Slaying the Hardest Homebuying Myths Today

Some Highlights:

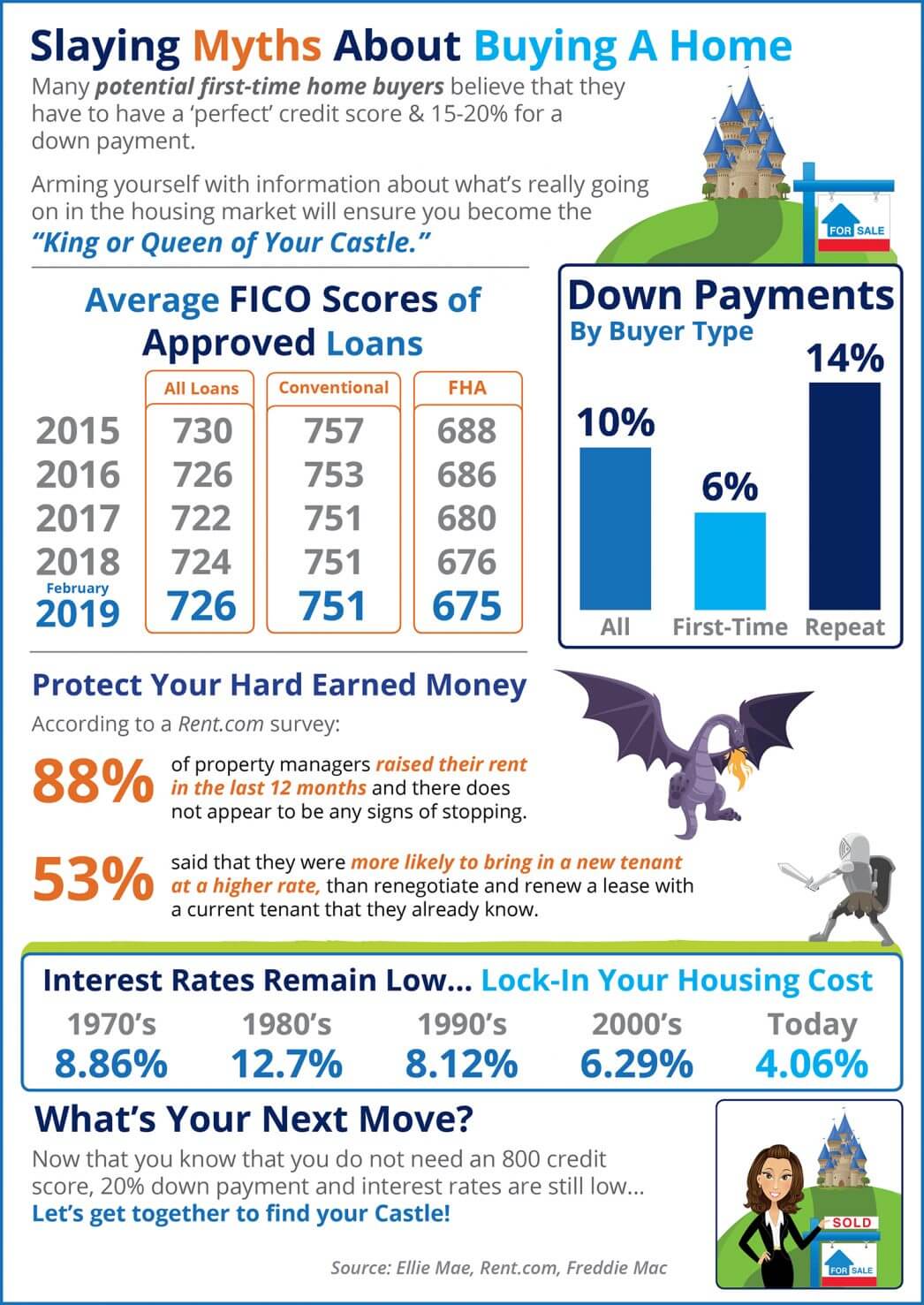

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

Most homeowners today are employed and have low-interest mortgages they can afford, so they are able to make payments.

What’s Behind Today’s Mortgage Rate Volatility?

The best way to navigate this landscape is to have a team of real estate experts by your side.

Don’t Let These Two Concerns Hold You Back from Selling Your House

Working with a local real estate agent is the best way to see what inventory trends look like in your area.

More Homes, Slower Price Growth – What It Means for You as a Buyer

Having a real estate agent who knows the local area can be a big advantage when you start the buying process.

What’s Motivating Homeowners To Move Right Now

Selling your home isn’t just about market conditions or mortgage rates—it’s also about making the best decision for your lifestyle and future.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

VA home loans are designed to make homeownership a reality for those who have served our country.