“Equity is the current value of your home minus what you owe on the loan.”

If you’re a current homeowner, you should know your net worth just got a big boost. It comes in the form of rising home equity. Equity is the current value of your home minus what you owe on the loan. Today, you’re building that equity far faster than you may expect – and this gain is great news for you.

Here’s how it happened. Home values are on the rise thanks to low housing supply and high buyer demand. Basically, there aren’t enough homes available to meet this high buyer interest, so bidding wars are driving home prices up. When you own a home, the rising prices mean your home is worth more in today’s market. And as home values climb, your equity does too. As Dr. Frank Nothaft, Chief Economist at CoreLogic, explains:

“Home prices rose 18% during 2021 in the CoreLogic Home Price Index, the largest annual gain recorded in its 45-year history, generating a big increase in home equity wealth.”

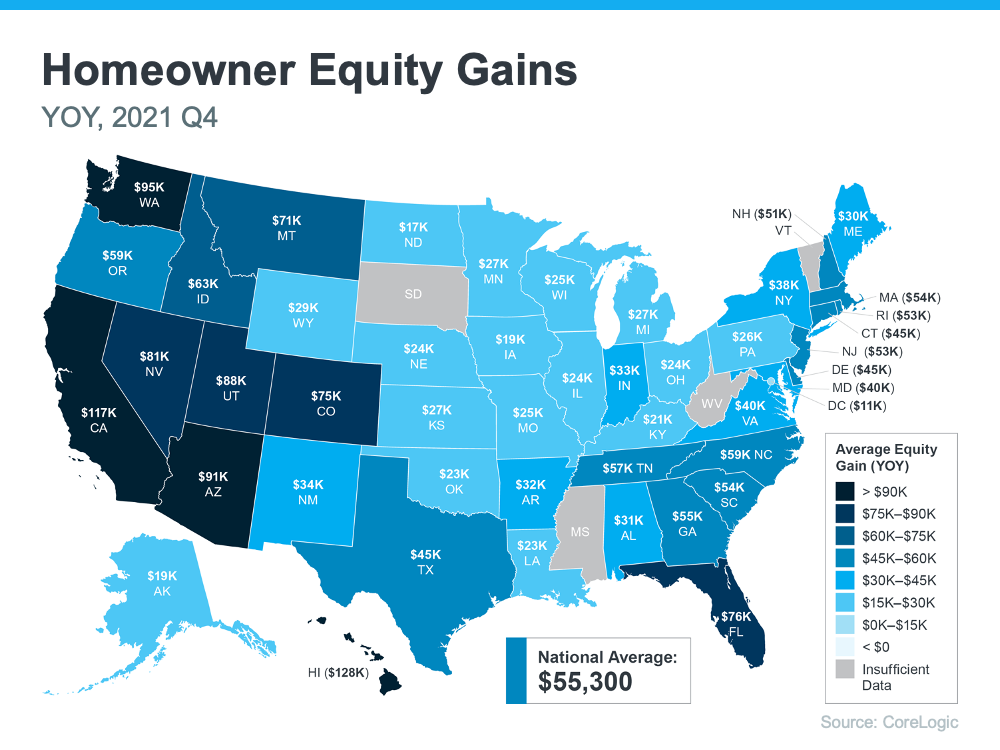

The latest Homeowner Equity Insights from CoreLogic shed light on just how much rising home values have boosted homeowner equity. According to that report, the average homeowner’s equity has grown by $55,300 over the last 12 months.

Want to know what’s happening in your area? Here’s a breakdown of the average year-over-year equity growth for each state based on that data.

How Rising Equity Impacts You

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home. It works like this: when you sell your house, the equity you built up comes back to you in the sale.

In a market where you’re gaining so much equity, it may be just what you need to cover a large portion – if not all – of the down payment on your next home. So, if you’ve been holding off on selling and worried about being priced out of your next home because of today’s home price appreciation, rest assured your equity can help fuel your move.

Bottom Line

Equity can be a real game-changer if you’re planning to make a move. To find out just how much equity you have in your home and how you can use it to fuel your next purchase, let’s connect so you can get a professional equity assessment report on your house.

To view original article, visit Keeping Current Matters.

How Today’s Mortgage Rates Impact Your Home Purchase

If you’re planning to buy a home, it’s critical to understand the relationship between mortgage rates and your purchasing power.

Three Tips for First-Time Homebuyers

No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a real estate professional.

Things That Could Help You Win a Bidding War on a Home

Bidding wars are common today with so many buyers looking to make a purchase before mortgage rates rise further.

Today’s Home Price Appreciation Is Great News for Existing Homeowners

Because it will take some time for housing supply to increase, experts believe prices will continue rising.

What You Need To Know About Selling in a Sellers’ Market

Listing your house this season means you’ll be in front of serious buyers who are ready to buy.

How Homeownership Can Help Shield You from Inflation

Buying a home allows you to stabilize what’s typically your biggest monthly expense: your housing cost.