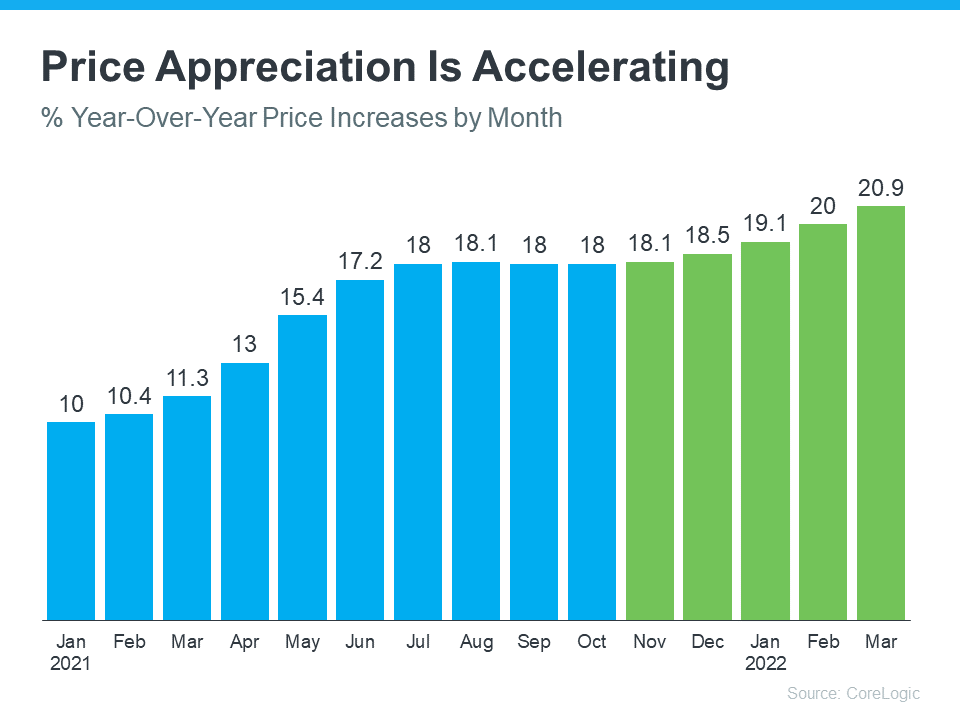

“Home price appreciation has been re-accelerating since November. “

As mortgage rates started to rise this year, many homeowners began to wonder if the value of their homes would fall. Here’s the good news. Historically, when mortgage rates rise by a percentage point or more, home values continue to appreciate. The latest data on home prices seems to confirm that trend.

According to data from CoreLogic, home price appreciation has been re-accelerating since November. The graph below shows this increase in home price appreciation in green:

This is largely due to an ongoing imbalance in supply and demand. Specifically, housing supply is still low, and demand is high. As mortgage rates started to rise this year, many homebuyers rushed to make their purchases before those rates could climb higher. The increased competition drove home prices up even more. Selma Hepp, Deputy Chief Economist at CoreLogic, explains:

This is largely due to an ongoing imbalance in supply and demand. Specifically, housing supply is still low, and demand is high. As mortgage rates started to rise this year, many homebuyers rushed to make their purchases before those rates could climb higher. The increased competition drove home prices up even more. Selma Hepp, Deputy Chief Economist at CoreLogic, explains:

“Home price growth continued to gain speed in early spring, as eager buyers tried to get in front of the mortgage rate surge.”

And experts say prices are forecast to continue appreciating, just at a more moderate pace moving forward. A recent article from Fortune says:

“. . . the swift move up in mortgage rates . . . doesn’t mean home prices are about to crash. In fact, every major real estate firm with a publicly released forecast model . . . still predicts home prices will climb further this year.”

What This Means for You

If you’re thinking about selling your house, you should know you have a great opportunity to list your home and capitalize on today’s home price appreciation. As prices rise, so does the value of your home, which gives your equity a big boost.

When you sell, you can use that equity toward the purchase of your next home. And at today’s record-level of appreciation, that equity may be enough to cover some (if not all) of your down payment.

Bottom Line

History shows rising mortgage rates have not had a negative impact on home prices. Now is still a great time to sell your house thanks to ongoing price appreciation. When you’re ready to find out how much equity you have in your current home and what’s happening with home prices in your local area, let’s connect.

To view original article, visit Keeping Current Matters.

The Truth About Down Payments

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

Expert Home Price Forecasts for 2024 Revised Up

Now that rates have come down from their peak, and with further declines expected this year, buyer demand has picked up.

Strategic Tips for Buying Your First Home

If you’re ready, willing, and able to buy your first home, here are some tips to help you turn your dream into a reality.

It’s Time To Prepare Your House for a Spring Listing

With the market gearing up for its busiest time of year, it’s important to make sure your house shines bright among the competition.

Bridging the Gaps on the Road to Homeownership

Homeownership is an important part of building household wealth that can be passed down to future generations.

Houses Are Still Selling Fast

Homes are selling faster than the norm for this time of year – and your house may sell quickly too. Are you thinking about selling your house? Give us a call!