“Buyers are now shifting their preferences back to existing homes.”

In April, the National Association of Home Builders (NAHB) posted an article, Home Buyers’ Preferences Shift Towards New Construction, which reported:

“60% of people who were looking to buy a home in 2020 said they’d prefer new construction to an existing home.”

However, it seems buyers are now shifting their preferences back to existing homes.

The latest Consumer Confidence Survey reveals the percentage of Americans planning to buy a home in the next six months is virtually the same as it was back in March. However, the percentage that plan to buy a newly constructed home is lower for that same period.

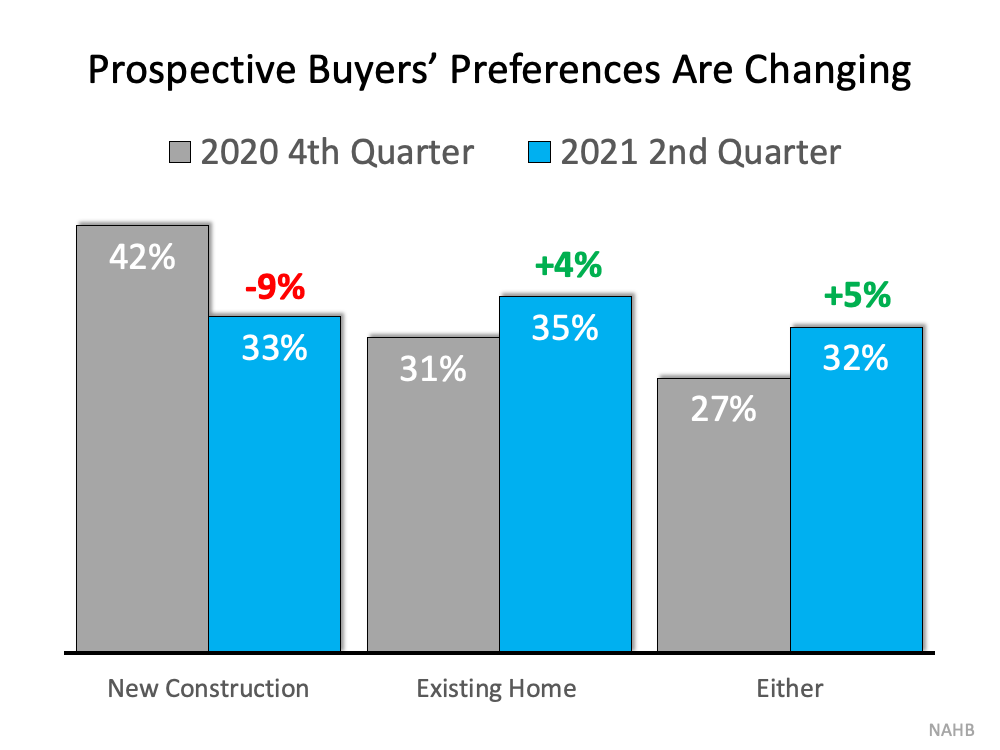

NAHB confirms this sentiment in their latest Housing Trends Report. The organization explains that existing homes are now the top preference among today’s buyers. Here’s a breakdown of those findings:

Why the shift?

There are several reasons why buyer preference is shifting. Here are two that impact purchasers looking to move in now:

- The process may move faster. Builders may not be able to guarantee when the house will be complete and ready for move-in due to supply chain challenges with materials like lumber and appliances. If you buy an existing home, not only is it ready, it also likely has a refrigerator, range, and other necessary home appliances already.

- There are no unexpected costs during the buying process. With the price of land, labor, and lumber being so volatile, many builders are including an escalation clause in the price negotiation to cover rising expenses. With an existing home, the final price you will pay is negotiated upfront.

Bottom Line

If you’re a homeowner looking to sell, your house is more attractive to a greater number of buyers as compared to earlier in the year. This might be the time for us to connect to discuss the possibility.

To view original article, visit Keeping Current Matters.

Home Prices Are Not Falling

Don’t fall for the negative headlines and become part of this statistic. Remember, data from a number of sources shows home prices aren’t falling anymore.

Unpacking the Long-Term Benefits of Homeownership

Higher mortgage rates, rising home prices, and ongoing affordability concerns may make you wonder if you should buy a home right now.

Why Your House Didn’t Sell

For insight on why your home didn’t sell, rely on a trusted real estate agent. A great agent will offer expert advice on relisting your house with effective strategies to get it sold.

The Return of Normal Seasonality for Home Price Appreciation

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear.

Beginning with Pre-Approval

Pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow.

Your Home Equity Can Offset Affordability Challenges

Some homeowners are reluctant to sell and take on a higher mortgage rate on their next home, but what about home equity?