“Two things are holding homeowners back from selling. Let’s take a look.”

Many homeowners thinking about selling have two key things holding them back. That’s feeling locked in by today’s higher mortgage rates and worrying they won’t be able to find something to buy while supply is so low. Let’s dive into each challenge and give you some helpful advice on how to overcome these obstacles.

Challenge #1: The Reluctance to Take on a Higher Mortgage Rate

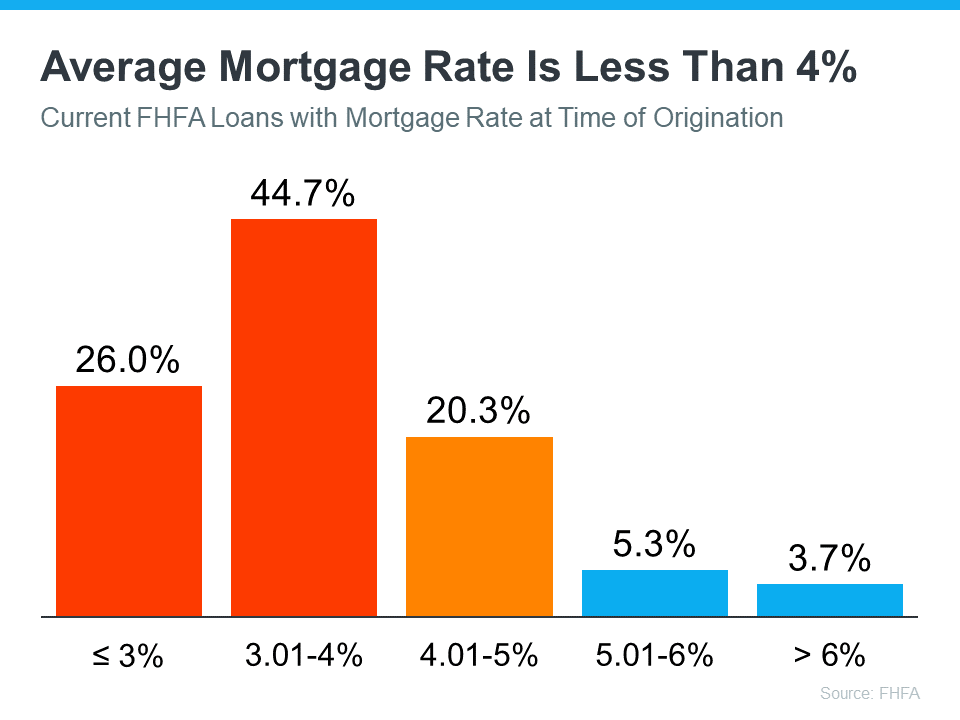

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

But today, the typical 30-year fixed mortgage rate offered to buyers is closer to 7%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as the mortgage rate lock-in effect.

But today, the typical 30-year fixed mortgage rate offered to buyers is closer to 7%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as the mortgage rate lock-in effect.

The Advice: Waiting May Not Pay Off

While experts project mortgage rates will gradually fall this year as inflation cools, that doesn’t necessarily mean you should wait to sell. Mortgage rates are notoriously hard to predict. And, right now home prices are back on the rise. If you move now, you’ll at least beat rising home prices when you buy your next home. And, if experts are right and rates fall, you can always refinance later if that happens.

Challenge #2: The Fear of Not Finding Something to Buy

When so many homeowners are reluctant to take on a higher rate, fewer homes are going to come onto the market. That’s going to keep inventory low. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Inventory will remain tight in the coming months and even for the next couple of years. Some homeowners are unwilling to trade up or trade down after locking in historically-low mortgage rates in recent years.”

Even though you know this limited housing supply helps your house stand out to eager buyers, it may also make you feel hesitant to sell because you don’t want to struggle to find something to purchase.

The Advice: Broaden Your Search

If fear you won’t be able to find your next home is the primary thing holding you back, remember to consider all your options. Looking at all housing types including condos, townhouses, and even newly built homes can help give you more to choose from. Plus, if you’re able to work fully remote or hybrid, you may be able to consider areas you hadn’t previously searched. If you can look further from your place of work, you may have more affordable options.

Bottom Line

Instead of focusing on the challenges, focus on what you can control. Let’s connect so you’re working with a professional who has the experience to navigate these waters and find the perfect home for you.

To view original article, visit Keeping Current Matters.

There’s Only Half the Inventory of a Normal Housing Market Today

If you want to list your house, know that there’s only about half the inventory there’d usually be in a more normal year.

Four Ways You Can Use Your Home Equity

Understanding how home equity works, and how to leverage it, is important for any homeowner.

Pricing Your House Right Still Matters Today

Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it.

Homebuyers Are Still More Active Than Usual

Buyer demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on the market.

Don’t Fall for the Next Shocking Headlines About Home Prices

In the coming months, you’re going to see even more headlines that either get what’s happening with home prices wrong or are misleading.

Foreclosure Numbers Today Aren’t Like 2008

Today, foreclosures are far below the record-high number that was reported when the housing market crashed.