Slaying the Hardest Homebuying Myths Today

Some Highlights:

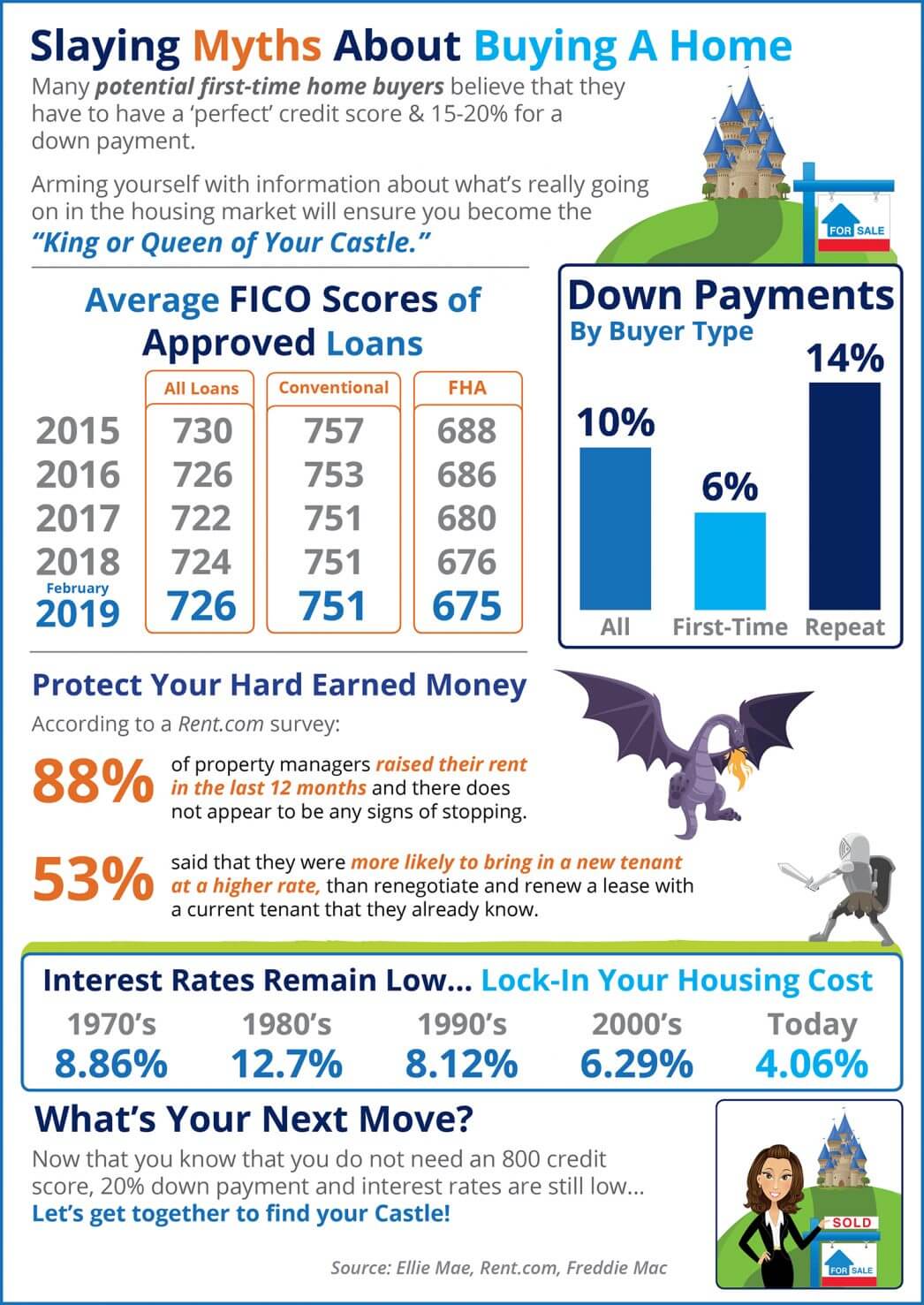

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

The Best Week To List Your House Is Almost Here – Are You Ready?

A seller listing a well-priced, move-in ready home is likely to find success.

Is It Time To Put Your House Back on the Market?

Since January, demand has picked up – and that should continue as spring draws even closer.

4 Things To Expect from the Spring Housing Market

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market.

Rising Inventory Means This Spring Could Be Your Moment

If you’ve been on the sidelines, waiting for the right time to buy, this spring could be the opening you’ve been hoping for.

What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must to protect your home and your investment.

Is the Housing Market Starting To Balance Out?

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years.