Slaying the Hardest Homebuying Myths Today

Some Highlights:

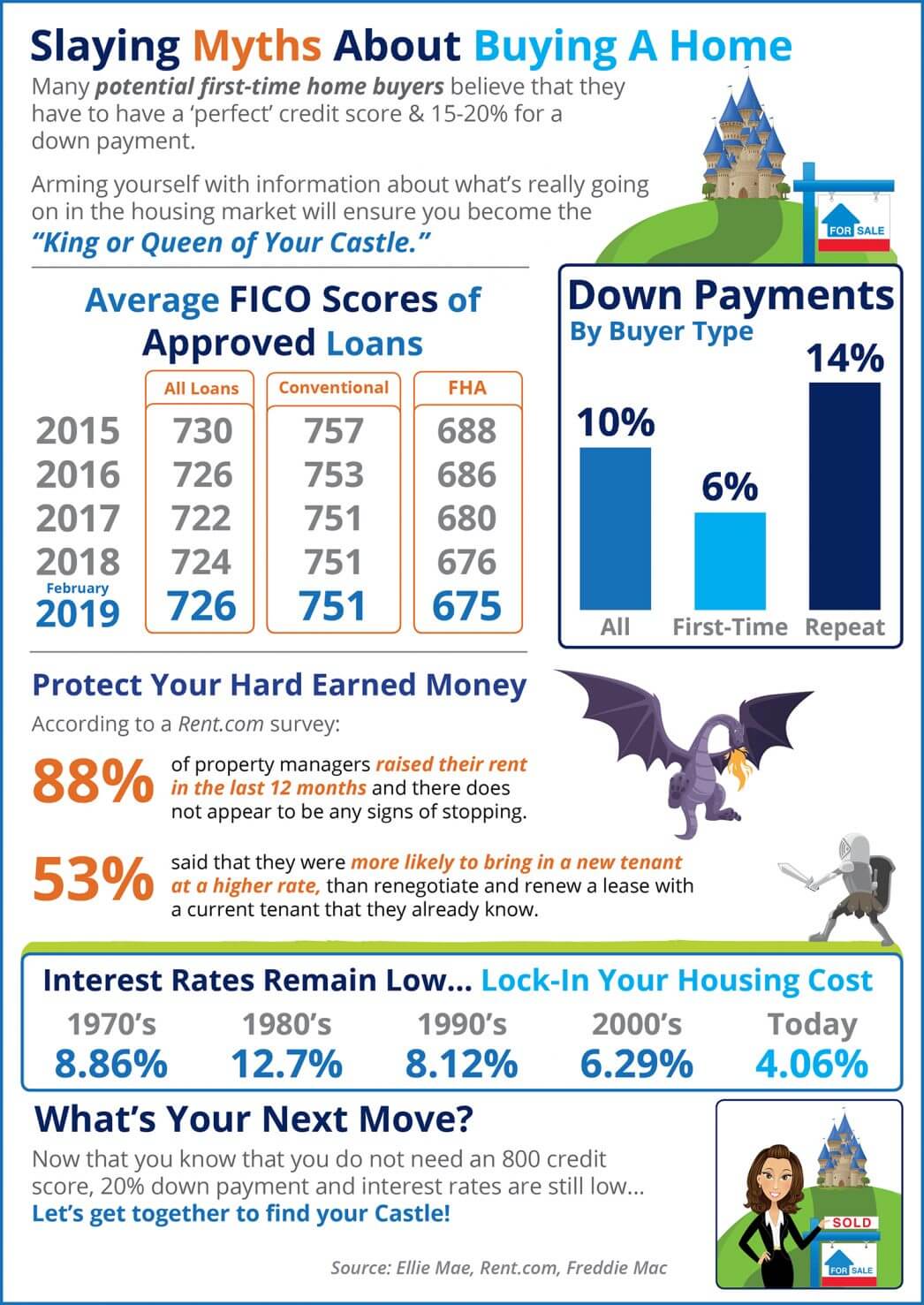

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

What Will It Take for Prices To Come Down?

It’s crucial to work with a local real estate expert who understands your market and can explain what’s going on where you live.

Why More Sellers Are Hiring Real Estate Agents

Selling your home is a big deal, and while FSBO might seem like a way to save time or money, it comes with a lot of responsibilities.

Why Owning a Home Is Worth It in the Long Run

Increased home values are a major reason so many homeowners are still happy with their decision today!

Sell Your House During the Winter Sweet Spot

While inventory is higher this year than the last few winters, if you work with an agent to list now, it’ll still be in this year’s sweet spot.

Should You Sell Your House As-Is or Make Repairs?

So, how do you make sure you’re making the right decision for your move? The key is working with a pro.

How Co-Buying a Home Helps with Affordability Today

If you are an aspiring homeowner, buying a home with your family or friends could be an option.