“Understanding how affordability works and the main market factors that impact it may help those who are ready to buy a home narrow down their optimal window of time to make a purchase.”

Everyone is ready to buy a home at different times in their lives, and despite the health crisis, today is no exception. Understanding how affordability works and the main market factors that impact it may help those who are ready to buy a home narrow down their optimal window of time to make a purchase.

There are three main factors that go into determining how affordable homes are for buyers:

- Mortgage Rates

- Mortgage Payments as a Percentage of Income

- Home Prices

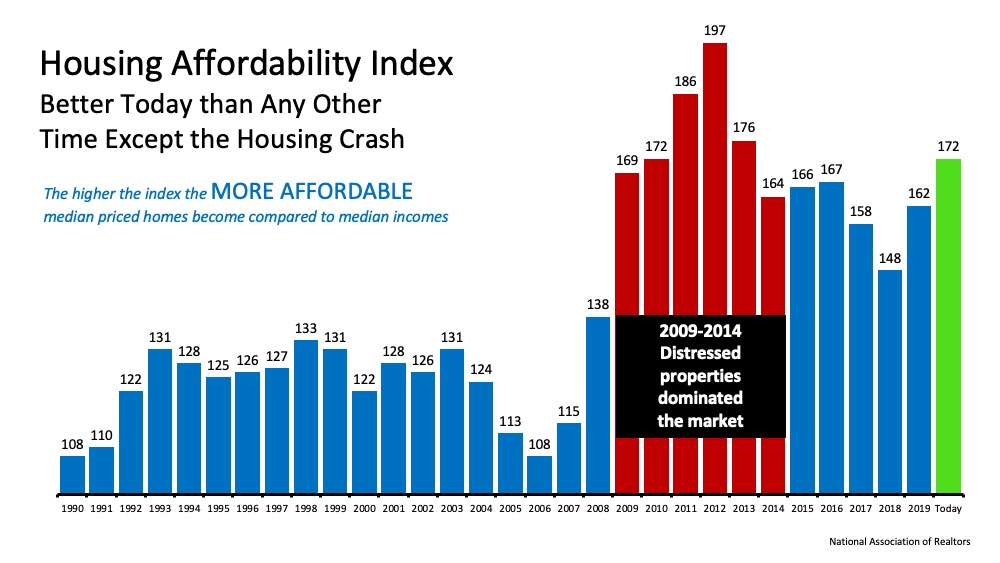

The National Association of Realtors (NAR), produces a Housing Affordability Index, which takes these three factors into account and determines an overall affordability score for housing. According to NAR, the index:

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here’s a graph of the index going back to 1990: The green bar represents today’s affordability. We can see that homes are more affordable now than they have been at any point since the housing crash when distressed properties (foreclosures and short sales) dominated the market. Those properties were sold at large discounts not seen before in the housing market.

The green bar represents today’s affordability. We can see that homes are more affordable now than they have been at any point since the housing crash when distressed properties (foreclosures and short sales) dominated the market. Those properties were sold at large discounts not seen before in the housing market.

Why are homes so affordable today?

Although there are three factors that drive the overall equation, the one that’s playing the largest part in today’s homebuying affordability is historically low mortgage rates. Based on this primary factor, we can see that it is more affordable to buy a home today than at any time in the last seven years.

If you’re considering purchasing your first home or moving up to the one you’ve always hoped for, it’s important to understand how affordability plays into the overall cost of your home. With that in mind, buying while mortgage rates are as low as they are now may save you quite a bit of money over the life of your home loan.

Bottom Line

If you feel ready to buy, purchasing a home this season may save you significantly over time based on historic affordability trends. Let’s connect today to determine if now is the right time for you to make your move.

To view original article, visit Keeping Current Matters.

3 Graphs Showing Why You Should Sell Your House Now

If you’re thinking about moving, these three graphs clearly show that it’s a great time to sell your house.

4 Big Incentives for Homeowners to Sell Now

The key to continued success in the residential housing market is for more listings to come on the market. Are you ready to sell?

Americans Find the Nonfinancial Benefits of Homeownership Most Valuable

The non-financial side of homeownership is most valued after a year full of pandemic-driven challenges.

Patience Is the Key to Buying a Home This Year

Low inventory in the housing market isn’t new, but it’s becoming more challenging to navigate.

Will the Housing Market Maintain Its Momentum?

Experts have forecasted that total home sales (existing homes and new construction) will continue their momentum into next year.

4 Tips to Maximize the Sale of Your House

Despite the speed and opportunity for sellers, there are still steps you can take to prep your house so you get the greatest possible return.