Slaying the Hardest Homebuying Myths Today

Some Highlights:

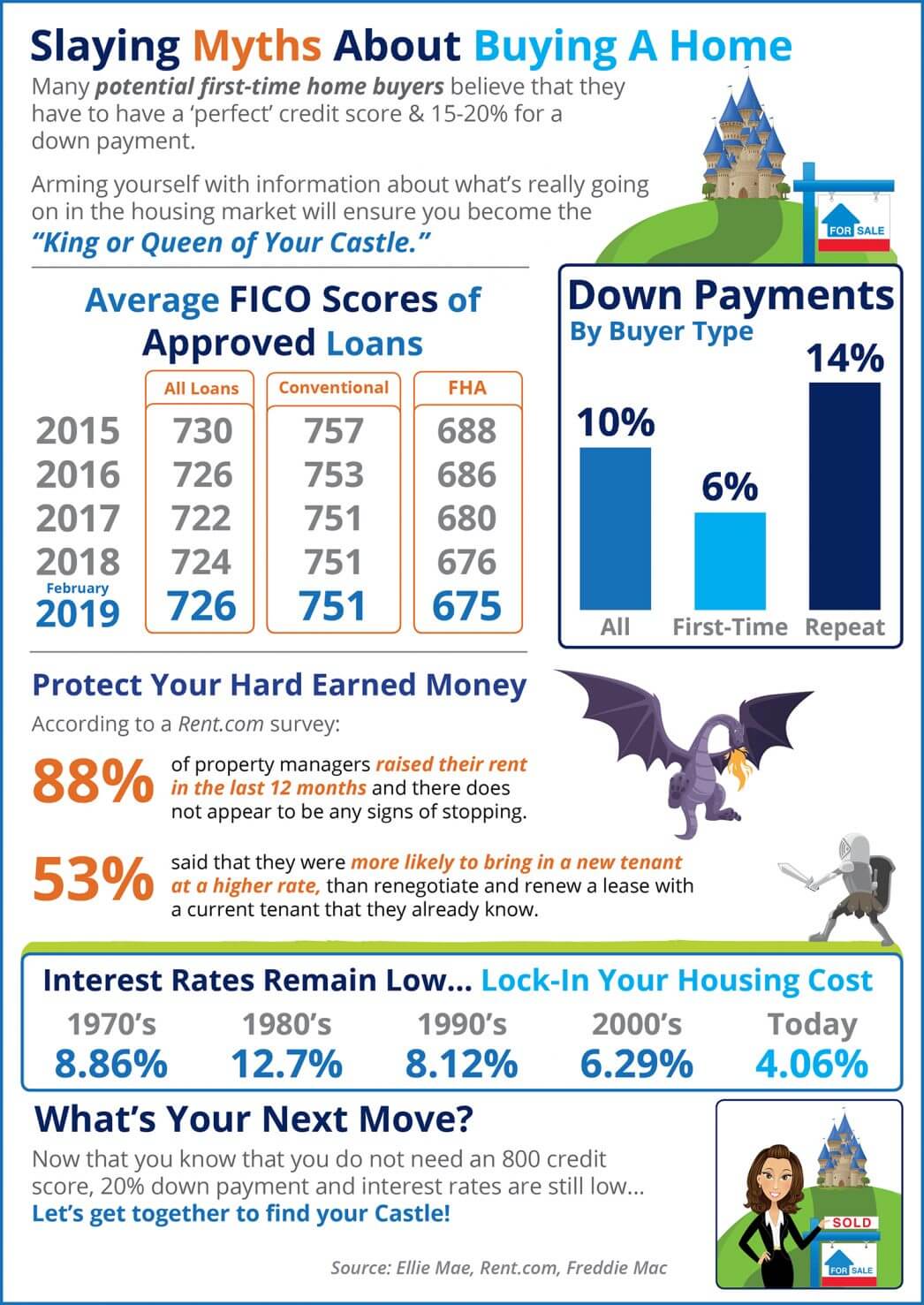

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

Thinking of Selling? You Want an Agent with These Skills

A great agent will be very good at explaining what’s happening in the housing market in a way that’s easy to understand.

Home Prices Are Climbing in These Top Cities

Persistent demand coupled with limited housing supply are key drivers pushing home values upward.

How Buying or Selling a Home Benefits Your Community

It makes sense that housing creates a lot of jobs because so many different kinds of work are involved in the industry.

Tips for Younger Homebuyers: How To Make Your Dream a Reality

An agent will help you prioritize your list of home features and find houses that can deliver on the top ones.

What Is Going on with Mortgage Rates?

Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year.

What More Listings Mean When You Sell Your House

if you’re considering whether or not to list your house, today’s limited supply is one of the biggest advantages you have right now.