Slaying the Hardest Homebuying Myths Today

Some Highlights:

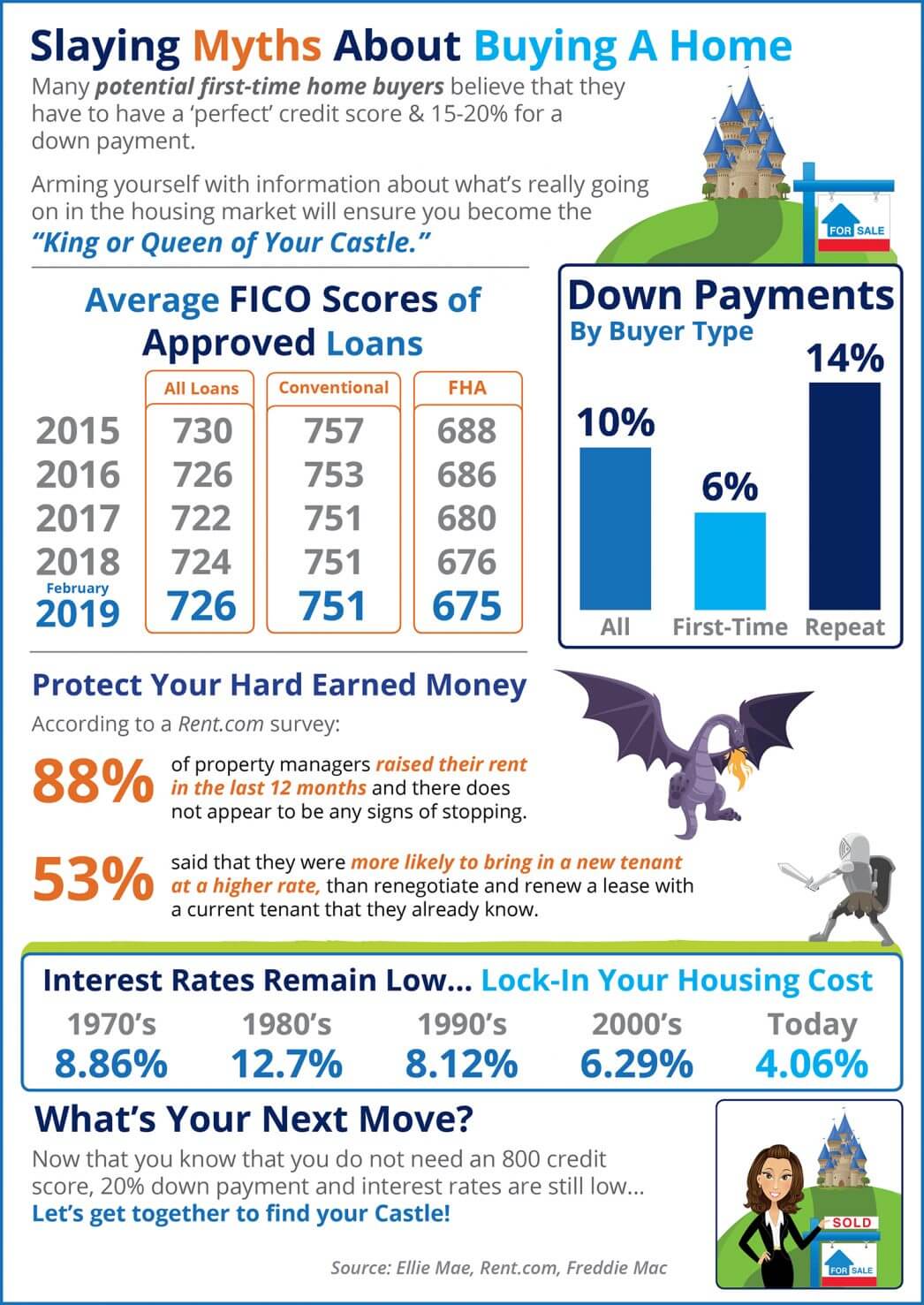

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

Experts Project Home Prices Will Rise over the Next 5 Years

Experts project home prices will continue to rise across the country for years to come at a pace that’s more normal for the market.

Are The Top 3 Housing Market Questions on Your Mind?

When it comes to what’s happening in the housing market, there’s a lot of confusion going around right now.

Is Wall Street Buying Up All the Homes in America?

Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

Are There Actually More Homes for Sale Right Now?

If you’re looking to buy, you may have slightly more options than you did in recent months, but you still need to brace for low inventory.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer.

People Are Still Moving, Even with Today’s Affordability Challenges

It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.