Slaying the Hardest Homebuying Myths Today

Some Highlights:

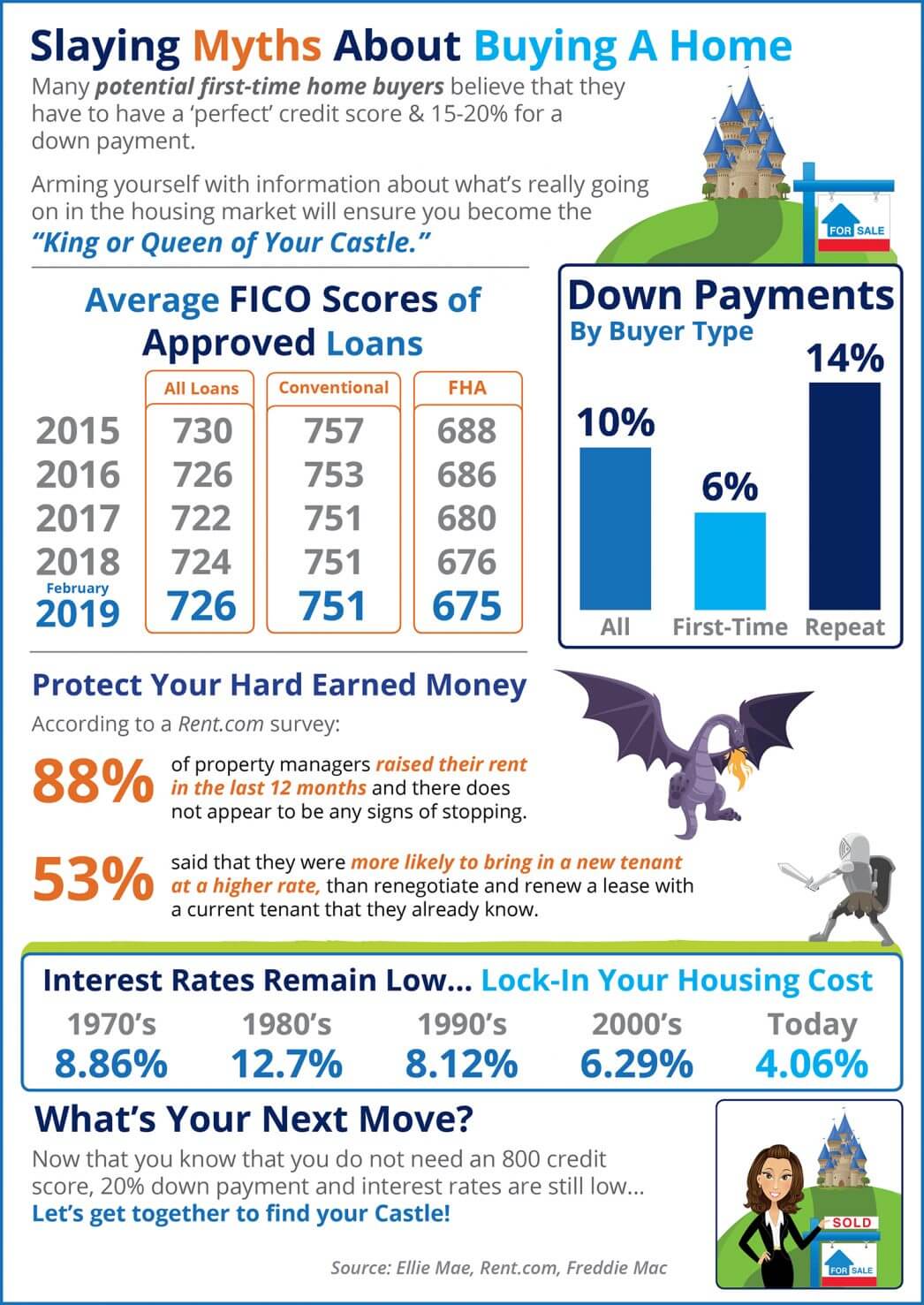

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

Are More Homes Coming onto the Market?

If you’ve been putting off selling your house, now may be the sweet spot to make your move. The longer you wait, the more competition you’ll have.

Why Is Housing Inventory So Low?

The shortage of inventory isn’t just a today problem. It’s been a challenge for years. Let’s take a look what contributed this limited supply

What Experts Project for Home Prices Over the Next 5 Years

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth.

Planning to Retire? Your Equity Can Help You Make a Move

Whether you’re looking to downsize, relocate to a dream destination, or move closer to friends or loved ones, equity in your home may help.

Expert Home Price Forecasts Revised Up for 2023

As activity slows again at the end of the year, home price growth will slow too. This doesn’t mean prices are falling.

Buyer Traffic Is Still Stronger than the Norm

Buyers will always need to buy, and those who can afford to move at today’s rates are going to do so.