“Based on recent home price appreciation, you’re building that equity far faster than you may expect – here’s how it works.”

If you own a home, your net worth likely just got a big boost thanks to rising home equity. Equity is the current value of your home minus what you owe on the loan. And today, based on recent home price appreciation, you’re building that equity far faster than you may expect – here’s how it works.

Because there’s an ongoing imbalance between the number of homes available for sale and the number of buyers looking to make a purchase, home prices are on the rise. That means your home is worth more in today’s market because it’s in high demand. As Patrick Dodd, President and CEO of CoreLogic, explains:

“Price growth is the key ingredient for the creation of home equity wealth. . . . This has led to the largest one-year gain in average home equity wealth for owners. . . .”

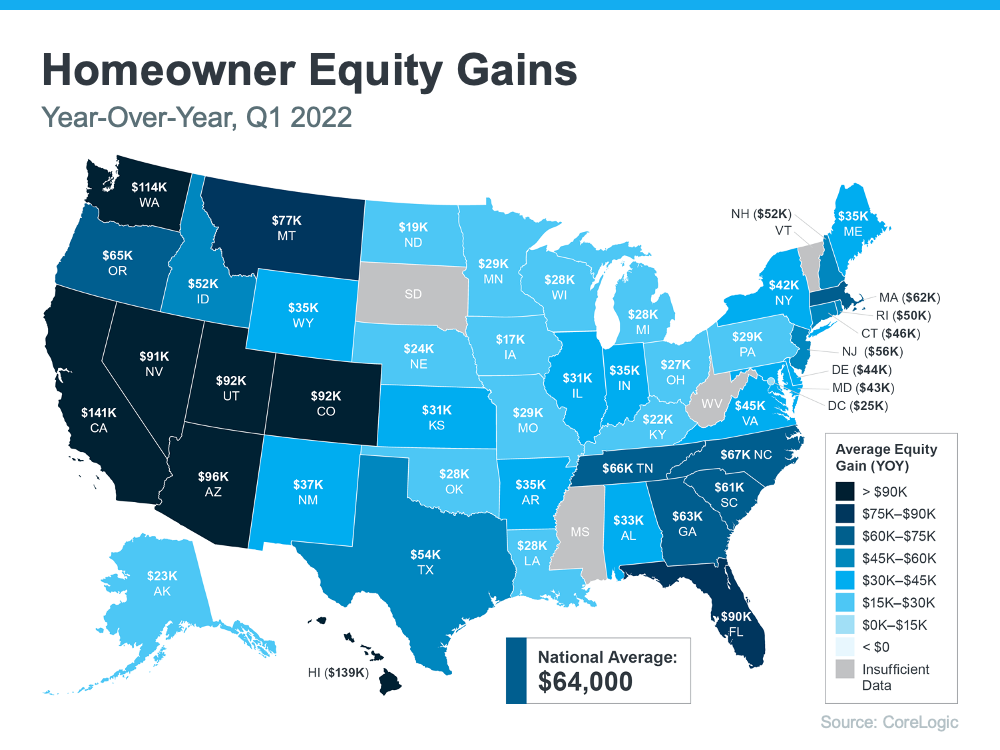

Basically, because your home value has likely climbed so much, your equity has increased too. According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner’s equity has grown by $64,000 over the last 12 months.

While that’s the nationwide number, if you want to know what’s happening in your area, look at the map below. It breaks down the average year-over-year equity growth for each state using the data from CoreLogic.

The Opportunity Your Rising Home Equity Provides

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. When you sell your current house, the equity you built up comes back to you in the sale. In a market where homeowners are gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

So, if you’ve been holding off on selling or you’re worried about being priced out of your next home because of today’s ongoing home price appreciation, rest assured your equity can help fuel your move.

Bottom Line

If you’re planning to make a move, the equity you’ve gained can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, let’s connect so you can get a professional equity assessment report on your house.

To view original article, visit Keeping Current Matters.

Unlocking Homebuyer Opportunities in 2024

If you’re ready and able to buy, you may find that the second half of 2024 is a bit easier to navigate.

How To Determine if You’re Ready To Buy a Home

While housing market conditions are definitely a factor in your decision, your own personal situation and your finances matter too.

Why Working with a Real Estate Professional Is Crucial Right Now

A real estate expert can carefully walk you through the whole real estate process and advise you on the best ways to achieve success.

Why Moving to a Smaller Home After Retirement Makes Life Easier

As you approach retirement, its important to think about whether your current home still fits your needs.

Why Your Asking Price Matters Even More Right Now

Accurate pricing depends on current market conditions – and only an agent has all information necessary to price your home correctly.

Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash.