“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership.”

If you’re planning to buy your first home, then you’re probably focused on saving for all the costs involved in such a big purchase. One of the expenses that may be at the top of your mind is your down payment. If you’re intimidated by how much you need to save for that, it may be because you believe you must put 20% down. That doesn’t necessarily have to be the case. As the National Association of Realtors (NAR) notes:

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership.”

And a recent Freddie Mac survey finds:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

Here’s the good news. Unless specified by your loan type or lender, it’s typically not required to put 20% down. This means you could be closer to your homebuying dream than you realize.

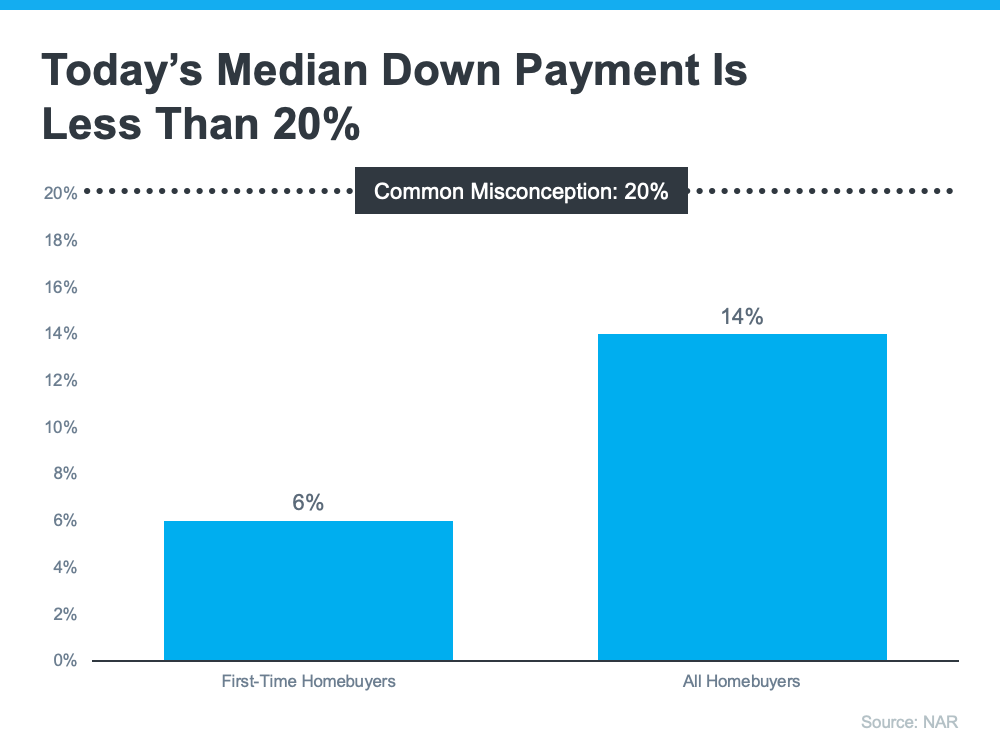

According to NAR, the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 14%. And it’s even lower for first-time homebuyers at just 6% (see graph below):

What does this mean for you? It means you may not need to save as much as you originally thought.

Learn About Options That Can Help You Toward Your Goal

And it’s not just how much you need for your down payment that isn’t clear. There are also misconceptions about down payment assistance programs. For starters, many people believe there’s only assistance available for first-time homebuyers. While first-time buyers have many options to explore, repeat buyers have some, too.

According to Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments. That same resource goes on to say:

“You don’t have to be a first-time buyer. Over 38% of all programs are for repeat homebuyers who have owned a home in the last 3 years.”

Plus, there are even loan types, like FHA loans with down payments as low as 3.5% as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants.

If you’re interested in learning more about down payment assistance programs, information is available through sites like Down Payment Resource. Then, partner with a trusted lender to learn what you qualify for on your homebuying journey.

Bottom Line

Remember, a 20% down payment isn’t always required. If you want to purchase a home this year, let’s connect to start the conversation about your homebuying goals.

To view original article, visit Keeping Current Matters.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.

Should I Move with Today’s Mortgage Rates?

While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

Keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Don’t Let Your Student Loans Delay Your Homeownership Plans

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time.

The Best Week To List Your House Is Almost Here

The third week of April brings the best combination of housing market factors for sellers.