Slaying the Hardest Homebuying Myths Today

Some Highlights:

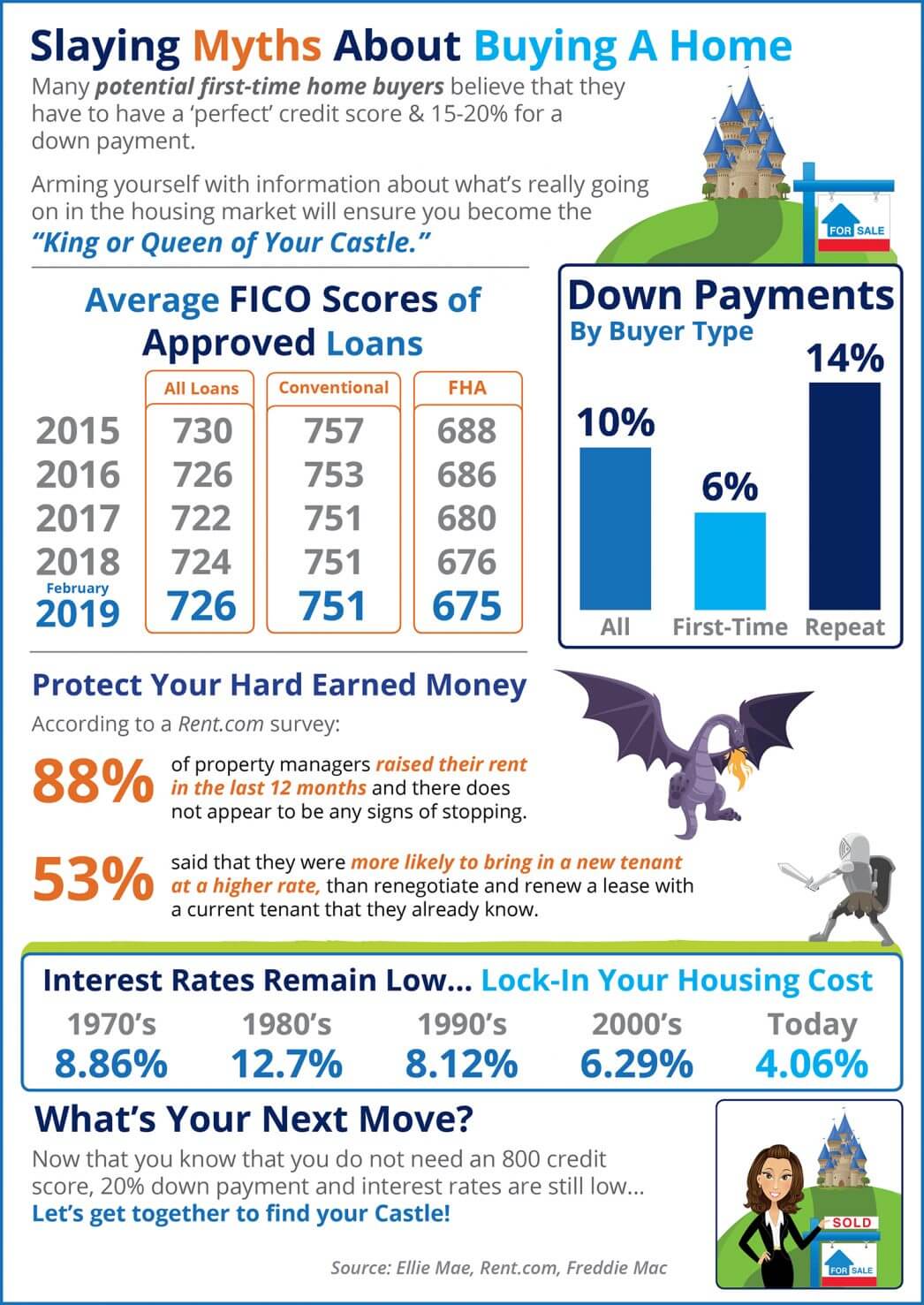

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

Why a Vacation Home Is the Ultimate Summer Upgrade

If you’re excited about getting away and having some fun in the sun, it might make sense to own your own vacation home.

What You Need To Know About Today’s Down Payment Programs

If you want more information on down payment programs, the best place to start is by contacting a trusted real estate professional.

Worried About Mortgage Rates? Control the Controllables

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

Here’s what’s really happening with home prices.

Your Equity Could Make a Move Possible

Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Equity can help you make your move.

More Than a House: The Emotional Benefits of Homeownership

Here’s a look at just a few of those more emotional or lifestyle perks, to help anchor you to why homeownership is one of your goals.