“Buyers are now shifting their preferences back to existing homes.”

In April, the National Association of Home Builders (NAHB) posted an article, Home Buyers’ Preferences Shift Towards New Construction, which reported:

“60% of people who were looking to buy a home in 2020 said they’d prefer new construction to an existing home.”

However, it seems buyers are now shifting their preferences back to existing homes.

The latest Consumer Confidence Survey reveals the percentage of Americans planning to buy a home in the next six months is virtually the same as it was back in March. However, the percentage that plan to buy a newly constructed home is lower for that same period.

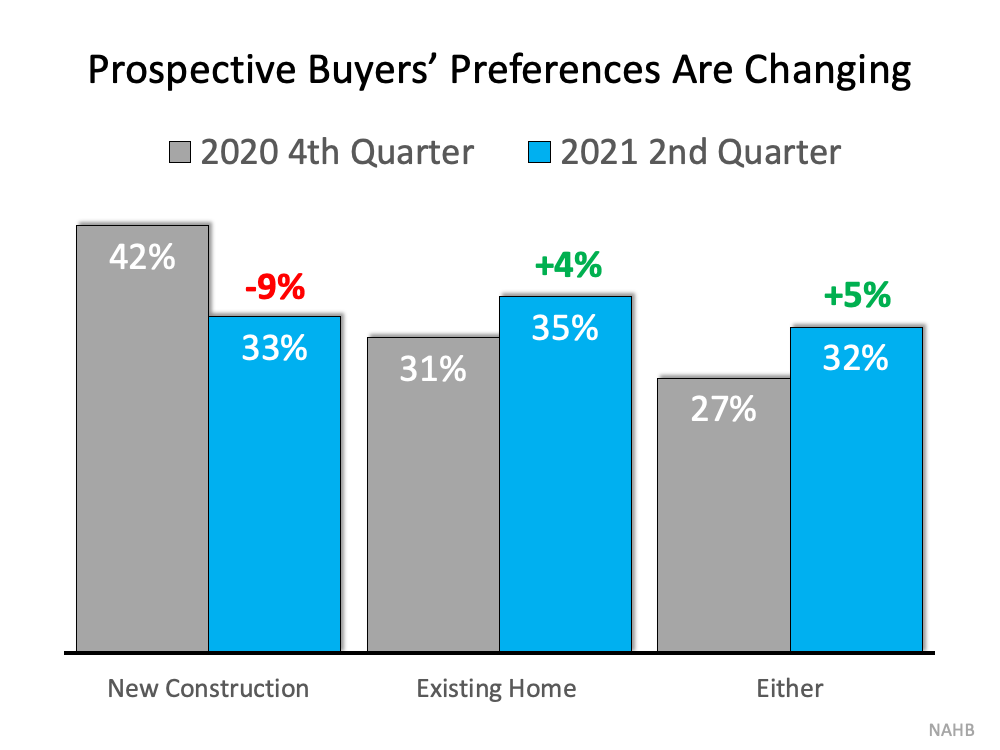

NAHB confirms this sentiment in their latest Housing Trends Report. The organization explains that existing homes are now the top preference among today’s buyers. Here’s a breakdown of those findings:

Why the shift?

There are several reasons why buyer preference is shifting. Here are two that impact purchasers looking to move in now:

- The process may move faster. Builders may not be able to guarantee when the house will be complete and ready for move-in due to supply chain challenges with materials like lumber and appliances. If you buy an existing home, not only is it ready, it also likely has a refrigerator, range, and other necessary home appliances already.

- There are no unexpected costs during the buying process. With the price of land, labor, and lumber being so volatile, many builders are including an escalation clause in the price negotiation to cover rising expenses. With an existing home, the final price you will pay is negotiated upfront.

Bottom Line

If you’re a homeowner looking to sell, your house is more attractive to a greater number of buyers as compared to earlier in the year. This might be the time for us to connect to discuss the possibility.

To view original article, visit Keeping Current Matters.

Why It Makes Sense to Move Before Spring

If you’re ready to buy a home, right now is the best time to do so before your competition grows and more buyers enter the market.

The 3 Factors That Affect Home Affordability

When you think about affordability, the full picture includes more than just mortgage rates and prices. Wages need to be factored in too.

Want To Sell Your House? Price It Right.

In today’s more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell.

Pre-Approval in 2023: What You Need To Know

To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you.

Think Twice Before Waiting for 3% Mortgage Rates

It’s important to have a realistic vision for what you can expect this year; advice of expert real estate advisors is critical.

Today’s Housing Market Is Nothing Like 15 Years Ago

In the 2nd half of 2022, there was a dramatic shift in real estate causing many people to make comparisons to the 2008 housing crisis.