“Buyers are now shifting their preferences back to existing homes.”

In April, the National Association of Home Builders (NAHB) posted an article, Home Buyers’ Preferences Shift Towards New Construction, which reported:

“60% of people who were looking to buy a home in 2020 said they’d prefer new construction to an existing home.”

However, it seems buyers are now shifting their preferences back to existing homes.

The latest Consumer Confidence Survey reveals the percentage of Americans planning to buy a home in the next six months is virtually the same as it was back in March. However, the percentage that plan to buy a newly constructed home is lower for that same period.

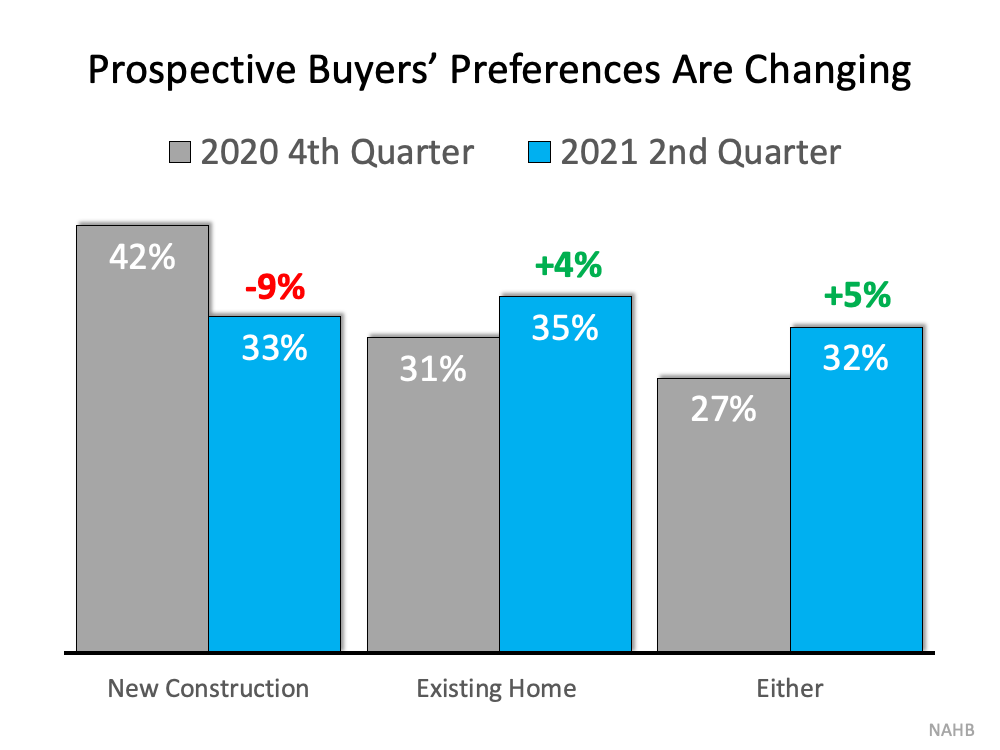

NAHB confirms this sentiment in their latest Housing Trends Report. The organization explains that existing homes are now the top preference among today’s buyers. Here’s a breakdown of those findings:

Why the shift?

There are several reasons why buyer preference is shifting. Here are two that impact purchasers looking to move in now:

- The process may move faster. Builders may not be able to guarantee when the house will be complete and ready for move-in due to supply chain challenges with materials like lumber and appliances. If you buy an existing home, not only is it ready, it also likely has a refrigerator, range, and other necessary home appliances already.

- There are no unexpected costs during the buying process. With the price of land, labor, and lumber being so volatile, many builders are including an escalation clause in the price negotiation to cover rising expenses. With an existing home, the final price you will pay is negotiated upfront.

Bottom Line

If you’re a homeowner looking to sell, your house is more attractive to a greater number of buyers as compared to earlier in the year. This might be the time for us to connect to discuss the possibility.

To view original article, visit Keeping Current Matters.

Buyers Want To Know: Why Is Housing Supply Still So Low?

While low inventory in the housing market isn’t new, it’s a challenge that continues to grow over time.

With Mortgage Rates Climbing, Now’s the Time to Act

Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades.

Why Inflation Shouldn’t Stop You from Buying a Home in 2022

Housing is commonly looked at as a good inflation hedge, especially with interest rates so low.

Real Estate Professionals Are Experts at Keeping You Safe When You Sell

Real estate professionals have learned new technologies plus safety and sanitation measures.

There Won’t Be a Wave of Foreclosures in the Housing Market

Most homeowners exited their forbearance plan either fully caught up or with a plan from the bank to start making payments again.

Avoid the Rental Trap in 2022

Before you decide whether to look for a new house or another apartment, it’s important to understand the true costs of renting in 2022.