prices are climbing.