“Historically, the choice between renting and buying a home has been a tough decision.”

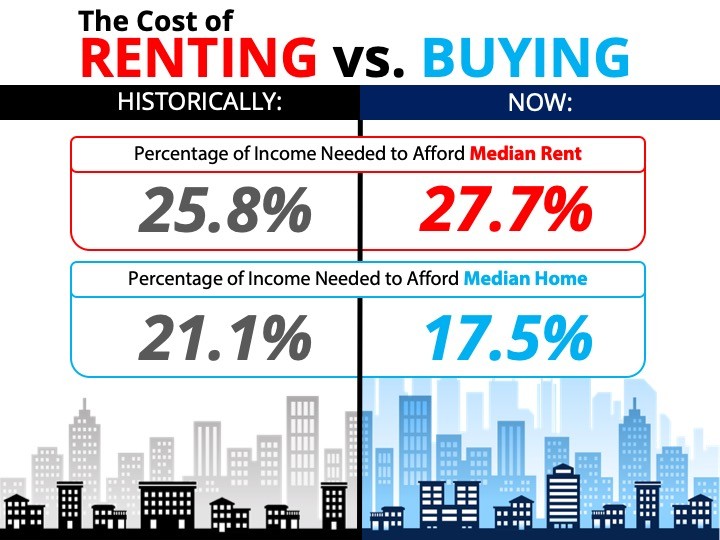

Some Highlights:

- Historically, the choice between renting and buying a home has been a tough decision.

- Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a median-priced home (17.5%), the choice is clear.

- Every market is different. Before you renew your lease, find out if you can put your housing costs to work by buying a home this year.

To view original article, visit Keeping Current Matters.

Is Wall Street Buying Up All the Homes in America?

Are institutional investors, like large Wall Street Firms, really buying up so many homes that the average person can’t find one?

Are There Actually More Homes for Sale Right Now?

If you’re looking to buy, you may have slightly more options than you did in recent months, but you still need to brace for low inventory.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer.

People Are Still Moving, Even with Today’s Affordability Challenges

It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.

The Latest 2024 Housing Market Forecast

The housing market is expected to be more active in 2024 and that may be in part because there will always be people whose lives change and need to move.

Thinking About Using Your 401(k) To Buy a Home?

Before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert.