“Based on recent home price appreciation, you’re building that equity far faster than you may expect – here’s how it works.”

If you own a home, your net worth likely just got a big boost thanks to rising home equity. Equity is the current value of your home minus what you owe on the loan. And today, based on recent home price appreciation, you’re building that equity far faster than you may expect – here’s how it works.

Because there’s an ongoing imbalance between the number of homes available for sale and the number of buyers looking to make a purchase, home prices are on the rise. That means your home is worth more in today’s market because it’s in high demand. As Patrick Dodd, President and CEO of CoreLogic, explains:

“Price growth is the key ingredient for the creation of home equity wealth. . . . This has led to the largest one-year gain in average home equity wealth for owners. . . .”

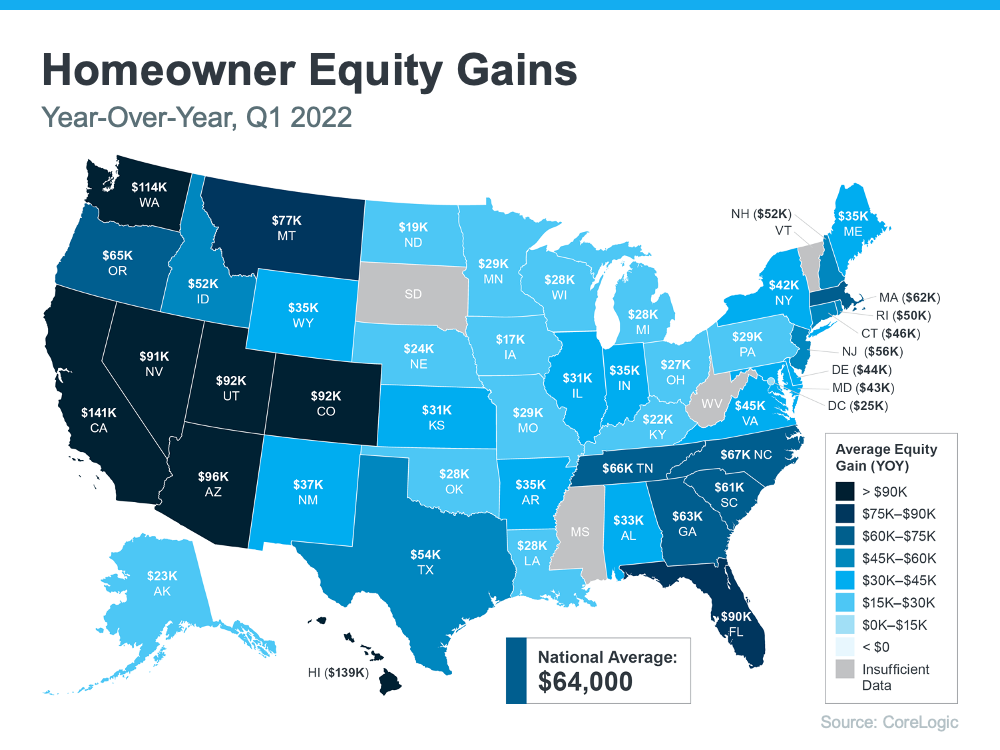

Basically, because your home value has likely climbed so much, your equity has increased too. According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner’s equity has grown by $64,000 over the last 12 months.

While that’s the nationwide number, if you want to know what’s happening in your area, look at the map below. It breaks down the average year-over-year equity growth for each state using the data from CoreLogic.

The Opportunity Your Rising Home Equity Provides

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. When you sell your current house, the equity you built up comes back to you in the sale. In a market where homeowners are gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

So, if you’ve been holding off on selling or you’re worried about being priced out of your next home because of today’s ongoing home price appreciation, rest assured your equity can help fuel your move.

Bottom Line

If you’re planning to make a move, the equity you’ve gained can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, let’s connect so you can get a professional equity assessment report on your house.

To view original article, visit Keeping Current Matters.

Expert Forecasts for the 2025 Housing Market

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends.

Time in the Market Beats Timing the Market

If you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it.

New Year, New Home: How to Make It Happen in 2025

Buying or selling is a big milestone and a great goal for this year. With the right expert, you’ll feel confident and ready to take on the market.

Simple Steps To Help You Save for Your First Home

Reaching your savings goal doesn’t mean making huge sacrifices overnight – small, consistent steps can get you there over time.

How Eco-Friendly Features Can Boost Your Home’s Value

Not sure which upgrades to prioritize? That’s where a local real estate agent comes in.

The Biggest Perks of Buying a Home This Winter

Since homes generally take longer to sell during the winter, sellers are often more motivated to close a deal.